Cowgirls drop final game of the series against UCF, 6-4

STILLWATER – The No. 19 Oklahoma State softball team dropped the rubber match of its weekend series against No. 24 UCF, 6-4, Sunday afternoon at Cowgirl Stadium.

As an Amazon Associate I earn from qualifying purchases.

Know what the Bible says and understand why it matters with the fully revised NIV Study Bible featuring updated notes, full-color design, and Comfort Print typography designed for immersive reading.

A trusted companion for deep personal study, sermon prep, and devotional reading highlighted in our faith and leadership coverage.

STILLWATER – The No. 19 Oklahoma State softball team dropped the rubber match of its weekend series against No. 24 UCF, 6-4, Sunday afternoon at Cowgirl Stadium.

Nvidia stock experienced its worst decline after the Q4 print, in spite of guiding for 1QFY27 sales growth of almost 15%. Read my analysis of NVDA stock here.

Nancy Guthrie has been missing for more than a month, and a former FBI agent says there's one area the authorities should focus on

It has been far from an ideal campaign for Real Madrid, who are already out of the Copa Del Rey while losing the Super Cup final to Barcelona.The team has struggled with quality and depth, while injur...

Real Madrid may have won at Celta Vigo on Friday, but it was another frustrating match for midfielder Arda Guler. The 21-year-old was visibly annoyed at being taken off after 65 minutes at Balaidos, a...

The redevelopment proposal would add a net of 350 units. Some local residents have opposed the project, citing concerns about traffic and overall neighborhood impact.

Critical injuries were reported after a Saturday night crash.

Critical injuries were reported after a Saturday night crash.

Merrimack Valley Pride defeated Bow Falcons 42-40 in the Division II quarterfinals, with sophomore Emma McNutt scoring the game-winning basket.

At a commemoration ceremony in central London on Sunday, bereaved families laid flowers and candles and observed a minute of silence.

In loving memory of my parents Bill (March 25 , 2001) and Dorothy (March 6, 2020), who are always cherished and forever in my heart. Your lives were a blessing. Eternally loved, Carla

Dave Meltzer and Garrett Gonzales addressed Konnan’s health on Saturday evening’s edition of Wrestling Observer Radio. Reports on Friday from Mexican outlet RECORD stated that Konnan was hospitalized in San Diego and had his leg amputated due to medical complications. The reports have not been independently confirmed and no official announcement has been made. In [...]

Israel on Sunday struck southern Lebanon, Beirut and oil storage facilities in Tehran as the war in the Middle East keeps escalating, and Prime Minister Benjamin Netanyahu promised “many surprises” for the next phase of the conflict.

The Pittsburgh Steelers' hectic 2026 offseason is not going to slow down anytime soon. As the NFL nears free agency, the team has several players set to become available and several decisions to make.

Our Knicks vs. Lakers predictions back New York to cover against Los Angeles.

Before you start planning another trip to your local Trader Joe's, make sure you take a look at why they have to recall items, because it happens a lot.

Qualification for the 2027 Women’s World Cup is underway, and plenty of our Juventus Women’s First Team players have been in action this weekend. So, let’s take a look at how our Bianconere fare...

Lawmakers say proposals that missed the cutoff can still return as floor debates begin.

Edgelord animation, riffing on Warhammer Space Marines, develops exciting new ways to ruin brains

Fans of Japanese anime and manga filled the DoubleTree by Hilton in Reading on Saturday for the first Reading Anime-Fest, many dressed as their favorite characters.

'No Girls Allowed' Box Set Spoofing Warhammer Hides Toxic Lead Kotaku

Maria Carrillo swept to the boys and girls team titles and handful of meet records were set throughout the day.

ICE and Border Patrol are increasingly using government body cameras and facial recognition scanners in deployments across U.S. cities. But some agents are taking matters into their own hands with Meta AI smart glasses. Josh Marcus reports

Troops across the United States have long set up booths in spots where they expect high footfall or a particularly cookie-hungry clientele, from shooting ranges to marijuana shops and bars. But where they are allowed to sell appears to depend on the state, Erin Keller finds

Most often, when you encounter a battery that’s past its prime, the warning sign is that it gets really, really hot while charging. Batteries and battery chargers normally heat up while charging—I’ve handled a bunch from tons of manufacturers over the years—but they should be warm, not scorching. Swelling is a surefire sign that your [...]The post Is Your E-Bike Battery Bad? Here’s How to Tell. appeared first on VICE.

Betting markets think Trump’s will decide who to back in Texas soon enough. But, Eric Garcia flags, his batting average has significant caveats.

Dunbarton residents voted down a citizen-petitioned article to move to the SB2 form of governance, while also passing a $11.6 million school district budget with a 10.4% increase from last year.

Trump is the GOAT in swaying GOP races — and prediction markets say he’ll decide Texas this way The IndependentThe Republicans Are Messing with Texas The New YorkerTrump’s dilemma in Texas CNN‘That’s bad for him to say’: Trump puts Paxton on notice in Texas Senate primary PoliticoTrump Is Expected to Endorse Cornyn The Atlantic

This week on "Face the Nation with Margaret Brennan," as the U.S. and Israeli forces stepped up their bombing campaign through the weekend, Margaret Brennan speaks to U.S. Energy Secretary Chris Wright, Israeli ambassador to the U.S. Michael Leiter and Democratic Sen. Tim Kaine.

Essex County will consider moving charges for the green bin program to the general levy for 2028 but will not fund the program from reserves for 2026 and 2027. Council voted Wednesday to stick with user fees to recover the costs of the green bin program but also to ask its administration to present an option [...]

NASA’s DART actually changed the orbit of an Asteroid around the Sun. The VergeNASA successfully kicks asteroid off course in Earth defence test France 24Spacecraft's impact changed asteroid's orbit around the sun in a save-the-Earth test, study finds CityNews HalifaxNASA’s DART Mission Changed Orbit of Asteroid Didymos Around Sun NASA (.gov)NASA warns that over 15,000 'city-killing' asteroids are orbiting Earth undetected Earth.com

A sinkhole on the 200 block of Church Street has blocked deliveries and foot traffic since late December; PWD urges residents to report leaks to (215) 685‐6300.

Watching a miniature Porsche-style car drift with an adult driver inside causes a strange cognitive dissonance. The proportions look absolutely silly, but the handling is uncannily real. Viral drifting videos from Kuwait brought the whole subculture into the spotlight, and now people want to know who’s making them. One of the names tied to that [...]The post Mini Sports Cars for Adults Are a Thing Now, and They Can Hit 50 MPH appeared first on VICE.

PM candidate is rapper-turned-politician Balendra Shah, who won 2022 Kathmandu mayoral race

Dan Bradbury is a winner of the Joburg Open for the second time. The Englishman held on for a one-shot victory at Houghton Golf Club with a superb up-and-down for par on the final hole. He finished with a 65...

Justin Bieber was clearly not in the mood for a photo op Friday night. The singer was photographed leaving Sushi Park in West Hollywood with wife Hailey Bieber after a late-night dinner ... but things got tense the second they hit the garage to... Permalink

Women around the world called Sunday for equal pay, reproductive rights, education, justice, and decision-making jobs while celebrating progress toward female empowerment during events marking International Women's Day. The event is commemorated in different ways and to varying degrees in different places, the AP reports. This year's theme is "Give...

Original Xbox emulation reaches Android VideoCardz.comYour phone can now run original Xbox games, but don’t expect Halo at 60 FPS Windows Central

New York — For months, investors and analysts have kept a close eye on the shadowy corner of finance known [...]

Desalination plants supply water to millions of residents in the region, raising new fears of risks in multiple parched desert nations.

Wells Fargo's preferred dividends are well covered, requiring less than 5% of net income. Click here to read more about WFC and WFC.PR.Z stocks.

Dodge may revive the V8 in the next Charger, with reports pointing to a Hellcat-powered version around 2028 as the brand seeks to boost disappointing sales.

ProShares UltraPro Short QQQ, Ondas, Applied Optoelectronics, American Airlines Group, Direxion Daily TSLA Bull 2X Shares, Applied Digital, and Oklo are the seven Mid Cap stocks to watch today, according to MarketBeat’s stock screener tool. Mid-cap stocks are shares of companies with a medium market capitalization—commonly defined by index providers as roughly $2 billion to [...]

CF Industries, Nutrien, Mosaic, Intrepid Potash, Lsb Industries, CVR Energy, and CVR Partners are the seven Fertilizer stocks to watch today, according to MarketBeat’s stock screener tool. Fertilizer stocks are shares of companies that manufacture, distribute, or sell fertilizer and other crop-nutrient products used in agriculture. Investors view them as a way to gain exposure [...]

Amazon.com, Costco Wholesale, Walmart, Booking, and Home Depot are the five Retail stocks to watch today, according to MarketBeat’s stock screener tool. Retail stocks are shares of companies whose primary business is selling goods or services directly to consumers, such as department stores, supermarkets, and e-commerce firms. Investors watch retail stocks to gauge consumer demand [...]

NetEase, Warner Music Group, and Tencent Music Entertainment Group are the three Music stocks to watch today, according to MarketBeat’s stock screener tool. Music stocks are shares of public companies whose primary business is creating, distributing, monetizing, or supporting music — for example record labels, streaming platforms, concert promoters, rights/royalty firms and music-tech manufacturers. Investors [...]

NVIDIA, Broadcom, Microsoft, Micron Technology, Palantir Technologies, Apple, and Meta Platforms are the seven Technology stocks to watch today, according to MarketBeat’s stock screener tool. Technology stocks are shares of companies whose primary business is creating, selling, or enabling technology—such as software, hardware, semiconductors, internet platforms, and IT services. Investors typically treat them as growth-oriented [...]

UnitedHealth Group, Johnson & Johnson, Intuitive Surgical, Medtronic, McKesson, Medline, and Novartis are the seven Healthcare stocks to watch today, according to MarketBeat’s stock screener tool. Healthcare stocks are shares of publicly traded companies whose primary businesses involve delivering medical goods and services—such as pharmaceutical and biotechnology firms, medical device makers, hospitals and clinics, health [...]

Casey’s General Stores, CAVA Group, and BJ’s Wholesale Club are the three Grocery stocks to watch today, according to MarketBeat’s stock screener tool. Grocery stocks are shares of companies whose primary business is selling food and household items through supermarkets, grocery chains and related retail or distribution channels. Investors typically view them as relatively defensive [...]

Saba Capital Income & Opportunities Fund (NYSEARCA:BRW – Get Free Report) declared a monthly dividend on Friday, February 27th. Stockholders of record on Tuesday, March 10th will be given a dividend of 0.085 per share on Tuesday, March 31st. This represents a c) annualized dividend and a dividend yield of 15.5%. The ex-dividend date of [...]

Oklo, NuScale Power, Centrus Energy, BWX Technologies, Nano Nuclear Energy, Lightbridge, and HCM II Acquisition are the seven Nuclear stocks to watch today, according to MarketBeat’s stock screener tool. “Nuclear stocks” are equities of companies involved in the nuclear energy value chain — for example uranium miners and processors, reactor and component manufacturers, utilities that [...]

Rocket Companies, Joint Stock Company Kaspi.kz, and UP Fintech are the three Fintech stocks to watch today, according to MarketBeat’s stock screener tool. Fintech stocks are shares of publicly traded companies that develop or use technology to deliver financial services—such as digital payments, online lending, mobile banking, robo-advice, blockchain applications, and back‐end financial infrastructure. For [...]

Brightstar Lottery (NYSE:BRSL – Get Free Report) announced a quarterly dividend on Tuesday, February 24th. Investors of record on Tuesday, March 10th will be given a dividend of 0.23 per share on Tuesday, March 24th. This represents a c) annualized dividend and a yield of 6.9%. The ex-dividend date of this dividend is Tuesday, March [...]

Caterpillar, Coherent, Eaton, Parker-Hannifin, and Linde are the five Industrial stocks to watch today, according to MarketBeat’s stock screener tool. Industrial stocks are shares of companies in the industrial sector—manufacturers of machinery and equipment, aerospace and defense contractors, construction and engineering firms, transportation and logistics providers, and related suppliers—whose revenues mainly come from producing capital [...]

Cellebrite DI (NASDAQ:CLBT) is expanding its “Case-to-Closure” platform with a growing set of digital forensics, evidence management, analytics, and AI-driven investigative tools, CFO Dave Barter said during a Morgan Stanley conference discussion. Barter described how the company’s products are used primarily by state and local law enforcement agencies, with a smaller enterprise segment, and outlined [...]

Hasbro, Toyota Motor, Mattel, MINISO Group, and Blue Hat Interactive Entertainment Technology are the five Toy stocks to watch today, according to MarketBeat’s stock screener tool. “Toy stocks” is an informal, often pejorative term for shares that investors treat like speculative playthings—typically low-priced, small‐cap, illiquid, or meme/penny stocks that show high volatility and limited fundamentals. [...]

Women across the world will call for equal pay, reproductive rights, education, justice and decision-making jobs and celebrate progress toward female empowerment during events and demonstrations marking International Women’s Day on Sunday. Officially recognized by the United Nations in 1977, International Women’s Day is commemorated in different ways and to varying degrees in places around [...]

New York City, New York Mar 8, 2026 (Issuewire.com) The Technology Gap in the Sports Industry Sport is one of the

Celtics power forward Jayson Tatum was grateful that he made his comeback from a ruptured right Achilles tendon at home in Boston.The six-time All-Star was almost as pleased that his second game was on the road Sunday afternoon.Tatum scored six of his 20 points in the fourth quarter, delivering the dagger on a 3-pointer with 1:59 remaining as the Celtics beat the Cleveland Cavaliers 109-98 in a battle of Eastern Conference contenders.“Today felt a lot more normal, just from a preparation standpoint in this league,” he said. “It felt like being back in the flow again.“It’s just amazing how happy I am to be back and wanting to be out there more.”Two nights earlier, Tatum collected 15 points, 12 rebounds and seven assists in his emotional return at TD Garden in a win over the Dallas Mavericks. He received multiple standing ovations in his first action since rupturing the tendon in the playoffs on May 12.The fans at Rocket Arena weren’t nearly as kind to him, but those wearing Celtics gear applauded him every time he touched the ball. They included his mother, Brandy Cole-Barnes, who surprised him by making the trip.Tatum and his mom were inseparable during his 298-day rehabilitation period, which began following reconstructive surgery on May 13.“She texted me this morning to say, ‘Hey, I’m coming to Cleveland,’” he said, smiling. “I looked up in the crowd and she was just crying. Seeing me on the court obviously brings her a lot of joy.”The 6-foot-8 Tatum started, logging 27 minutes and making 6-of-16 field goals in each game. His playing time is being restricted for precautionary reasons, but Boston coach Joe Mazzulla made sure Tatum was on the floor at crunch time.Tatum missed all six of his shots over the second and third quarters before coming through in his final, seven-minute stretch. He shared the court with longtime Celtics teammates — and fellow 2024 NBA champions — Jaylen Brown and Payton Pritchard.“We’re glad to have a first-team All-NBA player back who can do it all,” Pritchard said. “It makes us a really good team and he looks unbelievable. He’s doing things that not many players have done. It’s an easy transition for all of us.”Celtics storiesBoston Celtics8 hours agoCeltics-Cavs recap: Brown, Scheierman shine in C's winBoston CelticsMar 6Celtics-Mavs recap: Tatum flirts with triple-double in successful debutJayson TatumMar 6‘We're talking another ring': Fans thrilled by Jayson Tatum's return

TEHRAN (AP) — U.S. and Israeli airstrikes have pounded Iran since the initial volley that killed the country’s supreme leader, raising plumes of smoke and destroying buildings as the war takes its toll on civilians in Tehran and elsewhere.

Celebrities Call Out, React to Timothee Chalamet’s Viral Statements About Opera & Ballet Just JaredTimothée Chalamet triggers backlash over ballet and opera remarks BBCOpinion: Chalamet’s comments about art asinine Winnipeg Free PressTimothee Chalamet taken to task over opera, ballet dig CP24Timothée Chalamet Has a Point About Ballet The New York Times

It seems like T.I.'s feud with 50 Cent has inspired Papoose to reignite his own beef with Fif from earlier this year.The post Papoose Takes T.I.’s Lead By Dissing 50 Cent In “Many Men” Freestyle appeared first on HotNewHipHop.

KYIV, March 8 (Reuters) - Ukraine's President Volodymyr Zelenskiy said he and Dutch Prime Minister Rob Jetten discussed joint arms production...

Mappa finally returns to the world of 'Dorohedoro' next month and with more platforms for everyone to watch it on.

Lily Collins cast as Audrey Hepburn in "Breakfast at Tiffany's" biopic. Fans divided over the choice, but Hepburn's son approves the casting decision.

Not every lie corrodes trust. Research reveals that one specific kind of deception can make you more likable, more trusted and better at the relationships that matter.

Tax season is here, and many Americans are using their refunds to tackle essential expenses. According to Atomic Research, in a study commissioned by Metro by T-Mobile, nearly six in ten adults plan to use their tax refund to pay off debt or cover everyday costs. Metro is leaning into that mindset with a new [...]The post Use Your Tax Refund to Cut Your Phone Bill — Metro by T-Mobile Offers 6 Months of Unlimited Service for $120, Home Internet Savings & More appeared first on Cord Cutters News.

The Milan Cortina Winter Games opener in Para ice hockey drew a record crowd and set a new mark for the sport. On Saturday night, nearly 9,000 fans packed the stands at the preliminary game between four-time defending champion U.S....

Looking for some help with today’s Quordle words? Some hints and the answers are right here to give you a hand.

Fantasy fans are better served on HBO Max than science fiction fans. There’s some overlap between the two fandoms, but HBO Max clearly favors one over the other. That’s not to say you can’t find a great science fiction show on HBO Max. You just have to dig really deeply and dive into the occasional [...]

Sonos makes several great soundbars, including compact models for bedrooms and apartments, as well as high-end bars with Dolby Atmos surround sound.

Juan Soto and the Dominican Republic face the Netherlands during group play of the 2026 World Baseball Classic on Sunday in Miami.

Discover leading blockchain companies operating in Dubai and their key services. Explore Web3 development firms building crypto platforms and enterprise blockchain solutions.

Pro-Iran social media accounts adopted a narrative that exaggerates the destruction and death tolls wrought by the country's military.

Steve Carell has been making people laugh ever since his early days in improvisational comedy, and he was without a doubt at his funniest in The Office. The iconic NBC sitcom ran for nine seasons from 2005 until 2013, with Carell delivering laugh-out-loud scenes and lines in his role as Michael Scott, the regional manager [...]

These new Ryobi tools for 2026 will be an asset to your garage and yard. These 15 new tools can help you get ahead on your next DIY project.

Image Courtesy of The CWThe Arrowverse was one of the greatest comic book franchises in television history and faithfully adapted several storylines from the comics. However, the franchise didn’t always adapt the characters accurately from their DC counterparts. This didn’t hurt the show too much since it was about the feel and themes from the show, even if the [...]

"Octopus farming is not a feasible industry."The post Efforts Grow to Ban Octopus Farming appeared first on Futurism.

"We need a once-in-a-generation investment in public agricultural R&D," at least $100 billion over 10 years, writes Cary Fowler.

Timothee Chalamet has been in some hot water the past few days over comments he made about opera and ballet, which have gone incredibly viral. The statements were shared during a discussion with Matthew McConaughey for a Variety and CNN Town Hall event. “I admire people, and I’ve done it myself, who go on a [...]

A stay at home mom is finding herself in a tough position with her work from home husband over their differing parenting styles. Now he’s not speaking to her after she made a recommendation about how to handle things. The 36-year-old “sleep deprived” mom said that she takes care of the couple’s 3-year-old daughter and [...]

WWE’s signing strategy for new wrestlers is not always fixed in advance. Sometimes the company recruits talent with a clear creative plan ready before they debut on television. In other cases, WWE signs wrestlers first and then works out their direction as they go. This mix of approaches shapes how quickly a new star finds [...]

For the first time in about 100 years, a growing number of states are deciding one staircase in apartment complexes is enough. Since 2024, Colorado, Connecticut ( with an asterisk ), Maine, Montana, New Hampshire, Texas, and Tennessee have signed off on code shifts that allow smaller midrise apartment buildings...

Recent research from Oxford University reveals a profound connection between tinnitus and sleep. Scientists discovered that deep non-REM sleep may suppress the brain hyperactivity causing tinnitus, offering new therapeutic insights for the 50 million Americans affected by this phantom sound condition.

Not a great look.The post Kalshi Sent Bizarre Message to Underage Streamer appeared first on Futurism.

This 183-Million-Year-Old Smooth Skin Fossil Just Gave Us a Sneak Peek at What Sea Monsters Really Looked Like The Daily Galaxy

Researchers in the US have demonstrated how quantum entanglement could be used to detect optical signals from astronomical sources at the single-photon level. Published in Nature, a team led by Pieter-Jan Stas at Harvard University showed how extremely weak light signals could be detected across a fiber link spanning more than 1.5 km—possibly paving the way for optical telescopes with unprecedented resolution.

A recent report on global tipping points warned that coral reefs face widespread dieback and have reached a point from which they cannot recover.

Isaiah Kletenik, MD, and Julian Kutsche, of the Center for Brain Circuit Therapeutics within the Mass General Brigham Neuroscience Institute, are the senior and lead authors of a paper published in Cortex, titled "Lesions Causing Aphantasia are Connected to the Fusiform Imagery Node."

‘I don’t have a problem with my lab being funded by Epstein,’ one wrote to another.

The Doomsday Clock—a symbolic device to signal an array of existential threats to the world since 1947—was recently moved to 85 seconds before midnight, the closest it has ever been to midnight. And that was before all-out war broke out in Iran.

The science of the zodiac is more intriguing than astrology would have you think

A new study shows that stars with low magnetic activity are likely to support exoplanetary systems, making the hunt for these celestial objects less random.

Losing an hour of sleep to daylight saving time is not good for you, but there are ways you can help yourself bounce back

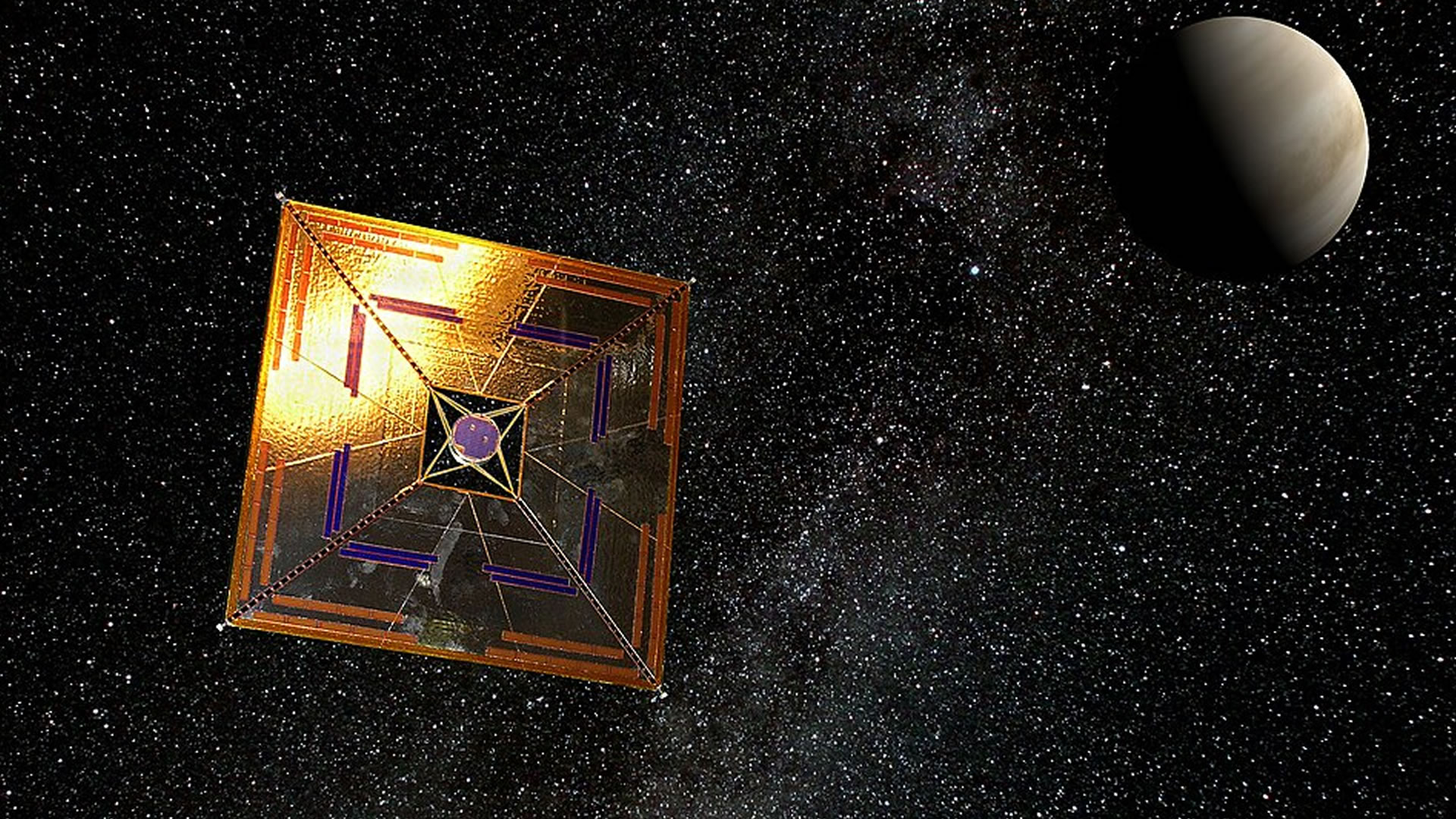

Tuskegee researchers build a nanoscale photonic crystal sail that reflects propulsion lasers while staying lightweight and cool.

Car buyers are running into a line on window stickers that's quietly getting a lot more expensive: the "destination charge." The fee, meant to cover getting a new vehicle from factory to dealer, now averages $1,600, up from roughly $1,200 in 2020, per industry data cited by Edmunds,...

NPR's Ayesha Rascoe speaks to researcher Elissia Franklin about a new study which found dangerous chemicals in some commonly used hair extensions.

Small size seems to have come before a change in diet for a tiny dinosaur lineage.

"Now studying tissue from cross-sections of a single brain to find out whether certain regions have higher ... concentrations."

Sometimes, the wisdom of the crowds is more distracting than it is useful.