Half Year FY26 Results - Investor Webinar (corrected version)

Perth, Western Australia, Feb. 04, 2026 (GLOBE NEWSWIRE) -- HALF YEAR FY26 RESULTS - INVESTOR WEBINAR / CALL

As an Amazon Associate I earn from qualifying purchases.

Know what the Bible says and understand why it matters with the fully revised NIV Study Bible featuring updated notes, full-color design, and Comfort Print typography designed for immersive reading.

A trusted companion for deep personal study, sermon prep, and devotional reading highlighted in our faith and leadership coverage.

Perth, Western Australia, Feb. 04, 2026 (GLOBE NEWSWIRE) -- HALF YEAR FY26 RESULTS - INVESTOR WEBINAR / CALL

We came across a bullish thesis on The Clorox Company on JB Global Capital’s Substack by Jack Beiro. In this article, we will summarize the bulls’ thesis on CLX. The Clorox Company’s share was trading at $109.70 as of January 28th. CLX’s trailing and forward P/E were 17.08 and 18.05 respectively according to Yahoo Finance. The Clorox Company [...]

We came across a bullish thesis on The Procter & Gamble Company on Value investing subreddit by kaskoosek. In this article, we will summarize the bulls’ thesis on PG. The Procter & Gamble Company’s share was trading at $149.90 as of January 28th. PG’s trailing and forward P/E were 21.83 and 21.05 respectively according to Yahoo Finance. The Procter [...]

Stories you may have missed from the world of business.

We came across a bullish thesis on UP Fintech Holding Limited on Kratic’s Substack by Kratic Capital. In this article, we will summarize the bulls’ thesis on TIGR. UP Fintech Holding Limited’s share was trading at $8.80 as of January 28th. TIGR’s trailing P/E was 10.62 according to Yahoo Finance. UP Fintech Holding (TIGR), widely known as Tiger Brokers, [...]

Restaurant chain Bahama Breeze will close all its restaurants in April. See what will happen to the locations.

We came across a bullish thesis on Oklo Inc. on stocks subreddit by C130J_Darkstar. In this article, we will summarize the bulls’ thesis on OKLO. Oklo Inc.’s share was trading at $86.04 as of January 28thth. Oklo Inc. develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States. [...]

We came across a bullish thesis on Honeywell International Inc. on Value investing subreddit by wisefox200. In this article, we will summarize the bulls’ thesis on HON. Honeywell International Inc.’s share was trading at $227.24 as of January 28th. HON’s trailing and forward P/E were 22.85 and 20.16 respectively according to Yahoo Finance. Honeywell International Inc. engages in [...]

We came across a bullish thesis on Zeta Global Holdings Corp. on RS Capital’s Substack by Riyado Sofian. In this article, we will summarize the bulls’ thesis on ZETA. Zeta Global Holdings Corp.’s share was trading at $19.47 as of January 28th. ZETA’s forward P/E was 20.92 according to Yahoo Finance. Zeta Global Holdings Corp. operates an omnichannel [...]

We came across a bullish thesis on TransMedics Group, Inc. on Johnny’s bearish Investing’s Substack. In this article, we will summarize the bulls’ thesis on TMDX. TransMedics Group, Inc.’s share was trading at $138.97 as of January 28th. TMDX’s trailing and forward P/E were 55.51 and 58.82 respectively according to Yahoo Finance. TransMedics Group (TMDX) is a U.S.-based [...]

The Boston Red Sox could still be searching for an infielder, and the organization now knows how much money this target will make.

We came across a bullish thesis on Trex Company, Inc. on Clayton Capital Insights’s Substack. In this article, we will summarize the bulls’ thesis on TREX. Trex Company, Inc.’s share was trading at $41.78 as of January 28th. TREX’s trailing and forward P/E were 22.81 and 26.39 respectively according to Yahoo Finance. Trex Company (NYSE: TREX) is the [...]

RPM International Inc. (NYSE:RPM – Get Free Report) saw a large growth in short interest in the month of January. As of January 15th, there was short interest totaling 2,265,281 shares, a growth of 29.5% from the December 31st total of 1,749,907 shares. Currently, 1.8% of the company’s shares are sold short. Based on an [...]

Mobix Labs, Inc. (NASDAQ:MOBXW – Get Free Report) was the target of a significant growth in short interest in January. As of January 15th, there was short interest totaling 19,058 shares, a growth of 31.3% from the December 31st total of 14,517 shares. Based on an average trading volume of 29,549 shares, the short-interest ratio [...]

FutureFuel Corp. (NYSE:FF – Get Free Report) was the target of a significant increase in short interest in the month of January. As of January 15th, there was short interest totaling 557,023 shares, an increase of 30.4% from the December 31st total of 427,066 shares. Based on an average daily trading volume, of 209,614 shares, [...]

Winnebago Industries, Inc. (NYSE:WGO – Get Free Report) was the target of a large increase in short interest during the month of January. As of January 15th, there was short interest totaling 2,887,092 shares, an increase of 31.6% from the December 31st total of 2,193,144 shares. Based on an average daily trading volume, of 792,687 [...]

Park-Ohio Holdings Corp. (NASDAQ:PKOH – Get Free Report) was the target of a large growth in short interest during the month of January. As of January 15th, there was short interest totaling 77,112 shares, a growth of 30.5% from the December 31st total of 59,104 shares. Based on an average daily volume of 21,421 shares, [...]

Cemex S.A.B. de C.V. (NYSE:CX – Get Free Report) was the recipient of a significant increase in short interest during the month of January. As of January 15th, there was short interest totaling 10,724,962 shares, an increase of 31.0% from the December 31st total of 8,184,899 shares. Currently, 0.7% of the shares of the stock [...]

Nocera, Inc. (NASDAQ:NCRA – Get Free Report) was the target of a significant increase in short interest in the month of January. As of January 15th, there was short interest totaling 116,200 shares, an increase of 30.9% from the December 31st total of 88,755 shares. Based on an average daily trading volume, of 72,956 shares, [...]

Kentucky First Federal Bancorp (NASDAQ:KFFB – Get Free Report) saw a large growth in short interest during the month of January. As of January 15th, there was short interest totaling 8,575 shares, a growth of 30.0% from the December 31st total of 6,598 shares. Approximately 0.1% of the company’s shares are sold short. Based on [...]

Accenture is the world’s leading IT consultant, with advantages stemming from their depth and breadth across products, geographies and industries. Read more her.

Online review and consumer advocacy website, PissedConsumer.com, launched a new collective complaint feature to unite consumers over common concerns while seeking resolutions from companies. NEW YORK, Feb. 3, 2026 /PRNewswire/ -- PissedConsumer launched a collective complaint feature...

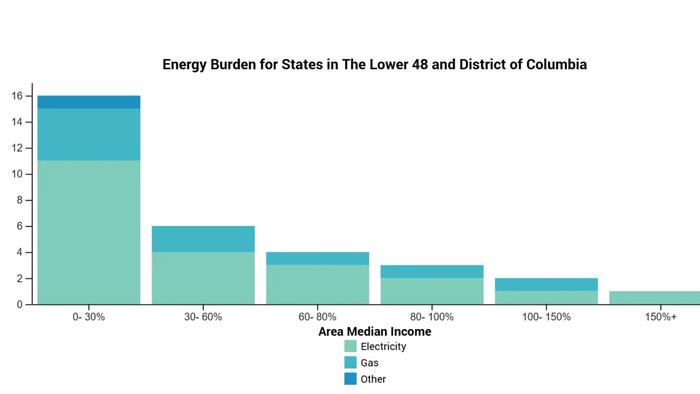

Customers, Don't Expect Electric Bill Relief In 2026: "The Cake Is Baked" By Robert Walton of UtilityDive,Rising energy demand, inflation, grid investment, extreme weather and volatile fuel costs are increasing the cost of electricity faster than many households can keep up, and there are no easy fixes, experts say.Mitigating the problem would require threading a needle of policy alternatives, but even with the right policies, it will take time to reduce customer energy burdens. The U.S. Energy Information Administration puts the national average residential price per kilowatt hour in 2026 at 18 cents, up approximately 37% from 2020.“I don’t see hidden costs that can be suddenly squeezed out of the system,” said Ray Gifford, managing partner of Wilkinson Barker Knauer’s Denver office and former chair of the Colorado Public Utilities Commission. “You are talking about an industry where most of the costs are fixed, and the assets are long-lived.”Energy affordability has recently become politically salient, but for many low-income people, “the energy affordability crisis is not new,” said Joe Daniel, a principal on the Rocky Mountain Institute’s carbon free electricity team.In 2017, 25% of all U.S. households — more than 30 million — faced a high energy burden, defined as spending more than 6% of income on energy bills, according to a report from the American Council for an Energy-Efficient Economy. For the poorest, it can be much higher. Households making less than 30% of area median income paid about 11% of their income for electricity alone, according to data from the Department of Energy covering the years 2018 to 2022. The Department of Energy’s Low-Income Energy Affordability Data Tool shows households’ energy burden in the lower 48 states and Washington, D.C. The data is based on the American Community Survey 5-year Estimates for 2018-2022. Retrieved from Department of Energy.“What is new is that because electricity prices have outpaced inflation, and, more importantly, dramatically outpaced wages, moderate- and middle-income families are starting to feel the squeeze,” Daniel said.Between December 2023 and June 2025, household energy arrearages rose by about 31%, according to the National Energy Assistance Directors Association. Forced disconnections for nonpayment are also rising, from 3 million in 2023 to 3.5 million in 2024 and potentially 4 million in 2025, it said.The increases in electricity prices have not been felt evenly across the country, and the reasons for their rise also vary by region. Still, residential rates have risen faster than those for commercial and industrial customers, and the prices charged by investor-owned utilities are higher and have risen faster than those charged by public power utilities, raising pressure on regulators and elected officials to try to rein in costs.At least six states introduced legislation last year to limit utilities’ return on equity. California’s Public Utilities Commission recently lowered utilities’ ROE in that state by 0.3 percentage points. And newly elected New Jersey Governor Mikie Sherrill used her first day in office to issue executive orders seeking to freeze electricity cost increases and direct regulators to “modernize” the electric utility business model by making profits “less dependent on capital spending.”Investors are spooked. Jefferies reported “considerable inbound concern from investors of all types” in January, ahead of Sherrill’s inauguration, related to the anticipated freeze.But some consumer advocates question whether actions taken now will be too little, too late.“They’re freezing rates at the highest they’ve ever been,” said Mark Wolfe, executive director of the National Energy Assistance Directors Association.Low-income customers are “continually falling behind,” and utilities “spend considerable resources trying to collect,” he said. “I don’t think it works, especially as electricity gets more and more expensive, going up faster than incomes.”Jay Griffin, a former utility regulator and executive chair for the Regulatory Assistance Project, recently wrote that utility business model reform “isn’t just an abstract policy debate, it’s a practical necessity.”“By rewarding capital investment over outcomes, the model encourages utilities to ‘spend money to make money,’ while discouraging non-capital solutions like demand management and distributed energy resources,” he said. “This model creates risk for customers and investors alike.”The electric utility sector says it is working to address affordability issues.Last year, investor-owned utilities allocated about $7 billion to support customer programs, according to their trade group, the Edison Electric Institute. Those efforts included energy audits and weatherization education, usage-reduction programs for low-income households, bill assistance and payment plans, relief programs and referrals for community support.President Donald Trump takes the stage to speak during a rally at the Horizon Events Center on Jan. 27, 2026, in Clive, Iowa. As a candidate, Trump promised to slash energy prices, including for electricity. Win McNamee via Getty Images“As demand grows in our evolving economy, we will continue building on our long track record of delivering customer savings and supporting families facing financial hardships,” EEI said in an emailed statement.Rising demand — does it hurt or help? The reasons for electricity price inflation are myriad and the mechanisms for determining price depend on the market, making it hard to generalize across the entire U.S. Grid investments, rising material and labor costs and natural disasters all play a role, but perhaps the issue that has attracted the most attention is that of large-load data centers and their unprecedented demands for power.After decades of stagnant growth, the EIA expects demand from the commercial and industrial sectors to grow U.S. electricity consumption by 1% in 2026 and 3% in 2027, “marking the first four years of consecutive growth since 2005–07, and the strongest four-year period of growth since the turn of the century.”Texas Gov. Greg Abbott and Alphabet and Google CEO Sundar Pichai lead a panel at the Google Midlothian Data Center on Nov. 14, 2025, in Midlothian, Texas. Data centers are driving demand growth after years of stagnation. Ron Jenkins via Getty ImagesLooking further out, the Bank of America Institute projects demand to rise at a 2.5% compound annual rate through 2035. It attributes the growth to not just data centers, but also building electrification, industrial growth and electric vehicles.Aggressive load forecasts have helped drive capacity prices to new highs in the PJM Interconnection, the largest grid operator in the country. Data center load accounted for $6.5 billion, or 40%, of the $16.4 billion in costs from the PJM Interconnection’s December capacity auction, according to the grid operator’s independent market monitor.“Generally speaking, the higher the demand, the higher the prices go,” said Marc Brown, the Consumer Energy Alliance’s executive director of Northeast.But some research has found that growing demand — from large loads as well as consumer electrification efforts — can also be a grid asset. A study released over the summer from the Lawrence Berkeley National Laboratory concluded that load growth helped depress electricity prices over the past five years, and states with the largest price increases typically featured shrinking customer loads.“It remains unclear whether broader, sustained load growth will increase long-run average costs and prices,” the researchers said. “In some cases, spikes in load growth can result in significant, near-term retail price increases.”RMI’s Daniel said higher throughput on the grid can help to lower rates by spreading costs over a broader customer base, and flexible demand can be used to address grid stress and peak loads.“Done poorly or done correctly, it has the capability of dramatically impacting rates and bills,” he said.Gifford also said that load growth has the potential to benefit the grid, but only under the right circumstances.“Load growth, if allocated and planned for properly, can lower per-unit costs to customers on the [transmission and distribution] and even generation side,” Gifford said. But the impacts would take some time to materialize.A lack of competition in transmission and distributionExperts say transmission and distribution costs are another major driver of rising consumer bills.“Some of that is because it’s an old grid that needs to get replaced,” said said RMI’s Daniel. “And because of inflation and supply chain issues, the costs to replace an aging grid have gone up.”Producer price index figures from November show copper wire and cable, as well as switchgear, costs were all up more than 11% year over year and about 60% from 2020. Tariffs, inflation and supply-chain issues have also impacted key components like aluminum, transformers and turbines. But many of the increases appearing on customer bills now are for infrastructure that was built over the past several years. And some argue the ROE model is incentivizing utilities and infrastructure owners and developers to build more expensively than necessary.High-voltage power lines run along the electrical power grid on Jan. 14, 2026, in Miami, Fla. Transmission and distribution costs have risen in recent years. Joe Raedle via Getty ImagesThere is a “regulatory gap in how transmission gets approved and then put on bills of utilities in parts of the country,” Daniel said. “We are building, essentially, the wrong type of transmission.”Utilities are building local, supplemental projects “that undergo less scrutiny and still deliver a high rate of return, instead of the larger transmission projects that deliver on affordability and reliability,” he said. A 2024 RMI report, for instance, found that in New England, annual spending on local transmission projects increased eightfold from 2016, to nearly $800 million in 2023. The Berkeley Lab study found that overall, investor-owned utilities’ inflation-adjusted spending on distribution and transmission increased from 2019 to 2024 while generation costs declined.Paul Cicio, chair of the Electricity Transmission Competition Coalition and president of the Industrial Energy Consumers of America, said the fault lies with regulators.In 2011, the Federal Energy Regulatory Commission issued Order 1000, which requires large transmission projects be subject to competitive bidding. But it made an exception for projects necessary for short-term reliability.The result, Cicio said, was that just 5% of transmission projects are now being competitively bid. The “loophole” was supposed to be closed in 2024 with FERC Order 1920, but the order did not include ratepayer cost containment provisions, he added.“FERC needs to close that loophole and require that these projects are competitively bid between utilities,” Cicio said. “Affordability is becoming a national political issue. ... Electricity costs are now on everybody’s radar.”Utilities have spent almost $154 billion annually on transmission investments in the last five years, said Cicio, “but that’s only the initial cost.”When FERC incentives and financing charges are factored in, the cost to consumers winds up being almost $1.8 trillion on transmission in the last five years, he noted.“These are massive amounts of layered-in dollars, and consumers are on the hook,” Cicio said. “The cake is baked.”Storms and wildfires require grid upgradesIndustry sources and grid planners say that in addition to building out transmission and distribution, utilities also have to harden the grid in the face of more destructive storms and wildfires. Last year, U.S. residents lost more power than any year in the previous decade, according to the EIA, with hurricanes a leading cause. The annual average of 11 hours of electricity interruptions was nearly double the annual average of the last 10 years, it said.On top of the costs of physical grid hardening, the cost of insurance also contributes to higher bills.In California, which has some of the highest electricity prices in the country, wildfire mitigation efforts cost ratepayers $27 billion between 2019 and 2023, with 40% of that coming from insurance costs, according to the World Resources Institute.A damaged utility pole is seen as people walk across a makeshift bridge in the aftermath of Hurricane Helene flooding on Oct. 8, 2024, in Bat Cave, N.C. Storms and wildfires require costly grid repaids and upgrades. Mario Tama via Getty ImagesThe cost of decarbonizationState policies driving decarbonization can also lead to higher prices, some say.The Berkeley Lab report linked price increases in recent years to net metered behind-the-meter solar and renewable portfolio standard programs. States with RPS programs that called for new supplies in the last five years increased retail electricity prices by about 0.4 cents/kWh, the study said. It also found, however, that electricity prices were unaffected by “market-based” utility-scale renewable energy projects built outside of RPS mandates.Those and other findings are driving some states to rethink their policies. Pennsylvania Republicans forced the state to withdraw from the Regional Greenhouse Gas Initiative last year, for instance, over affordability concerns. “Programs like RGGI have seen pretty significant [cost] increases,” said Brown from the Consumer Energy Alliance. Program revenues could be returned to consumers, or expenses capped, he said.Gifford said states with carbon reduction deadlines may need to rapidly to squeeze out a final 20% of carbon-emitting resources.“You could imagine some of those states reconsidering those mandates or creating a political face-saving way to back off,” he said. “But some of those transition costs are baked in already.”LNG exports contribute to volatile gas pricesNatural gas prices are one of the biggest determinants of power prices because gas generators tend to set the marginal price of electricity in organized markets, and vertically integrated utilities directly pass fuel costs on to consumers.The EIA expects the spot price of natural gas at Henry Hub to go down this year by 2% from 2025 before rising again in 2027.“Natural gas prices increase in our forecast because growth in demand — led by expanding liquefied natural gas exports and more natural gas consumption in the electric power sector — will outpace production growth,” it said.The advocacy group Public Citizen published a report in December arguing the Trump administration’s policies to increase liquefied natural gas exports are driving higher fuel costs and volatility, and, ultimately, higher electricity bills. Under President Trump, DOE has worked to aggressively increase exports, which the agency says are approximately 25% above 2024 levels.An average U.S. household paid over $124 more on its utility bills in the first nine months of 2025 than in the same period a year earlier due to rising natural gas prices, according to the report.“And the driver of this, that everyone in the industry acknowledges, is overwhelmingly record LNG exports that are just getting bigger and bigger,” said Tyson Slocum, director of Public Citizen’s energy program.Eight U.S. LNG export facilities now use more natural gas than all 74 million domestic gas utility household consumers, he said, adding: “That’s madness.”“If you start to take steps to reduce demand by LNG exporters, it is going to have a downward effect on domestic gas prices,” Slocum said.Customer support solutionsWhile experts and government agencies that track electricity prices see little hope for relief this year, some utilities and states are emphasizing bill assistance and other programs intended to help lower-income households in particular.But NEADA’s Wolfe said the programs don’t go far enough, and changes are necessary, particularly for low-income customers. “There should be no charge,” he said, for a “base amount of electricity for very-low-income families.”NEADA has also been critical of the Trump administration’s attitude toward the Low Income Home Energy Assistance Program, known as LIHEAP, a federally-funded, state-administered utility bill assistance program that has helped families afford power for decades. In April, the Department of Health and Human Services fired the entire LIHEAP program staff, and the administration proposed eliminating funding for the program in fiscal year 2026. The future of the program remains uncertain as lawmakers negotiate government funding. Even if LIHEAP survives, its budget would need to be increased “maybe 5-10 times in order to actually fully address the problem,” said Daniel. Utilities and governments should lean into low-income programs that directly provide energy assistance and support, he said.Fewer unpaid bills means fewer utility write-offs, which ultimately are paid by all customers.Those programs “tend to be far more cost-effective than we used to think,” he said, and “actually could drive down rates and bills for everybody.” Tyler DurdenTue, 02/03/2026 - 09:40

AT&T has finalized the $6 billion acquisition of substantially all of Lumen’s mass market fiber assets, a transaction that adds more than 1 million fiber...

U.S. stocks traded higher this morning, with the Dow Jones index gaining around 100 points on Tuesday.Following the market opening Tuesday, the Dow traded up 0.20% to 49,508.59 while the NASDAQ gained 0.26% to 23,654.18. The S&P 500 also rose, gaining, 0.09% to 6,984.74.Check This Out: How To Earn $500 A Month From Goldman Sachs Stock Ahead Of Q4 EarningsLeading and Lagging SectorsMaterials shares gained by 1.1% on Tuesday.In trading on Tuesday, financial stocks fell by 0.5%.Top HeadlinePepsiCo, Inc. (NASDAQ:PEP) posted better-than-expected fourth-quarter results.The company reported fourth-quarter adjusted earnings per share of $2.26, beating the analyst consensus estimate of $2.24. Quarterly sales of $29.34 billion (+5.6% year over year) outpaced the Street view of $28.972 billion.Equities Trading UP Tian Ruixiang Holdings Ltd (NASDAQ:TIRX) shares shot up 110% to $0.16 after the ...Full story available on Benzinga.com

Volatility was the name of the game in January, and retail traders were deeply involved in the action.

The Dubai base will serve as the provider’s regional hub for infrastructure projects and client partnerships across the broader Middle East and North Africa region

The Gateway Development Commission is suing the federal government for cutting off funding for the Hudson River Tunnel, a move that could suspend construction by the end of the week.

/Eli%20Lilly%20&%20Co_%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Eli Lilly has outperformed the broader market over the past year, and analysts remain highly bullish about the stock’s prospects.

The dermatologist-tested duo pairs gentle chemical resurfacing with daily hydration and SPF protection for visibly smoother lips The dermatologist-tested duo pairs gentle chemical resurfacing with daily hydration and SPF protection for visibly smoother lips

A 2,167-square-foot townhouse, built in 2001, has changed hands.

Aflac Incorporated (NYSE:AFL) is included among the Dividend Growth Stocks: 25 Aristocrats. On January 28, TD Cowen trimmed its price target on Aflac Incorporated (NYSE:AFL) to $100 from $102 and kept a Hold rating. The change was part of a broader fourth-quarter preview across the life insurance group. TD Cowen said it expects a modest [...]

Transcendent Capital Group LLC grew its holdings in iShares Core S&P Mid-Cap ETF (NYSEARCA:IJH – Free Report) by 7.6% during the 3rd quarter, according to the company in its most recent filing with the SEC. The fund owned 114,437 shares of the company’s stock after purchasing an additional 8,131 shares during the period. iShares Core [...]

CNBC’s David Faber delivers his latest Faber Report.

The Walt Disney Company announced Tuesday that Josh D'Amaro, head of its theme parks division, will replace Bob Iger as chief executive when the entertainment titan steps down in March.

On Monday, Cathie Wood-led Ark Invest executed significant trades involving Teradyne Inc. (NASDAQ:TER) , Robinhood Markets Inc. (NASDAQ:HOOD), and Alphabet Inc. (NASDAQ:GOOG). The Teradyne TradeArk Invest sold shares across ARK Innovation ETF (BATS:ARKK), ARK Autonomous Technology & Robotics ETF (BATS:ARKQ), and ARK Space & Defense Innovation ETF (BATS:ARKX). Teradyne’s stock surged by 3.52% to close at $249.53 on the same day, following a positive fourth-quarter earnings report that exceeded expectations. In the after-hours trading, the stock shot up over 19%.The sale involved 48,865 shares from ARKK, 111,768 shares from ARKQ, and 11,980 shares from ARKX, totaling approximately $43.07 million. Teradyne beat fourth-quarter estimates on both earnings and revenue, driven by AI-related demand, and issued a bullish outlook with first-quarter EPS and sales guidance far above expectations. ...Full story available on Benzinga.com

Uninterrupted access to a power supply is crucial for different ventures, including construction.

The Athletics have continued their trend of signing their young talent to long-term deals as All-Star SS Jacob Wilson officially inked his $70 million contract Monday.

Peak OnlyFans? Platform In Talks To Sell 60% Stake Following the Wall Street Journal's reporting last week, Bloomberg has provided additional color on OnlyFans' plan to sell a 60% stake in a deal valued at about $3.5 billion. The report is based on people familiar with the matter and has not been confirmed by the company.OnlyFans owner Fenix International Ltd. is in "early talks" with San Francisco-based Architect Capital to sell a 60% stake worth about $3.5 billion. The proposed structure includes roughly $2 billion of debt and may take months to formalize.Architect Capital describes itself as an asset manager focused on improving businesses where it sees opportunities to build stronger financial infrastructure. Given OnlyFans' heavy reliance on sexually explicit content, it remains unclear whether a shift away from sex creators is part of the video platform's longer-term vision under potential new ownership.OnlyFans has explored sale options since last spring, including a prior effort that valued the business at nearly $8 billion, as owner Leonid Radvinsky looks to monetize after pandemic-era growth.According to publicly available data, Ukrainian-American Leonid Radvinsky owns Fenix.British filings showed that Radvinsky had paid himself at least $1 billion in dividends since buying OnlyFans in 2018.Meanwhile, Americans spend billions annually on OF subscriptions. Peak OF? OnlyFans Model Gets Baptized, Reconnects With Jesus After Sex SpreeThe Wall Street Journal reported last week that, in a presentation to investors, Architect Capital said it sees value in offering "services" to OnlyFans content creators. It's anyone's guess at what these services could be, whether financial infrastructure or creator tools... Tyler DurdenMon, 02/02/2026 - 09:40

TNRD staff have initiated the process of asking for public assent to borrow for the proposed hall

Save up to 70% off Business Class flights to Europe aboard carriers like British Airways, American Airlines, Star Alliance, and more. Book this travel deal by February 28.Satisfy your wanderlust - and your wallet - by taking a look at all our top travel deals. Shop Now at Skylux

Vague presidential assurances don’t turn a baseless lawsuit into a good one.The post On his IRS suit, Trump claims ‘nobody would care’ about a multibillion-dollar payout appeared first on MS NOW.

The tumble in gold that saw the yellow metal drop over $1,000 an ounce in just two days hasn’t deterred Wall Street from recommending the metal.

Temu averaged 114 million monthly active users in Latin America in the first half of 2025, a 165% increase year-on-year from 2024, Sensor Tower estimates.

Wild swings that swept through financial markets overnight are calming a bit as Wall Street opens for trading

The Trump administration plans to deploy nearly $12 billion to create a strategic reserve of rare earth elements

We recently compiled a list of the 20 Best Biotech Stocks Under $20 to Buy Now. The tenth stock on our list is Legend Biotech Corporation. TheFly reported on January 22 that H.C. Wainwright lowered LEGN’s price target to $50 from $60 but kept a Buy rating, noting Q4 Carvykti sales of $555M missed the $582M consensus. They [...]

TORONTO — Corus Entertainment Inc. says it will seek court approval of a recapitalization deal that would see its debtholders take ownership of the company after a shareholder vote on the proposal failed to pass.

Aptiv PLC (NYSE:APTV) reported its fourth-quarter results for 2025 on Monday, as the stock traded lower following the release. The global automotive technology supplier reported U.S. GAAP revenue of $5.153 billion, up from $4.907 billion a year earlier.The company said fourth-quarter revenue increased 3% on an adjusted basis, reflecting growth of 8% in North America and 12% in South America, partially offset by declines of 1% in Europe and 1% in Asia.Aptiv’s fourth-quarter adjusted EPS of $1.86 beat a $1.85 analyst estimate, while revenue of $5.153 billion exceeded a $5.105 billion estimate. Earnings were down on a GAAP basis from the prior year, the company said, reflecting higher tax expense.Adjusted operating income was $607 million, with an adjusted operating income margin of 11.8%. Cash from operations totaled $818 million in the quarter.Segment PerformanceBy segment, Advanced Safety and User Experience reported fourth-quarter net sales of $1.419 billion, up 3% year over year. Engineered Components Group reported $1.644 billion, an increase of 4%, while Electrical Distribution Systems reported $2.302 billion, ...Full story available on Benzinga.com

We recently compiled a list of the 20 Best Biotech Stocks Under $20 to Buy Now. Ardelyx, Inc. is next on our list. TheFly reported on January 29 that TD Cowen raised its price target on ARDX to $13 from $10 while maintaining a Buy rating. The adjustment followed an update to the firm’s financial model ahead of the ARDX’s fourth-quarter results. [...]

A landslide last week collapsed tunnels at a major coltan mining site in eastern Congo, leaving at least 200 people dead

We recently compiled a list of the 20 Best Biotech Stocks Under $20 to Buy Now. The eighth stock on our list of best biotech stocks under $20 is CytomX Therapeutics, Inc. TheFly reported on January 20 that Piper Sandler raised its price target on CTMX to $10 from $6.50, keeping an Overweight rating. The firm noted [...]

Fernando Vigil's family fled Nicaragua post-revolution, settled in Austin, ran a MAACO franchise, and later he founded Teca Partners.

Former Trump economic advisor Gary Cohn warns of a K-shaped economy creating two Americas: one prospering through asset ownership, another struggling with stagnant wages and rising costs. This structural divergence threatens economic stability and social cohesion.

Bitcoin holds below $80,000 as January prediction contracts miss liquidation-driven slide: Asia Morning Briefing CoinDeskBitcoin dips below $79,000 as market digests silver sell-off, Trump's Fed chair pick CNBC'This is absolutely INSANE': Bitcoin’s weekend crash exposes the cracks beneath crypto’s latest boom CoinDeskBitcoin’s Price Sinks Further. What to Know. Barron'sBitcoin Drops Below $78,000 After Trump Taps Kevin Warsh To Lead Federal Reserve Forbes

Trump family crypto firm sold major stake to UAE investment firm The Washington Post‘Spy Sheikh’ Bought Secret Stake in Trump Company The Wall Street JournalU.A.E. Firm Quietly Took Stake in the Trump Family’s Crypto Company The New York TimesUnited Arab Emirates' 'Spy Sheikh' bought secret stake in Trump crypto company: WSJ CNBCAbu Dhabi Royal Bought Stake in Trump’s Crypto Venture, WSJ Says Bloomberg

Democrat Wins Texas Special Election, Eroding GOP's Slim House Majority Republicans' thin majority in the US House grew slimmer still on Saturday, as a special election in Texas has filled a long-vacant seat with a Democrat who's vowed to "tear ICE up from the roots." Progressive leftist Christian Menefee will represent Texas's 18th Congressional District, after beating fellow Democrat Amanda Edwards in a runoff election for a seat that's been vacant since Democrat Sylvester Turner died last March.The development comes as new polls show Democrats with a national edge heading into November's midterms. While the black-and-Latino-dominated Houston-area district was predestined to send another Democrat to Washington, the finality of a free-for-all race that started with 16 candidates means Republicans will soon have a razor-thin four-seat lead.Texas Congressional Candidate Christian Menefee speaks to supporters during his watch party at The Post Houston on Election Day, in Houston, on Jan. 31, 2026. Karen Warren /AP PhotoBefore Saturday, Republicans held a narrow 218–213 majority in the U.S. House. Democrats will likely push for Menefee’s immediate swearing in, which will erode the GOP lead to 218–214.Three additional House vacancies in Georgia, New Jersey, and California have special elections scheduled in March, April, and August, respectively.Democrats were furious last year when House Speaker Mike Johnson (R-La.) delayed the swearing-in of Rep. Adelita Grijalva (D-Ariz.) until mid-November, two months after she won a special election.Despite Democrats’ excitement over Menefee’s win, it doesn’t offer much insight into which party has an edge in November’s midterm elections. The 2024 Democratic presidential candidate and former Vice President Kamala Harris won Texas’s 18th district by a 40 percent-point margin over President Donald Trump, 69 percent to 29 percent.Chistian Menefee (right) was endorsed by Texas Rep. Jasmine Crockett (Photo: Menefee for Congress)Democrats accused Gov. Gregory Abbott of slow-rolling the special election, so as to ease the pressure on House Speaker Mike Johnson, who must repeatedly contend with rebellious GOP holdouts as he ushers bills through the legislative process in a closely-split House.Though Turner died in March, Abbott didn't schedule the election until November, saying he felt it important not to rush things, given Harris County's checkered election history."No county in Texas does a worse job of conducting elections than Harris County. They repeatedly fail to conduct elections consistent with state law," he said in April.The delay was compounded when the race went to a runoff. Speaking to cheering supporters Saturday night, Menefee addressed some of his remarks to President Trump: "The results here tonight are a mandate for me to work as hard as I can to oppose your agenda, to fight back against where you're taking this country and to investigate your crimes." The progressive Menefee, who was Harris County Attorney, assured the crowd that he would work to deliver universal health care, impeach Homeland Security Secretary Kristi Noem, and "tear ICE up from the roots." Amanda Edwards going *very* negative on Christian Menefee in the closing days of the TX-18 all-Democratic special election >>> pic.twitter.com/i9rLeOSJV1— Jacob Rubashkin (@JacobRubashkin) January 30, 2026If recent polls are an indication, the GOP has ground to make up if it's to retain its hold on the House. A Fox News poll published this week found that, in a generic "which party do your prefer" question, 52% of voters said they'd back a Democrat to represent their district, compared to 46% who said they'd vote Republican.Analysts caution that these polls have limited predictive value at this point."Political science analyses demonstrate that aggregate responses to this question begin to more accurately predict the actual House vote by around mid-summer," GOP pollster Daron Shaw told Fox. Trump could be a significant handicap for Republican office-seekers. On the issue of affordability, voters currently prefer Democrats by a whopping 14-point margin, and Dems are sure to emphasize the role of Trump's sprawling tariff regime in boosting prices.He's also given them a heap of tone-deaf quotes to use in advertising - for example, saying "the word 'affordability' is a con job."Meanwhile, Trump has dampened the enthusiasm of many conservatives, through his failure to deliver spending cuts, his administration's attempts to avoid releasing the Epstein files, and his pursuit of the Deep State's regime change agenda in Venezuela, Cuba and Iran. Tyler DurdenSun, 02/01/2026 - 21:35

Catheter Precision, Inc. (NYSEAMERICAN:VTAK – Get Free Report) saw a significant increase in short interest in the month of January. As of January 15th, there was short interest totaling 29,614 shares, an increase of 72.2% from the December 31st total of 17,195 shares. Approximately 1.8% of the shares of the company are sold short. Based [...]

SCHMID Group N.V. (NASDAQ:SHMD – Get Free Report) saw a large growth in short interest in January. As of January 15th, there was short interest totaling 1,017,453 shares, a growth of 75.3% from the December 31st total of 580,328 shares. Based on an average daily trading volume, of 512,270 shares, the days-to-cover ratio is currently [...]

ALPS REIT Dividend Dogs ETF (NYSEARCA:RDOG – Get Free Report) was the target of a large growth in short interest in January. As of January 15th, there was short interest totaling 64 shares, a growth of 77.8% from the December 31st total of 36 shares. Approximately 0.0% of the company’s stock are short sold. Based [...]

ALPS Medical Breakthroughs ETF (NYSEARCA:SBIO – Get Free Report) saw a significant increase in short interest in the month of January. As of January 15th, there was short interest totaling 44,222 shares, an increase of 72.6% from the December 31st total of 25,624 shares. Based on an average daily volume of 54,403 shares, the short-interest [...]

Rein Therapeutics Inc. (NASDAQ:RNTX – Get Free Report) saw a significant increase in short interest in the month of January. As of January 15th, there was short interest totaling 351,493 shares, an increase of 76.0% from the December 31st total of 199,688 shares. Approximately 1.4% of the company’s shares are sold short. Based on an [...]

Invesco S&P SmallCap Consumer Staples ETF (NASDAQ:PSCC – Get Free Report) saw a significant growth in short interest in the month of January. As of January 15th, there was short interest totaling 34,654 shares, a growth of 73.9% from the December 31st total of 19,924 shares. Based on an average daily volume of 16,791 shares, [...]

WisdomTree Emerging Markets Efficient Core Fund (NYSEARCA:NTSE – Get Free Report) was the recipient of a large increase in short interest in the month of January. As of January 15th, there was short interest totaling 2,600 shares, an increase of 76.8% from the December 31st total of 1,471 shares. Currently, 0.2% of the company’s stock [...]

Matthews China Active ETF (NYSEARCA:MCH – Get Free Report) saw a significant increase in short interest in January. As of January 15th, there was short interest totaling 3,160 shares, an increase of 73.3% from the December 31st total of 1,823 shares. Based on an average daily volume of 2,689 shares, the days-to-cover ratio is presently [...]

'This is absolutely INSANE': Bitcoin’s weekend crash exposes the cracks beneath crypto’s latest boom CoinDeskBitcoin hovers near $77,000 but 'investors not yet positioned to buy the dip' Yahoo FinanceBitcoin Price Forecasts Turn Bearish as BTC Follows Old Bear Market Patterns BinanceBitcoin Slide Deepens as BTC/USD Squeeze Risk Builds FOREX.comBitcoin (BTC) Flirts With Lowest Price Since Trump’s Return to Office Bloomberg.com

BlackRock MuniYield Pennsylvania Quality Fund (NYSE:MPA – Get Free Report) was the recipient of a large growth in short interest in the month of January. As of January 15th, there was short interest totaling 10,167 shares, a growth of 79.3% from the December 31st total of 5,669 shares. Currently, 0.1% of the company’s shares are [...]

Invesco S&P 500 Equal Weight Real Estate ETF (NYSEARCA:RSPR – Get Free Report) was the target of a large increase in short interest during the month of January. As of January 15th, there was short interest totaling 10,831 shares, an increase of 80.8% from the December 31st total of 5,991 shares. Based on an average [...]

Kairos Pharma, Ltd. (NYSEAMERICAN:KAPA – Get Free Report) saw a large growth in short interest during the month of January. As of January 15th, there was short interest totaling 192,015 shares, a growth of 81.0% from the December 31st total of 106,098 shares. Based on an average daily volume of 194,094 shares, the days-to-cover ratio [...]

Bitcoin's 40% decline over four months reflects fundamental weakness in cryptocurrency demand as both institutional and retail investors retreat. Bloomberg attributes the downturn to an absence of buyers and deteriorating belief in digital assets' value proposition amid regulatory uncertainty and macroeconomic pressures.

Nova Eye Medical Limited (ELXMF) Q2 2026 Earnings Call February 1, 2026 7:30 PM ESTCompany ParticipantsMark Flynn - Investor RelationsThomas Spurling - MD...

Send your letter to [email protected]

The business, established in 1916, is experiencing its first winter season and despite the cold, customers keep coming.

Ottawa wants to get banks, pension funds involved in affordable housing: minister Global NewsView Full Coverage on Google News

Trek Financial LLC lifted its stake in Alphabet Inc. (NASDAQ:GOOG – Free Report) by 40.2% in the 3rd quarter, HoldingsChannel reports. The institutional investor owned 142,706 shares of the information services provider’s stock after purchasing an additional 40,883 shares during the quarter. Alphabet accounts for approximately 2.1% of Trek Financial LLC’s investment portfolio, making the [...]

Terra Alpha Investments LLC bought a new stake in Carrier Global Corporation (NYSE:CARR – Free Report) during the 3rd quarter, Holdings Channel reports. The institutional investor bought 33,073 shares of the company’s stock, valued at approximately $1,974,000. Carrier Global makes up about 2.0% of Terra Alpha Investments LLC’s investment portfolio, making the stock its 21st [...]

FSA Wealth Partners Inc. raised its holdings in shares of Capital Group Dividend Value ETF (NYSEARCA:CGDV – Free Report) by 3.8% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 615,537 shares of the company’s stock after buying an additional 22,507 shares [...]

See beyond the near-term headwinds and focus on the long-term upside.

Patriot Gold Corp. (OTCMKTS:PGOL – Get Free Report) was the recipient of a large drop in short interest during the month of January. As of January 15th, there was short interest totaling 43,425 shares, a drop of 23.5% from the December 31st total of 56,775 shares. Based on an average trading volume of 53,112 shares, [...]

Oracle Co. Japan (OTCMKTS:OCLCF – Get Free Report) was the target of a significant decrease in short interest in January. As of January 15th, there was short interest totaling 133,973 shares, a decrease of 21.6% from the December 31st total of 170,909 shares. Based on an average daily volume of 228 shares, the short-interest ratio [...]

Naked Wines plc (OTCMKTS:NWINF – Get Free Report) was the recipient of a significant decrease in short interest during the month of January. As of January 15th, there was short interest totaling 7,303 shares, a decrease of 22.3% from the December 31st total of 9,394 shares. Based on an average trading volume of 4,842 shares, [...]

Defiance Daily Target 2X Long ORCL ETF (NASDAQ:ORCX – Get Free Report) traded down 5.2% during mid-day trading on Friday . The company traded as low as $11.82 and last traded at $12.01. 3,651,760 shares changed hands during trading, a decline of 18% from the average session volume of 4,445,560 shares. The stock had previously [...]

PSP Swiss Property AG (OTCMKTS:PSPSF – Get Free Report) saw a significant drop in short interest in January. As of January 15th, there was short interest totaling 20,142 shares, a drop of 29.4% from the December 31st total of 28,526 shares. Based on an average daily volume of 0 shares, the days-to-cover ratio is currently [...]

PICC Property and Casualty Company Limited (OTCMKTS:PPCCY – Get Free Report) saw a significant increase in short interest in the month of January. As of January 15th, there was short interest totaling 4,104 shares, an increase of 61.0% from the December 31st total of 2,549 shares. Based on an average daily volume of 2,801 shares, [...]

-logo-1200x675.png?v=20240521153233)

Northfield Bancorp, Inc. (NASDAQ:NFBK – Get Free Report)’s stock price passed above its 200-day moving average during trading on Friday . The stock has a 200-day moving average of $11.32 and traded as high as $12.35. Northfield Bancorp shares last traded at $12.32, with a volume of 175,499 shares traded. Wall Street Analyst Weigh In [...]

Kering SA (OTCMKTS:PPRUY – Get Free Report) saw a significant drop in short interest in the month of January. As of January 15th, there was short interest totaling 21,452 shares, a drop of 20.6% from the December 31st total of 27,020 shares. Based on an average daily trading volume, of 264,766 shares, the days-to-cover ratio [...]

Oracle Co. Japan (OTCMKTS:OCLCF – Get Free Report) was the recipient of a significant decline in short interest in January. As of January 15th, there was short interest totaling 133,973 shares, a decline of 21.6% from the December 31st total of 170,909 shares. Based on an average trading volume of 228 shares, the days-to-cover ratio [...]

Shares of CVB Financial Corporation (NASDAQ:CVBF – Get Free Report) crossed above its 200-day moving average during trading on Friday . The stock has a 200-day moving average of $19.45 and traded as high as $19.81. CVB Financial shares last traded at $19.71, with a volume of 2,597,301 shares trading hands. Analysts Set New Price [...]

Shares of Medallion Financial Corp. (NASDAQ:MFIN – Get Free Report) crossed above its two hundred day moving average during trading on Friday . The stock has a two hundred day moving average of $10.14 and traded as high as $10.35. Medallion Financial shares last traded at $10.29, with a volume of 73,091 shares traded. Wall [...]

Newron Pharmaceuticals S.p.A. (OTCMKTS:NWPHF – Get Free Report) was the target of a significant decrease in short interest in January. As of January 15th, there was short interest totaling 70,538 shares, a decrease of 23.0% from the December 31st total of 91,573 shares. Currently, 0.4% of the company’s stock are sold short. Based on an [...]

Diebold Nixdorf, Incorporated (NYSE:DBD – Get Free Report) passed above its 200-day moving average during trading on Friday . The stock has a 200-day moving average of $62.23 and traded as high as $70.25. Diebold Nixdorf shares last traded at $69.0550, with a volume of 220,222 shares changing hands. Analysts Set New Price Targets A [...]

CTV News Edmonton looks at some of the most expensive homes for sale in Edmonton in January 2026.

SINGAPORE, Feb 1 (Reuters) – Two tankers suspected of illegal ship-to-ship oil transfers were detained and more than 512 million ringgit ($129.9 million) worth of crude oil seized 24 nautical miles west...

Explosion In AI Data Center Buildouts Will Demand Next-Gen Counter-Drone Security Despite trillions of dollars slated for global data center buildouts, power grid upgrades, and other artificial intelligence infrastructure expansion through the end of the decade, there remains very limited investor discussion about the next-generation physical security architecture required to defend these increasingly critical and high-value infrastructure nodes, including data centers, power plants, and grid transmission chokepoints.Protection of data centers from suicide drone swarm attacks is currently assessed as a lower risk at the moment, while the Trump administration, particularly following last year's "Restoring American Airspace Sovereignty" executive order, is primarily focused on counter-UAS measures to secure stadiums and related venues against drone attacks ahead of the 2026 FIFA World Cup.In recent weeks, U.S. military, federal agencies, and local authorities gathered for a two-day summit near U.S. Northern Command headquarters, bringing together federal agencies, 11 U.S. host committees, and FIFA's security heads to prepare for matches across the United States, Mexico, and Canada."We're never going to not worry about a dirty bomb," Miami-Dade County Sheriff Rosanna Cordero-Stutz, who participated in the planning session, told Politico. "But we also recognize that there's a lot of other things that we need to worry about as well.""You can't just give counter-UAS mitigation equipment to law enforcement that hasn't learned how to use it yet," said White House FIFA World Cup Task Force Andrew Giuliani, who coordinated the federal government's role in tournament preparations and addressed the drone threat at the summit.Trump's counter-UAS EO last June, combined with heightened drone-threat concerns ahead of FIFA World Cup events, underscores the urgent need for low-cost, rapidly deployable kinetic interceptor counter-UAS systems that could be repurposed to defend high-value infrastructure and critical assets beyond the soccer tournament.Beyond the FIFA World Cup and back to the data center buildout story, Morgan Stanley's Vishwanath Tirupattur forecasts that nearly $3 trillion of global data center spend will occur through 2028, comprising $1.6 trillion on hardware (chips/servers) and $1.3 trillion on building data center infrastructure, including real estate, build costs, and maintenance.Wall Street analysts largely end their analysis at the financing and construction of next-generation data centers, with limited discussion regarding the modern security architecture required once these facilities are built and become instant high-value targets for non-state actors or foreign adversaries; traditional perimeter measures such as metal chainlink fencing and standard surveillance systems are rendered useless in the world of emerging AI threats, including coordinated autonomous drone or swarm-based attacks enabled by advances in AI and low-cost unmanned systems.The deployment of low-cost kinetic counter-UAS intercept systems from the US could soon become a reality in Ukraine and be field-tested on the front lines, where tons of operational data would be gathered to help developers refine these systems ahead of future deployment to protect stadiums, data centers, and other high-value assets from drone threats across North America.Cameron Rowe founded counter-UAS intercept startup Sentradel, which builds autonomous turrets to detect, track, and destroy FPV (first-person view) drones that can be easily modified with explosives. The low-cost interceptor uses a rifle that launches low-cost 5.56 bullets at incoming FPVs, versus current systems that use missiles and may cost tens of thousands per interception, where the economics of war aren't there.Meet Sentradel's low-cost kinetic interceptor counter-UAS system:Watch Company Update #robotics #drones @sts_3d @camrrowe pic.twitter.com/0JoVSeYkpI— Sentradel (@sentradel) December 2, 2025There's growing interest from the Trump administration that these counter-UAS intercept systems will be guarding high-value assets, perhaps not stadiums immediately, but likely data centers in the future, especially as former Google CEO Eric Schmidt recently warned that attacks on data centers are only a matter of time. Readers can see the full story here. Tyler DurdenSat, 01/31/2026 - 21:35

Similar projects in the Greater Toronto and Hamilton areas can get up to $750,000 in provincial funding per bed, while the Sault's Finnish Resthome is eligible for just $450,000

Global Ship Lease (NYSE:GSL) used a recent investor presentation and Q&A to outline its positioning as an independent owner and lessor of mid-sized and smaller container ships, emphasizing contracted revenue visibility, balance sheet progress, and what management described as favorable industry dynamics for the vessel segments where it operates. Business model and contracted revenue visibility [...]

iShares MSCI Australia ETF (NYSEARCA:EWA – Get Free Report) saw a significant decrease in short interest in January. As of January 15th, there was short interest totaling 1,364,439 shares, a decrease of 55.2% from the December 31st total of 3,045,951 shares. Approximately 2.9% of the company’s stock are short sold. Based on an average daily [...]

Kingsbarn Dividend Opportunity ETF (NYSEARCA:DVDN – Get Free Report) was the recipient of a large growth in short interest during the month of January. As of January 15th, there was short interest totaling 604 shares, a growth of 122.9% from the December 31st total of 271 shares. Based on an average trading volume of 1,503 [...]

Frontier Asset Core Bond ETF (NYSEARCA:FCBD – Get Free Report) was the recipient of a significant increase in short interest in January. As of January 15th, there was short interest totaling 1,750 shares, an increase of 96.0% from the December 31st total of 893 shares. Approximately 0.1% of the company’s stock are sold short. Based [...]

Eventide High Dividend ETF (NYSEARCA:ELCV – Get Free Report) was the target of a significant growth in short interest in January. As of January 15th, there was short interest totaling 16,258 shares, a growth of 50.9% from the December 31st total of 10,774 shares. Currently, 0.3% of the shares of the stock are short sold. [...]