Robotic Surgery and the Future of Precision Medicine

Robotic surgery is transforming precision medicine by enabling minimally invasive procedures and improved outcomes through advanced surgical technology at Liv Hospital.

As an Amazon Associate I earn from qualifying purchases.

Know what the Bible says and understand why it matters with the fully revised NIV Study Bible featuring updated notes, full-color design, and Comfort Print typography designed for immersive reading.

A trusted companion for deep personal study, sermon prep, and devotional reading highlighted in our faith and leadership coverage.

Robotic surgery is transforming precision medicine by enabling minimally invasive procedures and improved outcomes through advanced surgical technology at Liv Hospital.

The White House is set to present plans for the ballroom on January 8.

If the Mike Macdonald biography ever comes out, the ghost writer will likely earn his money. The Seahawks coach's no-nonsense approach to the job usually includes no stories at his news conferences. But Wednesday, when asked if the season has gone as expected or deviated from what he envisioned, he offered a yarn from early in his career.

Atlantic Union Bankshares (NASDAQ: AUB) recently received a number of ratings updates from brokerages and research firms: 12/11/2025 – Atlantic Union Bankshares was given a new $45.00 price target on by analysts at Raymond James Financial, Inc.. 12/11/2025 – Atlantic Union Bankshares had its “buy” rating reaffirmed by analysts at Cowen Inc. 12/11/2025 – Atlantic [...]

A number of research firms have changed their ratings and price targets for Anixa Biosciences (NASDAQ: ANIX): 12/29/2025 – Anixa Biosciences had its “sell (d-)” rating reaffirmed by analysts at Weiss Ratings. 12/27/2025 – Anixa Biosciences was downgraded by analysts at Wall Street Zen from a “hold” rating to a “sell” rating. 12/22/2025 – Anixa [...]

These farmers are cutting pollution and fighting hunger — with bacteria The Washington Post

Warren Buffett has handed over the reins after a six-decade run that turned an unremarkable textile mill into one of the most powerful compounding engines in history.

The influence of those we’ve lost does not fade with time

Adobe (NASDAQ:ADBE) has outperformed the market over the past 20 years by 2.97% on an annualized basis producing an average annual return of 11.65%. Currently, Adobe has a market capitalization of $146.35 billion. Buying $100 In ADBE: If an ...Full story available on Benzinga.com

SCHG ETF review: low-cost large-cap growth with quality tilt, but high P/E risks. See why SCHG earns a solid "hold" and nearly a "buy" rating heading into 2026.

OpenAI is revolutionizing AI talent acquisition by offering average stock-based compensation of $1.5 million per employee in 2025, surpassing pre-IPO payouts at Google and Facebook. This strategy, using profit participation units, counters competition from rivals like Meta and Anthropic, fueling a sector-wide pay escalation amid a fierce talent war.

Palantir's fundamentals are stellar, with accelerating revenue growth, elite 80%+ gross margins, and robust free cash flow generation. See why PLTR stock is a Hold.

Qudian Inc. – Sponsored ADR (NYSE:QD – Get Free Report) saw a significant decrease in short interest in the month of December. As of December 15th, there was short interest totaling 440,863 shares, a decrease of 17.4% from the November 30th total of 533,915 shares. Based on an average daily trading volume, of 301,106 shares, [...]

Asana, Inc. (NYSE:ASAN – Get Free Report) was the target of a large decrease in short interest in December. As of December 15th, there was short interest totaling 13,963,921 shares, a decrease of 18.3% from the November 30th total of 17,097,048 shares. Based on an average daily trading volume, of 5,343,617 shares, the short-interest ratio [...]

Molina Healthcare, Inc (NYSE:MOH – Get Free Report) was the recipient of a large drop in short interest during the month of December. As of December 15th, there was short interest totaling 3,621,816 shares, a drop of 17.4% from the November 30th total of 4,386,502 shares. Based on an average daily trading volume, of 1,419,977 [...]

Dexterra Group Inc. (OTCMKTS:HZNOF – Get Free Report) traded up 1% during mid-day trading on Monday . The company traded as high as $8.74 and last traded at $8.7180. 1,640 shares were traded during mid-day trading, an increase of 90% from the average session volume of 862 shares. The stock had previously closed at $8.63. [...]

US Solar Fund (LON:USF – Get Free Report) shares were down 2% during mid-day trading on Monday . The stock traded as low as GBX 0.34 and last traded at GBX 0.34. Approximately 50,000 shares were traded during trading, a decline of 93% from the average daily volume of 738,185 shares. The stock had previously [...]

Blackline Safety Corp. (OTCMKTS:BLKLF – Get Free Report)’s share price shot up 1.5% on Monday . The company traded as high as $4.92 and last traded at $4.89. 4,500 shares traded hands during mid-day trading, a decline of 69% from the average session volume of 14,295 shares. The stock had previously closed at $4.82. Wall [...]

Inuvo, Inc (NYSEAMERICAN:INUV – Get Free Report) was the recipient of a significant decline in short interest in December. As of December 15th, there was short interest totaling 31,742 shares, a decline of 18.1% from the November 30th total of 38,748 shares. Currently, 0.2% of the shares of the stock are short sold. Based on [...]

Mirion Technologies, Inc. (NYSE:MIR – Get Free Report) saw a large decline in short interest in the month of December. As of December 15th, there was short interest totaling 21,104,501 shares, a decline of 17.8% from the November 30th total of 25,684,851 shares. Based on an average daily volume of 2,924,697 shares, the days-to-cover ratio [...]

Fidelity Sustainable High Yield ETF (NYSEARCA:FSYD – Get Free Report) saw a large decline in short interest during the month of December. As of December 15th, there was short interest totaling 5,119 shares, a decline of 17.5% from the November 30th total of 6,203 shares. Approximately 0.4% of the company’s shares are sold short. Based [...]

NRG Energy, Inc. (NYSE:NRG – Get Free Report) saw a large decline in short interest in December. As of December 15th, there was short interest totaling 4,094,527 shares, a decline of 18.4% from the November 30th total of 5,017,597 shares. Approximately 2.1% of the shares of the stock are sold short. Based on an average [...]

Shares of Rio Silver Inc. (CVE:RYO – Get Free Report) were down 16.7% during trading on Wednesday . The stock traded as low as C$0.50 and last traded at C$0.50. Approximately 371,103 shares were traded during trading, an increase of 744% from the average daily volume of 43,971 shares. The stock had previously closed at [...]

Viking Holdings Ltd. (NYSE:VIK – Get Free Report) saw a significant drop in short interest in December. As of December 15th, there was short interest totaling 3,679,624 shares, a drop of 17.6% from the November 30th total of 4,467,323 shares. Based on an average daily volume of 2,441,502 shares, the days-to-cover ratio is currently 1.5 [...]

Genius Group Limited (NYSEAMERICAN:GNS – Get Free Report) saw a significant decrease in short interest in December. As of December 15th, there was short interest totaling 5,479,854 shares, a decrease of 18.1% from the November 30th total of 6,687,188 shares. Currently, 12.8% of the shares of the company are sold short. Based on an average [...]

CACI International, Inc. (NYSE:CACI – Get Free Report) was the target of a significant decline in short interest in December. As of December 15th, there was short interest totaling 668,679 shares, a decline of 18.5% from the November 30th total of 820,362 shares. Based on an average trading volume of 254,146 shares, the days-to-cover ratio [...]

Shares of Emergent Metals Corp. (CVE:EMR – Get Free Report) shot up 25% during trading on Wednesday . The company traded as high as C$0.05 and last traded at C$0.05. 519,005 shares traded hands during trading, an increase of 398% from the average session volume of 104,154 shares. The stock had previously closed at C$0.04. [...]

Grindr Inc. (NYSE:GRND – Get Free Report) was the recipient of a significant decrease in short interest during the month of December. As of December 15th, there was short interest totaling 7,720,536 shares, a decrease of 18.2% from the November 30th total of 9,434,993 shares. Based on an average daily trading volume, of 1,268,416 shares, [...]

Docebo Inc. (OTCMKTS:DCBOF – Get Free Report)’s share price was up 0.9% on Monday . The stock traded as high as $22.32 and last traded at $22.20. Approximately 31,423 shares changed hands during mid-day trading, an increase of 1,834% from the average daily volume of 1,625 shares. The stock had previously closed at $22.01. Docebo [...]

Banca Mediolanum S.p.A. (OTCMKTS:BNMDF – Get Free Report)’s stock price traded up 23.8% on Monday . The stock traded as high as $24.75 and last traded at $24.75. 830 shares changed hands during mid-day trading, an increase of 78% from the average session volume of 465 shares. The stock had previously closed at $20.00. Banca [...]

Exlites Holdings International Inc. (OTCMKTS:EXHI – Get Free Report)’s share price traded down 3.6% on Monday . The company traded as low as $0.40 and last traded at $0.40. 200 shares were traded during mid-day trading, a decline of 81% from the average session volume of 1,078 shares. The stock had previously closed at $0.4150. [...]

BlackRock Health Sciences Term Trust (NYSE:BMEZ – Get Free Report) was the recipient of a significant drop in short interest during the month of December. As of December 15th, there was short interest totaling 105,961 shares, a drop of 17.6% from the November 30th total of 128,622 shares. Based on an average daily trading volume, [...]

After several draws, the $80 million Lotto Max jackpot was won in Ontario for the first time. The Ontario Lottery and Gaming Corporation (OLG) says the winning ticket was sold in London, Ont. on Dec. 30. This marks the second time the $80 million jackpot has been claimed by a single ticket holder. The first [...]

Pirate Chain (ARRR) traded up 1.1% against the dollar during the twenty-four hour period ending at 9:00 AM E.T. on December 31st. In the last seven days, Pirate Chain has traded down 4% against the dollar. Pirate Chain has a total market cap of $52.09 million and approximately $143.87 thousand worth of Pirate Chain was [...]

Verrica Pharmaceuticals Inc. (NASDAQ:VRCA – Get Free Report) saw a significant decline in short interest in the month of December. As of December 15th, there was short interest totaling 380,561 shares, a decline of 26.2% from the November 30th total of 515,613 shares. Approximately 5.2% of the company’s shares are sold short. Based on an [...]

Goldfinch (GFI) traded 7.2% lower against the U.S. dollar during the one day period ending at 9:00 AM Eastern on December 31st. Goldfinch has a total market capitalization of $17.42 million and approximately $280.14 thousand worth of Goldfinch was traded on exchanges in the last 24 hours. In the last week, Goldfinch has traded down [...]

Orbit Chain (ORC) traded down 5.7% against the U.S. dollar during the 24-hour period ending at 9:00 AM Eastern on December 31st. In the last seven days, Orbit Chain has traded 0.7% higher against the U.S. dollar. Orbit Chain has a market cap of $1.54 million and $2.37 thousand worth of Orbit Chain was traded [...]

Keep Network (KEEP) traded 3.4% higher against the U.S. dollar during the one day period ending at 9:00 AM Eastern on December 31st. During the last seven days, Keep Network has traded down 15.3% against the U.S. dollar. Keep Network has a total market capitalization of $86.41 million and $10.47 thousand worth of Keep Network [...]

TrueUSD (TUSD) traded down 0% against the US dollar during the 24 hour period ending at 9:00 AM ET on December 31st. TrueUSD has a market cap of $492.94 million and approximately $12.87 million worth of TrueUSD was traded on exchanges in the last day. One TrueUSD token can now be bought for $1.00 or [...]

Valley National Bancorp (NASDAQ:VLYPO – Get Free Report) was the target of a significant decrease in short interest in the month of December. As of December 15th, there was short interest totaling 6,398 shares, a decrease of 19.2% from the November 30th total of 7,922 shares. Based on an average daily volume of 2,260 shares, [...]

Enzyme (MLN) traded 1.1% lower against the US dollar during the 24 hour period ending at 9:00 AM E.T. on December 31st. Enzyme has a total market capitalization of $13.78 million and $4.93 million worth of Enzyme was traded on exchanges in the last 24 hours. Over the last week, Enzyme has traded down 2.7% [...]

Wellchange Holdings Company Limited (NASDAQ:WCT – Get Free Report) was the target of a large decline in short interest in December. As of December 15th, there was short interest totaling 32,195 shares, a decline of 24.8% from the November 30th total of 42,795 shares. Based on an average daily volume of 129,940 shares, the days-to-cover [...]

VistaGen Therapeutics, Inc. (NASDAQ:VTGN – Get Free Report) was the recipient of a large growth in short interest in December. As of December 15th, there was short interest totaling 1,791,894 shares, a growth of 40.6% from the November 30th total of 1,274,319 shares. Based on an average daily volume of 992,442 shares, the short-interest ratio [...]

Value Line, Inc. (NASDAQ:VALU – Get Free Report) was the target of a significant decrease in short interest in the month of December. As of December 15th, there was short interest totaling 9,007 shares, a decrease of 18.9% from the November 30th total of 11,109 shares. Currently, 0.1% of the shares of the stock are [...]

Keep Network (KEEP) traded up 3.4% against the U.S. dollar during the twenty-four hour period ending at 9:00 AM Eastern on December 31st. Keep Network has a market capitalization of $86.41 million and approximately $10.47 thousand worth of Keep Network was traded on exchanges in the last 24 hours. One Keep Network token can currently [...]

Saga (SAGA) traded 3.2% higher against the dollar during the 1 day period ending at 9:00 AM Eastern on December 31st. In the last week, Saga has traded 2.1% lower against the dollar. Saga has a total market cap of $18.76 million and approximately $7.68 million worth of Saga was traded on exchanges in the [...]

-PORTAL.png?v=2024-02-28)

Portal (IOU) (PORTAL) traded 4% lower against the U.S. dollar during the 1-day period ending at 9:00 AM ET on December 31st. One Portal (IOU) token can currently be purchased for approximately $1.62 or 0.00002331 BTC on major cryptocurrency exchanges. Portal (IOU) has a total market capitalization of $2.63 billion and approximately $124.59 thousand worth [...]

Celo Dollar (CUSD) traded down 0% against the US dollar during the 24 hour period ending at 9:00 AM ET on December 31st. One Celo Dollar token can now be purchased for $1.00 or 0.00001125 BTC on major exchanges. During the last seven days, Celo Dollar has traded down 0.1% against the US dollar. Celo [...]

Goldfinch (GFI) traded down 7.2% against the U.S. dollar during the 24-hour period ending at 9:00 AM ET on December 31st. In the last week, Goldfinch has traded 2.5% lower against the U.S. dollar. One Goldfinch token can now be purchased for $0.19 or 0.00000210 BTC on popular cryptocurrency exchanges. Goldfinch has a total market [...]

ThetaDrop (TDROP) traded 3.3% higher against the US dollar during the 24-hour period ending at 9:00 AM E.T. on December 31st. ThetaDrop has a total market cap of $9.82 million and $505.08 thousand worth of ThetaDrop was traded on exchanges in the last day. One ThetaDrop token can currently be purchased for $0.0008 or 0.00000001 [...]

Value Line, Inc. (NASDAQ:VALU – Get Free Report) was the recipient of a large drop in short interest in December. As of December 15th, there was short interest totaling 9,007 shares, a drop of 18.9% from the November 30th total of 11,109 shares. Currently, 0.1% of the shares of the stock are sold short. Based [...]

TORONTO, Dec. 30, 2025 (GLOBE NEWSWIRE) -- Purpose Investments Inc. ("Purpose") today announced the final annual capital gain and income distributions for its open-end exchange-traded funds structured as mutual fund trusts (the "Funds") with a December 15, 2025 tax year-end. The notional distributions represent capital gains realized and income earned by the Funds, as applicable, during the year.Details of the per-unit distribution amounts are as follows:Final Annual Notional Capital Gain DistributionsFund NameTicker SymbolExchangeFinal Annual Capital Gain Distribution Per UnitNAV Per Unit (as of Dec 30, 2025)FinalAnnual Capital Gain Distribution (% of Dec 30, 2025 NAV)Purpose Bitcoin Yield ETF – ETF UnitsBTCYTSX$1.0327$6.8115.16%Purpose Bitcoin Yield ETF – ETF Non-Currency Hedged UnitsBTCY.BTSX$1.2362$8.1715.13%Purpose Bitcoin Yield ETF – ETF Non-Currency Hedged USD UnitsBTCY.UTSXUS $ 1.0266US $ 6.7815.15%Purpose Ether Yield ETF – ETF UnitsETHYTSX$0.0722$2.662.71%Purpose Ether Yield ETF – ETF Non-Currency Hedged UnitsETHY.BTSX$0.0942$3.482.71%Purpose Ether Yield ETF – ETF Non-Currency Hedged USD UnitsETHY.UTSXUS $ 0.0725US $ 2.672.71%Purpose Ether ETF – ETF UnitsETHHTSX$0.6905$11.266.13%Purpose Ether ETF – ETF Non-Currency Hedged UnitsETHH.BTSX$0.8371$13.676.12%Purpose Ether ETF – ETF Non-Currency Hedged USD UnitsETHH.UFull story available on Benzinga.com

Madison Short Term Strategic Income ETF (NYSEARCA:MSTI – Get Free Report) was the recipient of a significant decrease in short interest in December. As of December 15th, there was short interest totaling 1,926 shares, a decrease of 29.9% from the November 30th total of 2,749 shares. Currently, 0.1% of the shares of the stock are [...]

Invesco RAFI Developed Markets ex-U.S. Small-Mid ETF (NYSEARCA:PDN – Get Free Report) saw a large drop in short interest in the month of December. As of December 15th, there was short interest totaling 1,789 shares, a drop of 32.6% from the November 30th total of 2,653 shares. Currently, 0.0% of the company’s shares are short [...]

SPDR ICE Preferred Securities ETF (NYSEARCA:PSK – Get Free Report) was the target of a significant decline in short interest during the month of December. As of December 15th, there was short interest totaling 14,311 shares, a decline of 39.7% from the November 30th total of 23,719 shares. Currently, 0.1% of the company’s stock are [...]

Invesco National AMT-Free Municipal Bond ETF (NYSEARCA:PZA – Get Free Report) was the target of a significant decline in short interest in December. As of December 15th, there was short interest totaling 291,083 shares, a decline of 22.9% from the November 30th total of 377,760 shares. Based on an average trading volume of 1,065,945 shares, [...]

MicroSectors U.S. Big Oil 3X Leveraged ETNs (NYSEARCA:NRGU – Get Free Report) was the recipient of a large drop in short interest in December. As of December 15th, there was short interest totaling 13,386 shares, a drop of 25.6% from the November 30th total of 17,985 shares. Based on an average trading volume of 37,546 [...]

Global X U.S. Preferred ETF (NYSEARCA:PFFD – Get Free Report) was the target of a large decline in short interest in the month of December. As of December 15th, there was short interest totaling 732,478 shares, a decline of 25.5% from the November 30th total of 982,713 shares. Based on an average daily volume of [...]

ProShares Short Real Estate (NYSEARCA:REK – Get Free Report) was the recipient of a large decline in short interest during the month of December. As of December 15th, there was short interest totaling 10,554 shares, a decline of 26.3% from the November 30th total of 14,329 shares. Currently, 1.6% of the company’s shares are sold [...]

ClearShares OCIO ETF (NYSEARCA:OCIO – Get Free Report) was the recipient of a significant increase in short interest in the month of December. As of December 15th, there was short interest totaling 3,862 shares, an increase of 31.0% from the November 30th total of 2,948 shares. Based on an average daily trading volume, of 793 [...]

NYLI MacKay Municipal Insured ETF (NYSEARCA:MMIN – Get Free Report) was the recipient of a significant drop in short interest in the month of December. As of December 15th, there was short interest totaling 33,904 shares, a drop of 25.3% from the November 30th total of 45,377 shares. Currently, 0.2% of the company’s stock are [...]

Invesco Financial Preferred ETF (NYSEARCA:PGF – Get Free Report) was the target of a large drop in short interest in the month of December. As of December 15th, there was short interest totaling 64,444 shares, a drop of 31.1% from the November 30th total of 93,569 shares. Based on an average daily volume of 200,290 [...]

American Century Multisector Income ETF (NYSEARCA:MUSI – Get Free Report) saw a large increase in short interest in December. As of December 15th, there was short interest totaling 15,368 shares, an increase of 29.9% from the November 30th total of 11,834 shares. Based on an average daily trading volume, of 23,414 shares, the days-to-cover ratio [...]

Invesco Food & Beverage ETF (NYSEARCA:PBJ – Get Free Report) was the recipient of a large decrease in short interest during the month of December. As of December 15th, there was short interest totaling 6,562 shares, a decrease of 39.1% from the November 30th total of 10,778 shares. Currently, 0.3% of the shares of the [...]

PGIM Ultra Short Bond ETF (NYSEARCA:PULS – Get Free Report) was the recipient of a large decrease in short interest in December. As of December 15th, there was short interest totaling 279,329 shares, a decrease of 38.0% from the November 30th total of 450,343 shares. Approximately 0.1% of the company’s stock are sold short. Based [...]

TL;DR summary: OPEC+ is widely expected to reaffirm its planned pause in oil output increases at a meeting this weekend, as evidence builds of a growing global supply surplus and slowing demand growth. With crude prices under sustained pressure, the group appears inclined to prioritise market stability over further production hikes.---OPEC+ is expected to stick with its decision to pause further oil supply increases when it meets this weekend, amid rising concerns that the global market is already slipping into oversupply, according to multiple delegates familiar with the group’s discussions.Key members of the alliance, led by Saudi Arabia and Russia, are scheduled to hold a monthly video conference on January 4. The meeting will review a policy decision first taken in November to halt additional production hikes during the first quarter, following a rapid revival of output earlier this year. The group reconfirmed that stance at a gathering earlier this month and is widely expected to do so again, delegates said, speaking on condition of anonymity due to the private nature of the talks.The cautious approach reflects a sharply deteriorating price environment. Crude futures have fallen more than 15% over the course of this year and are on track for their steepest annual decline since the 2020 pandemic-driven collapse. Prices have been weighed down by rising supply from both OPEC+ producers and non-OPEC competitors, while global demand growth has slowed as economic momentum softens across key consuming regions.Oversupply risks are becoming harder to ignore. Forecasters, including the International Energy Agency, are warning that the oil market could face a record surplus next year if current trends persist. Even OPEC’s own secretariat, which typically presents a more optimistic outlook, is now projecting a modest supply glut in 2026, a notable shift that underscores the challenge facing producers.For OPEC+, the decision to hold production steady reflects a delicate balancing act. On one hand, further supply restraint risks ceding market share to rival producers, particularly in the Americas. On the other, pushing ahead with output increases in the face of weakening demand could deepen price losses and strain the fiscal positions of oil-dependent economies.The planned pause also buys the group time to assess how global demand evolves into the first half of the year, particularly as monetary policy remains restrictive in many advanced economies and China’s recovery continues to disappoint. Any signs of further demand weakness or accelerating inventories are likely to reinforce the case for continued caution.As a result, markets are likely to view this weekend’s meeting less as a catalyst for immediate change and more as confirmation that OPEC+ is shifting into a defensive posture, focused on preventing a sharper downturn rather than engineering a price rebound. This article was written by Eamonn Sheridan at investinglive.com.

Trump vetoes bipartisan bill to provide clean water to rural Southeastern Colorado Colorado Public RadioTrump vetoes the first two bills of this term CBS NewsTrump vetoes bill to fund Arkansas Valley Conduit in Colorado 9NewsTrump Issues First Second-Term Vetoes for Colorado Water Project and Florida Tribal Measure U.S. News & World ReportTrump issues first presidential vetoes of this term KING5.com

The owner, a large development company, argued it should be assessed at $14.7 million

The Skagit County Board of Commissioners signed agreements Monday to begin providing services at the Skagit STAR Center, a newly-built facility for voluntary mental health and addiction treatment.

A new sighting of Tesla Cybercab prototypes in Austin, Texas, is fueling the ongoing debate about the vehicle’s design. While the prototypes were spotted with steering wheels, which is standard for testing, it raises questions about whether Tesla can actually stick to its plan to launch the vehicle without them given the state of its self-driving effort. more...

The company hopes to become Hong Kong's first publicly listed pet hospital chain, hoping investors will overlook its weak performance metricsKey Takeaways:Ringpai has filed to list in Hong Kong, reporting cumulative losses of 450 million yuan over the past three yearsThe pet hospital operator continued to bleed red ink in the first half of this year, reporting a loss attributable to ordinary shareholders of 28.42 million yuanPet ownership has surged as a lifestyle choice among increasingly affluent Chinese in the last two decades, fueling early investor enthusiasm about the sector's big potential. But the reality has been far less to bark about, with most pet-oriented businesses offering up options that often leave investors in the financial doghouse.One of those is veterinary leader New Ruipeng, whose recent struggles included a failed attempt at a U.S. listing a couple of years ago. Now, Ruipeng's biggest rival, Ringpai Veterinary Hospital Management Holdings Co. Ltd., is hoping to find its own home in the financial markets with its filing this month for an IPO in the hot Hong Kong market.Ringpai founder Li Shoujun is certainly qualified for the job, graduating from Inner Mongolia Agricultural University in 1988 and earning a PhD in preventive veterinary medicine from China Agricultural University in 2005. He worked at Tianjin Fuyuan Food from 1988 to 1997, before striking out on his own between 1998 and 2001 to establish Ruipu (Tianjin) Biological Pharmaceutical and Ruipu (Baoding) Biological Pharmaceutical.Leveraging his extensive background in animal health and growing business savvy, Li spotted an opportunity presented by China's booming economy and rising wealth, which were fueling a new craving for pet ownership. Catering to that demand, he founded Ringpai in 2012, betting that pet healthcare would quickly become a big business.Top-tier investors have agreed with Li's vision. The company's backers include the likes of ...Full story available on Benzinga.com

MINISO Group (NYSE:MNSO – Get Free Report) and Shoe Carnival (NASDAQ:SCVL – Get Free Report) are both retail/wholesale companies, but which is the better business? We will contrast the two businesses based on the strength of their profitability, dividends, institutional ownership, earnings, valuation, risk and analyst recommendations. Dividends MINISO Group pays an annual dividend of [...]

DuPont de Nemours (NYSE:DD – Get Free Report) and Geltech Solutions (OTCMKTS:GLTC – Get Free Report) are both basic materials companies, but which is the better investment? We will compare the two businesses based on the strength of their dividends, earnings, valuation, institutional ownership, risk, profitability and analyst recommendations. Profitability This table compares DuPont de [...]

Shares of Lindblad Expeditions (NASDAQ:LIND – Get Free Report) have been assigned an average rating of “Moderate Buy” from the six research firms that are presently covering the firm, Marketbeat reports. One analyst has rated the stock with a sell rating, one has assigned a hold rating and four have assigned a buy rating to [...]

Hippo (NYSE:HIPO – Get Free Report) and MGIC Investment (NYSE:MTG – Get Free Report) are both finance companies, but which is the better investment? We will compare the two businesses based on the strength of their earnings, institutional ownership, profitability, analyst recommendations, risk, valuation and dividends. Earnings and Valuation This table compares Hippo and MGIC [...]

DuPont de Nemours (NYSE:DD – Get Free Report) and Geltech Solutions (OTCMKTS:GLTC – Get Free Report) are both basic materials companies, but which is the better investment? We will contrast the two businesses based on the strength of their valuation, risk, earnings, dividends, analyst recommendations, institutional ownership and profitability. Analyst Ratings This is a summary [...]

NEW YORK (AP) — Stocks on Wall Street are largely unchanged as trading for 2025 nudges closer to the finish line. The Dow dipped 0.3% while the S&P 500 fell 0.1% and the Nasdaq added less than 0.1% early Tuesday.

911 call audio, police body camera footage show aftermath of Cinnabon mall incident WLUK

BEIJING, Dec. 30, 2025 /PRNewswire/ -- A collaboration spanning more than 16,000 kilometers and 15 years—including 38 research and field visits—has taken a team from Lanzhou University, led by Professor Xiong Youcai, from China's Loess Plateau to agricultural regions of East Africa. The...

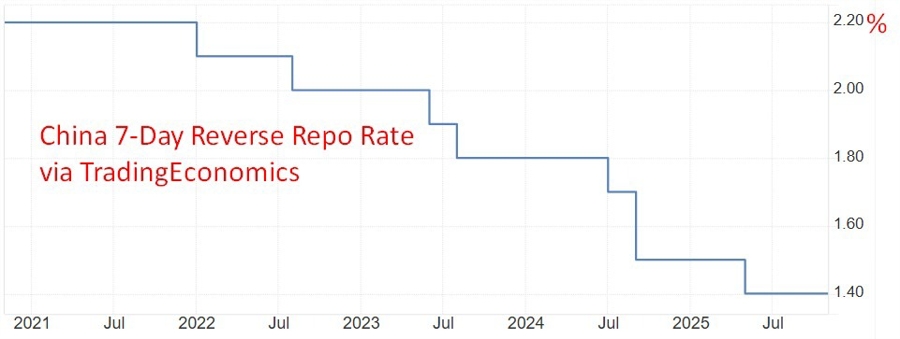

TL;DR summary:China delivered minimal rate cuts despite expectations for aggressive easing.The PBOC has prioritised financial stability and targeted liquidity tools.Fiscal stimulus is expected to carry the bulk of policy support into 2026.China’s central bank has taken a notably restrained approach to monetary easing, defying widespread expectations for aggressive rate cuts as the economy grapples with weak domestic demand, deflationary pressure and structural imbalances. Over the past year, the People’s Bank of China trimmed its policy rate only once, by 10 basis points, the smallest annual reduction since 2021, despite forecasts from major Wall Street banks calling for easing of up to 40 basis points. Info comes via a Bloomberg report, gated. The caution has surprised markets, particularly after Beijing signalled a shift to a “moderately loose” monetary stance for the first time in 14 years as it prepared for escalating trade tensions with the US. What economists underestimated was the resilience of China’s export sector, concerns over banking-system stability, and the impact of a strong equity-market rally, all of which reduced the urgency for sweeping rate cuts.Compared with global peers, China’s stance stands out. While advanced-economy central banks have cut policy rates by an average of 1.6 percentage points over the past two years, the PBOC has delivered only a fraction of that. Adjusted for inflation, Chinese interest rates have moved back into positive territory, underscoring Beijing’s reluctance to follow the ultra-loose playbook adopted by the Federal Reserve, European Central Bank and Bank of Japan during downturns.Instead, policymakers have leaned on targeted and less conventional tools. Liquidity injections through short- and medium-term operations, selective relending programs, support for equity markets and renewed government bond purchases have kept funding conditions loose without slashing benchmark rates. These measures have pushed interbank borrowing costs, such as the seven-day repo rate, to their lowest levels since early 2023. Officials see limited scope for further cuts, with the key policy rate, the 7-day reverse repo, at 1.4% and concerns that deeper reductions could compress bank margins, weaken credit growth and fuel “Japanification” fears. As a result, fiscal policy is set to play the dominant role in 2026, with monetary policy focused on maintaining liquidity and keeping government borrowing costs low rather than driving a demand-led rebound. --- The 7-day reverse repo rate, now considered a key policy signal, was cut from 1.5% to 1.4% on May 9, 2025.The 1-year LPR was trimmed to 3.0% from 3.1%, and the 5-year LPR was lowered to 3.5% from 3.6% in May also.. This article was written by Eamonn Sheridan at investinglive.com.

T. Rowe Price Hedged Equity ETF (NYSEARCA:THEQ – Get Free Report) was the target of a significant increase in short interest in the month of December. As of December 15th, there was short interest totaling 2,125 shares, an increase of 65.9% from the November 30th total of 1,281 shares. Currently, 0.3% of the company’s stock [...]

Vanguard Energy ETF (NYSEARCA:VDE – Get Free Report) was the recipient of a large drop in short interest in December. As of December 15th, there was short interest totaling 93,583 shares, a drop of 35.2% from the November 30th total of 144,455 shares. Based on an average trading volume of 553,292 shares, the days-to-cover ratio [...]

Hypatia Women CEO ETF (NYSEARCA:WCEO – Get Free Report) was the target of a large drop in short interest in the month of December. As of December 15th, there was short interest totaling 842 shares, a drop of 37.3% from the November 30th total of 1,342 shares. Currently, 0.5% of the company’s stock are short [...]

SP Funds Dow Jones Global Sukuk ETF (NYSEARCA:SPSK – Get Free Report) was the target of a large decrease in short interest during the month of December. As of December 15th, there was short interest totaling 10,668 shares, a decrease of 35.0% from the November 30th total of 16,414 shares. Currently, 0.0% of the shares [...]

ProShares Short 7-10 Treasury (NYSEARCA:TBX – Get Free Report) was the target of a significant decline in short interest during the month of December. As of December 15th, there was short interest totaling 114 shares, a decline of 31.7% from the November 30th total of 167 shares. Based on an average trading volume of 3,045 [...]

Virtus Reaves Utilities ETF (NYSEARCA:UTES – Get Free Report) was the recipient of a large decline in short interest in the month of December. As of December 15th, there was short interest totaling 124,700 shares, a decline of 37.8% from the November 30th total of 200,641 shares. Approximately 0.8% of the company’s shares are sold [...]

SPDR Portfolio Long Term Treasury ETF (NYSEARCA:SPTL – Get Free Report) was the target of a significant growth in short interest in the month of December. As of December 15th, there was short interest totaling 1,429,185 shares, a growth of 72.9% from the November 30th total of 826,630 shares. Based on an average trading volume [...]

ProShares Ultra FTSE Europe (NYSEARCA:UPV – Get Free Report) was the recipient of a significant increase in short interest in the month of December. As of December 15th, there was short interest totaling 1,789 shares, an increase of 59.7% from the November 30th total of 1,120 shares. Based on an average trading volume of 873 [...]

China plans strict AI rules to protect children and tackle suicide risks BBCChina to crack down on AI chatbots around suicide, gambling CNBCChina’s Plans for Humanlike AI Could Set the Tone for Global AI Rules Scientific AmericanChina issues draft rules to regulate AI with human-like interaction ReutersChina bans AI-powered relatives to comfort the elderly theregister.com

This ETF brings geographic diversification to portfolios with an above-average (though not risky) dividend yield.

Following its big rally this year, should you put Bank of Nova Scotia stock in you TFSA or RRSP?The post Is BNS Stock a Buy, Sell, or Hold for 2026? appeared first on The Motley Fool Canada.

Got $1,000? Three quiet Canadian stocks serving essential services can start paying you now and compound for years.The post Got $1,000? These Canadian Stocks Look Like Smart Buys Right Now appeared first on The Motley Fool Canada.

InvestorsObserver Financial Analyst Sam Bourgi believes many young people could face a lifetime of renting a home instead of buying one.

Jen Hamilton thought gift cards would make ideal prizes to hand out at her corporate holiday party.

Vancouver woman warning others after retail gift card scam costs thousands CTV NewsGift card scam ruins charity's bid to help family | Hanomansing Tonight Yahoo News Canada'Never again,' says Windsor, Ont., senior after embarrassment of empty gift cards CBC

Travere Therapeutics, Inc. (NASDAQ:TVTX – Get Free Report) CAO Sandra Calvin sold 7,402 shares of the business’s stock in a transaction that occurred on Wednesday, December 24th. The shares were sold at an average price of $40.00, for a total transaction of $296,080.00. Following the completion of the transaction, the chief accounting officer owned 38,233 [...]

After a huge gain over the past decade, the S&P 500 trades at a historically expensive valuation.

How The AI Bubble Is Being Masked Within Big Tech Authored by Autumn Spredemann via The Epoch Times,As artificial intelligence (AI) investment ramps up, some analysts are now drawing comparisons to the early “dot com” days of the internet and the market crash that followed.It’s a deja vu moment for Wall Street: A revolutionary technology captures the imagination while capital floods in and valuations begin to put a high price on promises of a future that hasn’t arrived.Now, as AI spending accelerates and a handful of mega companies dominate returns, financial industry insiders are asking whether the AI boom has crossed the line into market bubble territory—when the price of an asset exceeds its actual value.Industries that have the most to gain—and lose—are reporting record earnings on AI. The top five companies on the S&P 500 are tech giants that are heavily invested in AI. Moreover, in the fourth quarter of 2024, 241 companies on the S&P 500 cited AI as part of their earnings—the highest number in a 10-year period, according to FactSet.Investment experts say this is a potential problem: How much of these reported returns belong to AI and how much is bundled in with other earnings?“Right now, stories about the future promise of AI are pushing stock prices higher. When those stories turn into earnings disappointments, prices will fall,” Paul Walker, author and owner of Fil Financial Corporation, told The Epoch Times.“What most investors don’t realize is just how concentrated the market has become. The so-called magnificent seven have driven roughly 60 percent or more of recent gains in the S&P 500 and Russell 1000,” he said.“In other words, people are far less diversified than they think. When those stocks stumble, panic spreads quickly, as investors dump index funds that are loaded with the same tech giants.”The “magnificent seven” companies include Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.Some analysts believe the AI bubble will continue growing in 2026. Investing.com reported Capital Economics analyst Jonas Goltermann’s theory that the environment surrounding AI “now has many of the hallmarks of a bubble,” and includes “hyperbolic beliefs about AI’s potential within the industry and among investors.”A recent J.P. Morgan analysis noted the majority of market bubbles follow a pattern and often begin with an “investor thesis” that the world is undergoing major changes.“Believers build capacity to meet future demand. The bubble begins to form in part because credit is widely available. Decaying underwriting standards and increasing leverage cause a disconnect between economic fundamentals and market valuations. More and more investors join the crowd—until fundamentals finally prevail and the bubble bursts,” the analysis stated.Apple announces upgrades to its artificial intelligence (AI) system, “Apple Intelligence,” during the annual Apple event at the company's corporate headquarters in Cupertino, Calif., on June 9, 2025. Apple is among the top five companies on the S&P 500 that are heavily invested in AI. Josh Edelson/AFP via Getty ImagesLiving in a BubbleComparisons have been made between the current level of AI investment and the conditions leading up to the dot com bust of 2000.According to a December GIS report, Oracle’s stock price soared 36 percent in September, despite the tech giant’s reported earnings falling below expectations. The stock price shot up after Oracle announced it expected AI-driven cloud revenue to hit $144 billion by 2030. It was the biggest single-day stock increase since 1992, which added an estimated $250 billion to the company’s market share.In the late 1990s, speculation and heavy funding of internet startup companies or dot coms pushed NASDAQ’s Composite Index from 751 in January of 1995 to more than 5,048 by March of 2000. However, with many companies failing to deliver on their promised returns, the market plummeted by more than 75 percent between March 2000 and October 2002. More than $5 trillion in market value was lost during that time.“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes,” Sam Altman, CEO of OpenAI, told The Verge in August. “When bubbles happen, smart people get overexcited about a kernel of truth.”Dan Buckley, chief analyst for DayTrading.com, said the current situation “doesn’t quite feel like 1999 yet, but it’s similar to 1998.”OpenAI CEO Sam Altman speaks during the OpenAI DevDay event in San Francisco on Nov. 6, 2023. Justin Sullivan/Getty Images“The real bubble typically forms after the technology proves that it matters, not before, as that’s what gets most investors off the sidelines,” he told The Epoch Times.Buckley believes AI has “crossed that line,” making the current market phase more dangerous.“Pricing can become even more stretched, and monetary and fiscal policy can become even more supportive of AI buildout. Governments are also getting involved, as they’re less sensitive to financial returns and see AI as a source of geopolitical power,” he said.The amount of money corporations have spent hitching their wagon to AI futures is significant. Major “hyperscaler” tech companies spent $106 billion in capital expenditures in the third quarter of 2025 alone, according to a Dec. 18 report from Goldman Sachs.Overall, large tech companies have spent an estimated $364 billion on AI this year, according to JDP Global.Goldman Sachs observed that investors are becoming more cautious about where they’re putting their money.“The past few months have seen the stock prices of AI hyperscalers diverge: Investors have rotated away from AI infrastructure companies where operating earnings growth is under pressure and where capex is being funded via debt,” the analysis said.Goldman Sachs also said investors are opting for companies that demonstrate clear evidentiary links between their AI expenditures and revenues.“There are some key similarities between AI and [the] dot com craze, both on the side of investors and corporations,” Pedro Silva, principal partner at Apex Investment Group, told The Epoch Times.A billboard advertises an artificial intelligence company in San Francisco on Sept. 16, 2025. Billboards advertising AI companies are appearing throughout the city and along Interstate 80. Justin Sullivan/Getty Images“From the investor side, people want to get in on AI just because they hear it on the news daily,” Silva said. “There is no real scrutiny of the valuations or possible future headwinds; if it says AI and it’s grown substantially, investors want to participate.”He said it’s similar from the corporate perspective. “Companies have to spend on AI, regardless of whether they see an immediate or obvious return on investment,” Silva said.“To not invest in AI as the leader of an organization seems like a dereliction of duty, but the application of the new technology is not always clear.”Thinking AheadBuckley believes most of the reported return on investment with AI is based on vision versus cash flow.“The productivity gains are genuine, even exceptional, in areas like coding, but the investment is ahead of the evidence,” he said. “There has generally been little hard disclosure on how much AI is monetized directly versus bundled into existing products or simply a matter of future promises.”He noted that any market devaluations related to AI and how it impacts individuals largely depend on how their income and savings are linked to technology.The tech sector alone now comprises 34 percent of the S&P 500, according to The Motley Fool. For the average American investor with a diversified portfolio, that means roughly one-third of their investment could be affected, for better or worse.“This [AI] buildout is based on the belief that ‘scale equals control.’ A break in that narrative is what’s likely to bust spending rather than traditional cyclical pressures like declining margins, falling stock prices, or rising interest rates,” Buckley said.“While a pullback in the AI space would reflect on [and] be felt on client statements, the bigger concern would be if it is perceived as a broader economic downturn,” he said.Traders work on the floor of the New York Stock Exchange in New York City on Nov. 19, 2025. Michael M. Santiago/Getty ImagesSilva warned that investors could misread a shrinkage of AI investment as something bigger and make hasty decisions.Silva emphasized that the top five tech giants are not synonymous with the U.S. economy, but their oversized representation in S&P returns could give that impression, triggering a broader equity selloff.Walker pointed out that, over longer periods, the stock market has still shown steady growth—even amid big changes. He stressed the importance of the bigger picture, because today’s market leaders can become “tomorrow’s case studies.”“Instead of trying to predict crashes or pick the next AI winner, investors should build a risk-based portfolio and rebalance it,” Walker said. “If your plan calls for 40 percent stocks, market drops mean you buy more, not panic. When markets boom, you buy less. Discipline beats prediction every time.” Tyler DurdenMon, 12/29/2025 - 09:40

It's no shocker that state-level departments of transportation work within the borders of their state, but the Arkansas Department of Transportation has gone beyond that, taking an active role in working and collaborating with other states' departments of transportation.

BME trades at an attractive discount, offers a monthly distribution, and provides exposure to healthcare investments. Read on the bullish thesis of BME here.