Iconic convenience store chain closing after long goodbye

The company has been living on borrowed time, and the much-loved name will soon disappear.

As an Amazon Associate I earn from qualifying purchases.

Know what the Bible says and understand why it matters with the fully revised NIV Study Bible featuring updated notes, full-color design, and Comfort Print typography designed for immersive reading.

A trusted companion for deep personal study, sermon prep, and devotional reading highlighted in our faith and leadership coverage.

The company has been living on borrowed time, and the much-loved name will soon disappear.

Bitcoin Plunges Below $100K as XRP and Dogecoin Prices Hit 2-Month Lows DecryptBitcoin Dips Below $100K as Iran Moves to Shut Strait of Hormuz Bitcoin.com NewsCrypto Market Liquidations Top $701M as US Strikes Hit Iran's Nuclear Facilities DecryptBTC, SOL, ADA, DOGE Bets Liquidated for $595M as U.S. Bombs Iran Nuclear Sites CoinDesk‘Doomsday Scenario’—Bitcoin Suddenly Drops Under $100,000 As Crypto Price Crash Fears Hit Ethereum And XRP Forbes

'Worst Ally': Army Colonel Removed From US Joint Chiefs Staff Over Israel Criticism A United States Army colonel has been removed from his position on the Pentagon staff supporting the Joint Chiefs after his Israel-critical social media posts were publicized by Jewish News Syndicate (JNS). Until this week, Army Col Nathan McCormack led the Joint Chiefs of Staff's Levant and Egypt branch. That team is part of the Joint Staff J5, which proposes strategies, plans, and policy recommendations to the chairman of the Joint Chiefs. Within hours of Tuesday's JNS report, McCormack was yanked from his post, with a Pentagon official telling JNS:“The individual is being returned to [the Army] while the matter is being investigated...The information on the X account does not reflect the position of the Joint Staff or the Department of Defense...Our global alliances and partnerships are vital to our national security, enhancing our collective defense, deterrence and operational reach.” Colonel Nathan McCormack was commissioned as an infantry second lieutenant two months after the United States invaded Iraq over false claims of a nuclear weapons program Here are the published comments that led to McCormack's removal: May 2025: "Netanyahu and his judeosupremacist cronies are determined to prolong the conflict for their own goals: either to remain in power or to annex the land."June 2024: "The more Israel's death cult escalates toward Hezbollah, the more we will see show-of-force attacks like this and 13 April." June 2024: “The U.S. has not been an honest broker. We have overwhelmingly enabled Israel’s bad behavior.”May 2024: Amid talk of pushing Gaza residents into other countries, McCormack wrote, "[Israel] wants to expel them and cleanse 'Eretz Israel' of ethnic Palestinians." April 2024: “I’ve lately been considering whether we might be Israel’s proxy and not realized it yet. Our worst ‘ally.’ We get literally nothing out of the ‘partnership’ other than the enmity of millions of people in the Middle East, Africa and Asia.” Oct 2023: "I agree that Israel has an absolute right to respond militarily, and that civilians may legally be caught in the crossfire, but you are ignoring the requirement of proportionality. Israel’s responses always (always—not hyperbole) disproportionately target Palestinian civilians." The JNS report that prompted McCormack's removal from the J5 gave no indication of how his semi-anonymous posts came to the pro-Israel outlet's attention. Up until his 2021 death, zealously pro-Israel billionaire and mega-campaign-contributor Sheldon Adelson was JNS's largest single donor. The JNS article included a disapproving quote from another Adelson-funded entity, the Foundation for Defense of Democracies, which -- despite its generic-sounding name -- declared in its initial tax-exempt-status-filing that its goal was to "enhance Israel's image in North America." McCormack's posts were made on X under an account using the name "Nate" and the handle "@mick_or_mack," with a profile that used a cartoon version of himself. His account no longer exists, but several of his posts are still viewable via internet archive links. McCormack didn't strive for full anonymity, as he once posted a photo of a Meritorious Service Medal certificate showing his full name. In May, he replied to an X user, "I’m the Joint Staff J5 Israel branch chief.” In Dec 2008, then-Captain McCormack speaks to a sheikh in Butoma, Iraq while serving as a 25th Infantry Division company commander (photo: US Army) The Pentagon told JNS another officer has been assigned to "look into the matter," but it's not clear that McCormack violated any Army policies. The branch's social media guide says "soldiers are encouraged to express their opinions of the political process online and offline." It advises soldiers to "avoid use of DoD titles, insignia, uniforms or symbols in a way that could imply DoD sanction or endorsement of content on your personal page." McCormack's profile included a disclaimer that his posts “do not represent the position of the Department of Defense or any of its components.” Then again, one of his posts might be read as attributing a position to the DOD, as he wrote:“Along with the World Health Organization and United Nations, we (Department of Defense, Department of State and the U.S. Intelligence Community) consider the Gaza Health Ministry figures to be generally reliable (though not precise), but probably less so now than they were originally due to the general destruction and chaos in Gaza.”Even if he's spared any formal discipline, it's safe to say there's zero chance McCormack will be returning to his position on the J5 staff. Beyond its general influence over US policy and personnel, Israel has a history of a strong presence directly inside the Pentagon. Here's how former Army Col. Lawrence Wilkerson -- who served as Secretary of State Colin Powell's chief of staff amid the run-up to the 2003 invasion of Iraq -- described what he witnessed: 🚨Col. Lawrence Wilkerson: ‘It’s UNQUESTIONABLE that the Epstein business was heavily influenced by MOSSAD!’‘I watched Mossad take over the Pentagon in 2002. The Pentagon was infiltrated by Mossad. They did not need any identification to get through the river entrance to the... pic.twitter.com/rZtnFTPc1k— Going Underground (@GUnderground_TV) June 9, 2025A Dallas native and Texas A&M graduate, McCormack was commissioned as an infantry second lieutenant just two months after the United States invaded Iraq based on the false pretense that Saddam Hussein was developing a nuclear weapon. As the United States contemplated that invasion, Benjamin Netanyahu told Congress: "There is no question whatsoever that Saddam is seeking and is working and is advancing towards the development of nuclear weapons—no question whatsoever.” "If you take out Saddam, I guarantee you that it will have enormous positive reverberations on the region." McCormack would later be deployed to Iraq, where he surely witnessed for himself the utter emptiness of Netanyahu's claims, and the catastrophic consequences of acting on them. As the Pentagon participated in deliberations over joining another Middle East war on nearly-identical premises, Colonel McCormack's contrarian perspective might have been particularly valuable at such a pivotal moment. Tyler DurdenSat, 06/21/2025 - 22:45

A transcript of President Donald Trump’s speech on U.S. airstrikes on Iran, which he delivered at the White House on Saturday night. Trump said, “Our objective was the destruction of Iran’s nuclear enrichment capacity and a stop to the nuclear...

FedEx founder Fred Smith dies, sources confirm WREG.comView Full Coverage on Google News

Friends of mine, prominent players in the New York City business community, tell me they are horrified that a certified socialist, Zohran Mamdani, might become our next mayor.

FedEx Founder Frederick Smith passes away, multiple sources confirm FOX13 MemphisFedEx founder Fred Smith has died localmemphis.comFedEx founder Fred Smith dies, sources confirm WREG.comFred Smith, FedEx founder and American business magnate, dies at 80 | Reports The Commercial AppealFred Smith family: All about FedEx founder's wife and children Hindustan Times

Ninth Circuit Strikes Down California's "1-In-30" Gun-Rationing Law Authored by Jonathan Turley,A unanimous panel of the United States Court of Appeals for the Ninth Circuit has struck down California’s “1-in-30” gun rationing law as unconstitutional under the Second Amendment.The law restricted citizens to one gun purchase every 30 days and was based on a ridiculous rationale that was shredded by the three-judge panel.California Penal Code § 27535(a) states that individuals may not apply “to purchase more than one firearm within any 30-day period,” and § 27540(f) prohibits a firearms dealer from delivering any firearm if the dealer is notified that “the purchaser has made another application to purchase a handgun, semiautomatic centerfire rifle, completed frame or receiver, or firearm precursor part” within the preceding 30-day period.Writing for the court, Judge Danielle Jo Forrest found the California law facially unconstitutional. She wrote:California suggests that the Second Amendment only guarantees a right to possess a single firearm, and that Plaintiffs’ rights have not been infringed because they already possess at least one firearm. California is wrong. The Second Amendment protects the right of the people to “keep and bear Arms,” plural. U.S. Const. amend. II (emphasis added). This “guarantee[s] the individual right to possess and carry weapons.” Heller, 554 U.S. at 592 (emphasis added).And not only is “Arms” stated in the plural, but this term refers to more than just guns. It includes other weapons and instruments used for defense. See id. at 581. California’s interpretation would mean that the Second Amendment only protects possession of a single weapon of any kind. There is no basis for interpreting the constitutional text in that way.The court rightfully dismisses the state’s forced and frankly frivolous argument.It then delivers a particularly lethal line on the historical prong of the analysis.Next, the panel held that California’s law is not supported by this nation’s tradition of firearms regulation. Bruen requires a “historical analogue,” not a “historical twin,” for a modern firearm regulation to pass muster. Here, the historical record does not even establish a historical cousin for California’s one-gun-a-month law.Here is the opinion: Nguyen v. Bontan Tyler DurdenSat, 06/21/2025 - 22:10

Democrats seem to be at odds once more when it comes to the Mideast. Even before President Donald Trump's announcement Saturday that the U.S. had struck Iranian nuclear sites, progressives demanded unified opposition of any U.S. such move. Party leaders...

“We have completed our very successful attack on the three Nuclear sites in Iran, including Fordow, Natanz, and Esfahan,” President Donald Trump said Saturday. The nuclear facilities were hit with massive bombs delivered from B-2 stealth bombers. U.S. Navy submarines also joined the attack, launching more than 30 Tomahawk missiles into Iran. Trump’s decision to join Israel’s war against Iran sharply escalates the conflict and appears to push any diplomatic solution out of reach. President Donald Trump on Saturday said the United States had attacked Iranian nuclear sites, pushing America into Israel‘s war with its longtime rival and regional power.“A short time ago, the U.S. military carried out massive precision strikes on the three key nuclear facilities in the Iranian regime, Fordo, Natanz and Isfahan,” Trump said in a speech from the White House.U.S. Navy submarines also launched more than 30 Tomahawk missiles into Iran, two defense officials told NBC News.Trump said the U.S. and Israel, “worked as a team, like perhaps no team has ever worked before. We’ve gone a long way to erasing this horrible threat” to the American ally.The president congratulated the U.S. military on “an operation the likes of which the world has not seen in many, many decades. Hopefully we will no longer need their services in this capacity.”“There will be either peace, or there will be tragedy for Iran far greater than we have witnessed over the last eight days. Remember, there are many targets left,” Trump said.“Tonight was the most difficult of them all by far, and perhaps the most lethal. But if peace does not come quickly, we will go after those other targets with precision, speed and skill, most of them can be taken out in a matter of minutes,” he added.Trump watched the strikes unfold Saturday from the White House Situation Room, where he was joined by his national security team and closest aides.White House | Via ReutersU.S. President Donald Trump holds a meeting alongside Secretary of State Marco Rubio in the Situation Room at the White House in Washington, D.C., U.S. June 21, 2025.The president initially announced the strikes on social media Saturday, where he wrote that “a full payload of BOMBS was dropped on the primary site, Fordow.”It was unclear late Saturday precisely how much damage the U.S. strikes had done to the heavily fortified Iranian nuclear sites, or whether any American military assets were still active in the country.Earlier in the day, several U.S. Air Force B-2 stealth bombers reportedly left Missouri, heading west over the Pacific Ocean. The massive planes are some of the only U.S. aircraft capable of carrying the GBU-57 Massive Ordnance Penetrator (MOP), a 30,000-pound bomb known as the “bunker buster.”The bunker buster bombs are widely viewed as the only conventional, non-nuclear weapons capable of inflicting serious damage on the Fordo nuclear facility, which is built into the side of a mountain.Saturday’s action puts the United States in direct armed conflict with Iran, a massive escalation in its involvement with Israel’s effort to cripple Tehran’s nuclear program and topple its regime.Trump spoke with Israeli Prime Minister Benjamin Netanyahu after the U.S. strikes, a White House official told NBC News.The decision to attack Iran once again engages the American military in active warfare in the Middle East — something Trump had vowed to avoid during his second term in office.It also marks a major shift from just 48 hours ago, when Trump said the United States would take “two weeks” to see if the conflict between Israel and Iran could be resolved diplomatically.“Based on the fact that there’s a substantial chance of negotiations that may or may not take place with Iran in the near future, I will make my decision whether or not to go within the next two weeks,” Trump said Thursday in a statement issued by the White House.Behind the scenes, the Trump administration has been trying to reach a deal with Iran over its nuclear program, and Trump in recent months had reportedly urged Netanyahu to hold off on a strike.Graphic by SYLVIE HUSSON, NALINI LEPETIT-CHELLA, SABRINA BLANCHARD| AFP | via Getty ImagesInfographic with a map of Iran showing nuclear sites, reactors and uranium mines. That diplomatic path may now be closed. Iranian Ayatollah Ali Khamenei said recently that “any American military entry will undoubtedly be met with irreparable damage.”“If they enter militarily, they will face harm that they cannot recover from,” he added in a statement read on Iranian state television.After the U.S. strikes, it was unclear what options remained for an Iranian retaliation against the United States.One possibility with direct impacts on the global economy and supply chain would be if Tehran were to set landmines down in the Strait of Hormuz, said Helima Croft, head of global commodity strategy at RBC Capital Markets.The narrow body of water between Iran and Oman is the transit point for about 20% of the world’s oil, via tanker ships. Landmines would effectively close the strait, because ships would not know where the mines were placed.“We’re already getting reports that Iran is jamming ship transponders very, very aggressively,” Croft told CNBC’s “Fast Money” on Wednesday.QatarEnergy and the Greek Shipping Ministry have already warned their vessels to avoid the strait as much as possible, Croft said.More such alerts were expected following Saturday’s U.S. attack on Iranian sites.Getty ImagesInfographic with map of the Gulf showing maritime tanker traffic in September 2024 through the Strait of HormuzTrump and previous American presidents have long insisted that Iran cannot have nuclear weapons.During his first term, Trump pulled the U.S. out of a nuclear agreement that the Obama administration and other nations had brokered with Iran in 2015, arguing it failed to protect America or deter Tehran’s enrichment aims.Israel has long claimed that Iran is developing nuclear weapons, and has threatened to strike its nuclear program before. But until now, Tel Aviv has limited its military engagement to targeted assassinations and cyber attacks.Tulsi Gabbard, Trump’s director of national intelligence, testified before Congress in March that the U.S. intelligence community “continues to assess that Iran is not building a nuclear weapon and Supreme Leader Khamenei has not authorized the nuclear weapons program that he suspended in 2003.”But Trump has repeatedly dismissed his own Cabinet official’s assessment.“I don’t care what she said. I think they were very close to having one,” Trump said on Air Force One last week. World leaders react after Trump says U.S. bombed nuclear sites in IranTrump rips into ‘too late’ Jerome Powell after Fed holds rates steadyA ‘spiral of escalation’: World braces for intensifying Iran-Israel conflictIsrael denies pursuing regime change in Iran; it aims to remove nuclear programIran threatens ‘irreparable damage’ if U.S. enters Israel conflictThese are the sticking points holding up a U.S.-EU trade dealNYC mayoral candidate Brad Lander released after arrest by ICETrump weighs potential U.S. military strike on Iran, demands surrender

This is your weekly lookahead at the key global events that could move markets and shape policy. NATO leaders meet in The Hague with Trump expected to ramp up pressure on Europe over defense spending. Summer Davos kicks off in Tianjin amid China-U.S. trade tensions, while Germany hosts its Day of Industry as economic sentiment improves.After a week of global market jitters, the reaction to U.S. strikes on Iranian nuclear facilities will be front and center over the coming days. Meanwhile, a trio of heavyweight events could also shape the economic and geopolitical mood. From NATO tensions in The Hague to trade talks in Tianjin and industrial optimism in Berlin — investors will be watching closely. The stage is set for tense talks at the NATO Summit in The Hague on Wednesday where U.S. President Donald Trump is expected to exert further pressure on Europe to boost defense spending Summer Davos takes place in Tianjin, China from Tuesday to Thursday with China trade talks underway Day of Industry in Germany on Monday and Tuesday as engine of growth restartsU.S.-Iran-IsraelAddressing the nation on Saturday evening, U.S. President Donald Trump said strikes on three of Iran’s nuclear sites were a “spectacular military success” that “completely obliterated” the country’s major enrichment facilities.The strikes, which mark the first time the U.S. has conducted a direct military attack on Iran, mark a dramatic escalation in geopolitical tensions. Trump’s claim about the result of the operation could not be independently confirmed.Iran Foreign Minister Abbas Araghchi slammed the U.S. strikes, describing them as “outrageous” and saying the country “reserves all options to defend its sovereignty, interest, and people.” Global investors will be scrambling to assess the fallout.On the DefensiveNATO meetings with Trump in attendance have a history of being dramatic. Back in 2017, the White House leader consistently questioned America’s commitment to the alliance, and accused other members of owing “massive amounts of money” to the overall share of defense spending.Fast forward to 2025 and the next NATO Leaders Summit with Trump is set to take place in The Hague, the Netherlands on Wednesday. Some problems are familiar – while defense spending has increased dramatically across Europe, countries like Spain risk derailing talks by calling the 5% of GDP target “unreasonable.” In addition, the war in Ukraine rages on. Meanwhile other problems are new – hostilities are rising between Israel and Iran, alongside other neighbors in the Middle East, are testing international relations to the limit. U.S. Ambassador to NATO Matthew Whittaker, told CNBC’s “Squawk Box Europe” that the region should not expect a free ride from the U.S. on defense spending, as “the 5% target is not a negotiating tactic.” Summer DavosOn the other side of the world, the Chinese city of Tianjin plays host to the World Economic Forum’s Meeting of New Champions running from Tuesday to Thursday, also known as the Summer Davos. Technology dominates the agenda at a tricky time for relations between China and the West, as trade negotiations with the U.S. are still on-going.Trump may have bought more time for TikTok, extending the deadline for China’s ByteDance to divest the social media platform’s U.S. business to September, but the latest round of trade talks in London led to a vague stand-off between the two superpowers, with no official readout. Speaking to CNBC right after those negotiations, U.S .Commerce Secretary Howard Lutnick was asked if current tariffs on China would not shift again, to which he replied, “you can definitely say that.”But this may do little to ease the conversations between Chinese officials and corporates in Tianjin, and the international delegates in attendance, who will be looking for more certainty from both the White House and Beijing.Engine of GrowthCloser to home, it’s the Day of Industry conference in Germany on Monday and Tuesday. This annual meeting in Berlin highlights German economic policy and global trade strategies. It could be a good time for the new government to be touting Europe’s so-called Engine of Growth, with four economic institutes raising their 2025 and 2026 GDP growth forecasts for Europe’s largest economy.During a recent trip to Washington DC, Chancellor Friedrich Merz dodged the ire that other world leaders have faced in the Oval Office, with Trump’s focus mostly dominated by his public spat with Elon Musk. But it’s not all clear roads ahead for Germany, as the country’s auto industry body reports that domestic auto-makers have shouldered around 500 million euros ($576.1 million) in costs associated with Trump’s import tariffs.

You might see this retailer disappear from your town soon.

Billionaire Mark Cuban has revealed that the Kamala Harris campaign sought to vet him for the 2024 Democratic vice presidential nomination, an offer he chose to decline.What Happened: Cuban, ex-owner of the Dallas Mavericks, was asked by the Harris campaign to submit vetting documents for the VP role. The billionaire confirmed the rumor during an interview on Friday.Cuban justified his decision by stating in the interview, “I’m not very good as the number two person.” He further confessed his discomfort with the traditional vice presidential duties of “shaking hands ...Full story available on Benzinga.com

Ohio power grid operator raises red flag as heat and industry drive demand 10TVPJM Issues Hot Weather Alert for Expected Heat Wave June 22–25 PJM Inside LinesPA PUC OFFERS TIPS TO KEEP COOL wccsradio.comState preps for higher heat, humidity next week; power demand forecast for electric utilities WGRZPUC Highlights #WaysToStayCool as Heat Wave Arrives – While Also Addressing Widespread Storm-Related Power Outages Beaver County Radio

29 Everyday Groceries That Used To Be Cheap But Are Now Basically A Luxury BuzzFeed

Omi, a Paris-based startup revolutionizing product visuals with 3D modeling and artificial intelligence, has won the "Most Promising" prize at the 2024 LVMH Innovation Awards. The award was presented on June 12 in Paris at leading European tech conference VivaTech, hosted by LVMH Image and Environment Director Antoine Arnault.Hugo Borensztein, co-founder and CEO of Omi, said the win reflects a broader shift happening across the luxury and retail industries. “Working with a Maison founded two centuries ago using the most advanced 3D and AI technologies expresses LVMH's bold, innovation-inspired vision. We are both honored and proud to be part of this adventure," Borensztein said in a statement by LVMH.Don't Miss:Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — this is your last chance to become an investor for $0.80 per share.Peter Thiel turned $1,700 into $5 billion—now accredited investors are eyeing this software company with similar breakout potential. Learn how you can invest with $1,000 at just $0.30/share.Omi Offers AI-Driven Visuals For The Future Of Luxury RetailOmi specializes in using 3D technology ...Full story available on Benzinga.com

Energy Secretary Chris Wright announced an ambitious plan to have three small modular reactors (SMRs) built and producing power at the Idaho National Laboratory (INL) by July 4, 2026. This initiative was revealed during a Senate Energy and Natural Resources Committee hearing on June 18, aligning with President Donald Trump’s executive orders to boost domestic [...]

Popular recording artist closes his Las Vegas Strip residency.

Probably like you, I’ve been trying to figure out why the Trump administration is rife with science denial. At first I attributed it to anti-intellectualism. With that, I thought, went an ideological mindset in which people identified with superficialities like He Who Dies with the Most Toys Wins. But that ... [continued]The post Trump 2.0 And Science Denial — Alice In Wonderland For The 21st Century appeared first on CleanTechnica.

Ranked: Countries With the Highest Share of Seniors Visual Capitalist

SAN DIEGO, June 21, 2025 (GLOBE NEWSWIRE) -- The law firm of Robbins Geller Rudman & Dowd LLP announces that purchasers of Tempus AI, Inc. (NASDAQ:TEM) common stock between August 6, 2024 and May 27, 2025, both dates inclusive (the "Class Period"), have until August 12, 2025 to seek appointment as lead plaintiff of the Tempus AI class action lawsuit. Captioned Shouse v. Tempus AI, Inc., No. 25-cv-06534 (N.D. Ill.), the Tempus AI class action lawsuit charges Tempus AI and certain of Tempus AI's top executives with violations of the Securities Exchange Act of 1934.If you suffered substantial losses and wish to serve as lead plaintiff of the Tempus AI class action lawsuit, please provide your information here:https://www.rgrdlaw.com/cases-tempus-ai-inc-class-action-lawsuit-tem.htmlYou can also contact attorneys J.C. Sanchez or Jennifer N. Caringal of Robbins Geller by calling 800/449-4900 or via e-mail at [email protected] ALLEGATIONS: Tempus AI is a technology company advancing precision medicine through the practical application of artificial intelligence, including generative AI.The Tempus AI class action lawsuit alleges that defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that: (i) Tempus AI inflated the ...Full story available on Benzinga.com

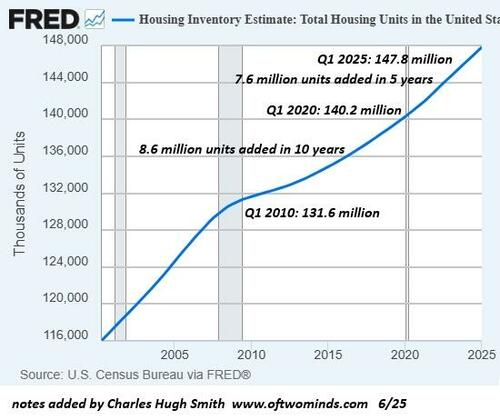

How Housing Bubble #2 Bursts? Authored by Charles Hugh Smith via OfTwoMinds blog,Corporate / private equity / STVR investors are all fair-weather owners of housing.Let's indulge in some basic logic:1. All credit-asset bubbles burst.2. U.S. housing is a credit-asset bubble.3. The U.S. housing bubble will burst.The only variables are how and when Housing Bubble #2 will burst. That's today's topic.I've been writing about housing since 2005, as Housing Bubble #1 was inflating. I've participated in / observed housing rising sharply in the late 1970s and the late 1980s, followed by deflation / stagnation. Housing Bubble #1--circa 2003-2008--was characterized by all the classic signs of a mania:1. Participants denied it was a bubble. When greed displaces prudence, this isn't a bubble doomed to pop, it's the New Normal.2. Fraud, malfeasance, misrepresentation, speculation and leverage were all rampant. In the euphoric ascent to ever higher valuations, why let foolish little things like income, risk management and credit ratings stand in the way of reaping more profits?Housing Bubble #2 has rolled over into the decline phase, but this is discounted by the consensus which holds that higher mortgage rates dented the market; once they drop a bit, housing will resume its ascent to ever-higher valuations.I see a different set of dynamics in play:1. The 40+ year cycle of interest rates / bond yields has turned. Rates will not go back to zero and stay flatlined for years. Risk and inflationary forces have changed and are not returning to The Great Moderation.2. The Federal Reserve / federal government effectively nationalized the mortgage industry post-2009 Global Financial Meltdown as the means to stop the decline of housing valuations and re-inflate them via super-low mortgage rates. The Fed bought a staggering $1.2 trillion of mortgage-backed securities in 2009-2010, up from zero--a monumental manipulation of the mortgage market that soon exceeded $1.6 trillion.How the housing/mortgage market managed to survive without Fed nationalization prior to 2009 remains a mystery.For its part, the federal government effectively nationalized the quasi-governmental mortgage agencies (Fannie Mae, Freddy Mac), using these agencies to guarantee most mortgages in the U.S.3. The incentive (lower mortgage rates) to commit fraud by claiming to be an owner-occupant rather than an investor has pushed mortgage fraud to levels that Federal Reserve researchers declare "rampant." Owner-Occupancy Fraud and Mortgage Performance (A 46-page PDF report is available on this link.)The study's authors found that "in most years, fraudulent investors make up roughly one-third of the total pool of investors." Fraud rates in excess of 13% were found in some states states.The frenzy to buy and convert houses to short-term vacation rentals (STVRs) took off in the post-pandemic "revenge travel" boom. Corporate purchases of houses as rental properties had taken off in the post-2009 era of mass foreclosures, a trend that accelerated as private equity sought new markets to exploit.Combine corporate / private-equity buyers with small investors flooding into STVRs and the post-pandemic panic-buying frenzy, and it's little wonder that investors--declared and fraudulent, large and small--now own huge swaths of housing in the U.S.:Investors Bought 26% of the Country's Most Affordable Homes in the Fourth Quarter--the Highest Share on RecordAn estimated 26% of Fort Worth's single family homes are owned by companies, city says(Yes, family trusts and households can own housing as LLCs, but the study linked above paid no attention to the type of ownership; it paid attention to A) if the owners have multiple first liens, and B) whether they moved following the origination of their new purchase mortgage or not.)4. The risks created by this preponderance of investor ownership are high. The Federal Reserve researchers found that fraudulent investors pose a much higher risk of default than declared investors and real owner-occupants.As "revenge travel" shrivels up, property taxes and insurance rise and inflation ravages household budgets, STVRs are quickly shifting from income-producing assets to loss-generating liabilities. Investors either sell before they're under-water or the risk of default rises accordingly.Professionally managed corporate and private-equity owners will start unloading properties as rents sag and vacancies rise. STVR owners who realize the tide has reversed will also rush to sell before the price slide gathers momentum.Let's look at some charts for context. Here is a chart of total housing units. Confounding the conventional narrative of a "housing shortage," the U.S. added 7.6 million housing units in the five years 2020-2025, a rate far higher than the 8.6 million units added over 10 years 2010-2020.Here is a chart of owner-occupied housing. Note that the number of owner-occupied homes was flatlined for 12 years--from 2005 to 2016. Then it suddenly leaps up by 10 million in a few years--from 76 million to 86 million. Did 10 million households all win the lottery, or is the bulk of this astounding increase the result of fraudulent investors posing as owner-occupant buyers?This map shows the extent of investor mortgage -fraud.This chart of Federal Reserve ownership of mortgage-backed securities (MBS) overlays neatly with each leap higher in valuations. Pump "free money" into the financial system and keep rates at historic lows, and voila, you can inflate a bubble for the ages.The post-pandemic buying frenzy pushed the cost per square foot of houses listed for sale up 57%.Unsurprisingly, this bubble pushed housing affordability to record lows.The Case-Shiller Index offers a long-term view of how far valuations could drop once the bubble bursts. A 40% decline would be the norm, and a 50% drop would be well within the typical range of bubbles bursting.The Fed's mass manipulation of mortgage rates in 2010 "saved" Bubble #1 from playing out in a free-market manner, but the Fed won't be able to engineer an equivalent "save" this time around, as the mortgage market has already been nationalized and the Fed already owns a stupendous $2.1 trillion of MBS.Corporate / private equity / STVR investors are all fair-weather owners of housing. Once the profits shrink or reverse into losses, investors push the "sell" button. And since housing is priced on the margins, it only takes a handful of get-me-out sales to push valuations down 10%, then 20%, then 30% and eventually to a bottom between 40% anf 50%.This vulnerability to the collapse of valuations is the bitter fruit of the Fed's manipulation of rates and mortgages over the past 16 years. We love a "free market" when rapidly expanding credit inflates a bubble, but oh dearie-dearie me, we have to stop the "free market" from operating if it bursts the bubble.Here's how Housing Bubble #2 bursts: buyers of overvalued, money-losing properties vanish, those who waited too long sink underwater (sales prices are lower than what they paid), marginal investors default, owner-occupants who lose their jobs sell or default, private equity realizes their losses will only increase the longer they hold off selling, and the momentum of sellers far outnumbering buyers cascades.Greed is replaced by fear, and then by the realization it's too late to exit without losses. This is how bubbles burst.* * *Become a $3/month patron of my work via patreon.com. Subscribe to my Substack for free Tyler DurdenSat, 06/21/2025 - 10:30

The Real National Emergency: Endless Wars, Failing Infrastructure, & A Dying Republic Authored by John Whitehead and Nisha Whitegead via The Rutherford Institute,“Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed.”- President Dwight D. Eisenhower (April 16, 1953)Seventy years after President Dwight D. Eisenhower warned about the cost of a military-industrial complex, America is still stealing from its own people to fund a global empire.In 2025 alone, the U.S. has launched airstrikes in Yemen (Operation Rough Rider), bombed Houthi-controlled ports and radar installations (killing scores of civilians), deployed greater numbers of troops and multiple aircraft carriers to the Middle East, and edged closer to direct war with Iran in support of Israel’s escalating conflict.Each of these “new” fronts has been sold to the public as national defense. In truth, they are the latest outposts in a decades-long campaign of empire maintenance—one that lines the pockets of defense contractors while schools crumble, bridges collapse, and veterans sleep on the streets at home.This isn’t about national defense. This is empire maintenance.It’s about preserving a military-industrial complex that profits from endless war, global policing, and foreign occupations—while the nation’s infrastructure rots and its people are neglected.The United States has spent much of the past half-century policing the globe, occupying other countries, and waging endless wars.What most Americans fail to recognize is that these ongoing wars have little to do with keeping the country safe and everything to do with propping up a military-industrial complex that has its sights set on world domination.War has become a huge money-making venture, and the U.S. government, with its vast military empire, is one of its best buyers and sellers.America’s role in the Russia-Ukraine conflict has already cost taxpayers more than $112 billion.And now, the price of empire is rising again.Clearly, it’s time for the U.S. government to stop policing the globe.The U.S. military reportedly has more than 1.3 million men and women on active duty, with more than 200,000 of them stationed overseas in nearly every country in the world.American troops are stationed in Somalia, Iraq and Syria. In Germany, South Korea and Japan. In Saudi Arabia, Jordan and Oman. In Niger, Chad and Mali. In Turkey, the Philippines, and northern Australia.Those numbers are likely significantly higher in keeping with the Pentagon’s policy of not fully disclosing where and how many troops are deployed for the sake of “operational security and denying the enemy any advantage.” As investigative journalist David Vine explains, “Although few Americans realize it, the United States likely has more bases in foreign lands than any other people, nation, or empire in history.”Incredibly, America’s military forces aren’t being deployed abroad to protect our freedoms here at home. Rather, they’re being used to guard oil fields, build foreign infrastructure and protect the financial interests of the corporate elite. In fact, the United States military spends about $81 billion a year just to protect oil supplies around the world.America’s military empire spans nearly 800 bases in 160 countries, operated at a cost of more than $156 billion annually. As Vine reports, “Even US military resorts and recreation areas in places like the Bavarian Alps and Seoul, South Korea, are bases of a kind. Worldwide, the military runs more than 170 golf courses.”This is how a military empire occupies the globe.For 20 years, the U.S. war machine propped up Afghanistan to the tune of trillions of dollars and thousands of lives lost. When troops left Afghanistan, the military-industrial complex simply shifted theaters—turning Yemen, Iran, and the Red Sea into new frontlines.Each new conflict is marketed as national defense. In reality, it’s business as usual for the Pentagon's global footprint, with American soldiers used as pawns in the government's endless quest to control global markets, prop up foreign regimes, and secure oil, data, and strategic ports—all while being told it’s for liberty.This is how the military-industrial complex, aided and abetted by the likes of Donald Trump, Joe Biden, Barack Obama, George W. Bush, Bill Clinton and others, continues to get rich at taxpayer expense.Yet while the rationale may keep changing for why American military forces are policing the globe, these wars abroad aren’t making America—or the rest of the world—any safer, are certainly not making America great again, and are undeniably digging the U.S. deeper into debt.War spending is bankrupting America.Although the U.S. constitutes only 5% of the world's population, America boasts almost 50% of the world's total military expenditure, spending more on the military than the next 19 biggest spending nations combined.In fact, the Pentagon spends more on war than all 50 states combined spend on health, education, welfare, and safety.The American military-industrial complex has erected an empire unsurpassed in history in its breadth and scope, one dedicated to conducting perpetual warfare throughout the earth.Since 2001, the U.S. government has spent more than $10 trillion waging its endless wars, much of it borrowed, much of it wasted, all of it paid for in blood and taxpayer dollars.Add Yemen and the Middle East escalations of 2025, and the final bill for future wars and military exercises waged around the globe will total in the tens of trillions.Co-opted by greedy defense contractors, corrupt politicians and incompetent government officials, America’s expanding military empire is bleeding the country dry at a rate of more than $32 million per hour.In fact, the U.S. government spent more money every five seconds in Iraq than the average American earns in a year.Talk about fiscally irresponsible: the U.S. government is spending money it doesn’t have on a military empire it can’t afford.Even if we ended the government’s military meddling today and brought all of the troops home, it would take decades to pay down the price of these wars and get the government’s creditors off our backs.As investigative journalist Uri Friedman puts it, for more than 15 years now, the United States has been fighting terrorism with a credit card, “essentially bankrolling the wars with debt, in the form of purchases of U.S. Treasury bonds by U.S.-based entities like pension funds and state and local governments, and by countries like China and Japan.”War is not cheap, but it becomes outrageously costly when you factor in government incompetence, fraud, and greedy contractors. Indeed, a leading accounting firm concluded that one of the Pentagon’s largest agencies “can’t account for hundreds of millions of dollars’ worth of spending.”Unfortunately, the outlook isn’t much better for the spending that can be tracked.A government audit found that defense contractor Boeing has been massively overcharging taxpayers for mundane parts, resulting in tens of millions of dollars in overspending. As the report noted, the American taxpayer paid:$71 for a metal pin that should cost just 4 cents; $644.75 for a small gear smaller than a dime that sells for $12.51: more than a 5,100 percent increase in price. $1,678.61 for another tiny part, also smaller than a dime, that could have been bought within DoD for $7.71: a 21,000 percent increase. $71.01 for a straight, thin metal pin that DoD had on hand, unused by the tens of thousands, for 4 cents: an increase of over 177,000 percent.The fact that such price gouging has become an accepted form of corruption within the American military empire is a sad statement on how little control “we the people” have over our runaway government.Mind you, this isn’t just corrupt behavior. It’s deadly, downright immoral behavior.Americans have thus far allowed themselves to be spoon-fed a steady diet of pro-war propaganda that keeps them content to wave flags with patriotic fervor and less inclined to look too closely at the mounting body counts, the ruined lives, the ravaged countries, the blowback arising from ill-advised targeted-drone killings and bombing campaigns in foreign lands, or the transformation of our own homeland into a warzone.The bombing of Yemen’s Ras Isa port by U.S. forces—killing more than 80 civilians—is just the latest example of war crimes justified as national interest.That needs to change.The U.S. government is not making the world any safer. It’s making the world more dangerous. It is estimated that the U.S. military drops a bomb somewhere in the world every 12 minutes. Since 9/11, the United States government has directly contributed to the deaths of around 500,000 human beings. Every one of those deaths was paid for with taxpayer funds.With the 2025 escalation, those numbers will only rise.The U.S. government is not making America any safer. It’s exposing American citizens to alarming levels of blowback, a CIA term referring to the unintended consequences of the U.S. government’s international activities. Chalmers Johnson, a former CIA consultant, repeatedly warned that America’s use of its military to gain power over the global economy would result in devastating blowback.The 9/11 attacks were blowback. The Boston Marathon Bombing was blowback. The attempted Times Square bomber was blowback. The Fort Hood shooter, a major in the U.S. Army, was blowback.The U.S. military’s ongoing drone strikes will, I fear, spur yet more blowback against the American people.The war hawks’ militarization of America—bringing home the spoils of war (the military tanks, grenade launchers, Kevlar helmets, assault rifles, gas masks, ammunition, battering rams, night vision binoculars, etc.) and handing them over to local police, thereby turning America into a battlefield—is also blowback.James Madison was right: “No nation could preserve its freedom in the midst of continual warfare.” As Madison explained, “Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes... known instruments for bringing the many under the domination of the few.”We are seeing this play out before our eyes.The government is destabilizing the economy, destroying the national infrastructure through neglect and a lack of resources, and turning taxpayer dollars into blood money with its endless wars, drone strikes and mounting death tolls.The nation’s infrastructure is in shambles. Public schools are underfunded. Mental health care is collapsing. Basic needs like housing, transportation, and clean water go unmet. Meanwhile, government contractors drop bombs on third-world villages and call it strategy.This isn’t just bad budgeting. It’s moral bankruptcy. A country that can’t care for its own people has no business policing the rest of the world.Bridges collapse, water systems fail, students drown in debt, and veterans sleep on the streets—while the Pentagon builds runways in the desert and funds proxy wars no one can explain.Clearly, our national priorities are in desperate need of overhauling.We are funding our own collapse. The roads rot while military convoys roll. The power grid fails while the drones fly. Our national strength is being siphoned off to feed a war machine that produces nothing but death, debt, and dysfunction.We don’t need another war. We need a resurrection of the republic.It’s time to stop policing the world. Bring the troops home. Shut down the military bases. End the covert wars. Slash the Pentagon’s budget. The path to peace begins with a full retreat from empire.At the height of its power, even the mighty Roman Empire could not stare down a collapsing economy and a burgeoning military. Prolonged periods of war and false economic prosperity largely led to its demise. As historian Chalmers Johnson predicts:The fate of previous democratic empires suggests that such a conflict is unsustainable and will be resolved in one of two ways. Rome attempted to keep its empire and lost its democracy. Britain chose to remain democratic and in the process let go its empire. Intentionally or not, the people of the United States already are well embarked upon the course of non-democratic empire.This is the “unwarranted influence, whether sought or unsought, by the military-industrial complex” that President Dwight Eisenhower warned us not to let endanger our liberties or democratic processes.Eisenhower, who served as Supreme Commander of the Allied forces in Europe during World War II, was alarmed by the rise of the profit-driven war machine that emerged following the war—one that, in order to perpetuate itself, would have to keep waging war.We failed to heed his warning.As I make clear in my book Battlefield America: The War on the American People and in its fictional counterpart The Erik Blair Diaries, war is the enemy of freedom.As long as America’s politicians continue to involve us in wars that bankrupt the nation, jeopardize our servicemen and women, increase the chances of terrorism and blowback domestically, and push the nation that much closer to eventual collapse, “we the people” will find ourselves in a perpetual state of tyranny.In the end, it’s not just the empire that falls. It’s the republic it hollowed out along the way.Views expressed in this article are opinions of the author and do not necessarily reflect the views of ZeroHedge. Tyler DurdenFri, 06/20/2025 - 22:35

Electricity prices for households have risen quickly and are expected to outpace U.S. inflation in coming years, experts said. There are many supply and demand factors at play. Data centers are a major contributor to greater demand for electricity, while the U.S. also has an aging infrastructure for transmission and distribution of power, experts said. Electricity prices are rising quickly for U.S. households, even as overall inflation has cooled.Electricity prices rose 4.5% in the past year, according to the consumer price index for May 2025 — nearly double the inflation rate for all goods and services.The U.S. Energy Information Administration estimated in May that retail electricity prices would outpace inflation through 2026. Prices have already risen faster than the broad inflation rate since 2022, it said.“It’s a pretty simple story: It’s a story of supply and demand,” said David Hill, executive vice president of energy at the Bipartisan Policy Center and former general counsel at the U.S. Energy Department.There are many contributing factors, economists and energy experts said.At a high level, the growth in electricity demand and deactivation of power-generating facilities are outstripping the pace at which new electricity generation is being added to the electric grid, Hill said.Prices are regionalU.S. consumers spent an average of about $1,760 on electricity in 2023, according to the EIA, which cited federal data from the Bureau of Labor Statistics.Of course, cost can vary widely based on where consumers live and their electricity consumption. The average U.S. household paid about 17 cents per kilowatt-hour of electricity in March 2025 — but ranged from a low of about 11 cents per kWh in North Dakota to about 41 cents per kWh in Hawaii, according to EIA data.Households in certain geographies will see their electric bills rise faster than those in others, experts said.Residential electricity prices in the Pacific, Middle Atlantic and New England regions — areas where consumers already pay much more per kilowatt-hour for electricity — could increase more than the national average, according to the EIA.“Electricity prices are regionally determined, not globally determined like oil prices,” said Joe Seydl, a senior markets economist at J.P. Morgan Private Bank.The EIA expects average retail electricity prices to increase 13% from 2022 through 2025.That means the average household’s annual electricity bill could rise about $219 in 2025 relative to 2022, to about $1,902 from $1,683, according to a CNBC analysis of federal data. That assumes their usage is unchanged.But prices for Pacific area households will rise 26% over that period, to more than 21 cents per kilowatt-hour, EIA estimates. Meanwhile, households in the West North Central region will see prices increase 8% in that period, to almost 11 cents per kWh.However, certain electricity trends are happening nationwide, not just regionally, experts said.Data centers are ‘energy hungry’Elijah Nouvelage | Bloomberg | Getty ImagesThe QTS data center complex under development in Fayetteville, Georgia, on Oct. 17, 2024.Electricity demand growth was “minimal” in recent decades due to increases in energy efficiency, according to Jennifer Curran, senior vice president of planning and operations at Midcontinent Independent System Operator, who testified at a House energy hearing in March. (MISO, a regional electric-grid operator, serves 45 million people across 15 states.)Meanwhile, U.S. “electrification” swelled via use of electronic devices, smart-home products and electric vehicles, Curran said.Now, demand is poised to surge in coming years, and data centers are a major contributor, experts said.Data centers are vast warehouses of computer servers and other IT equipment that power cloud computing, artificial intelligence and other tech applications.More from Personal Finance:How to protect financial assets amid immigration raids, deportation worriesGOP education plan may trigger ‘avalanche of student loan defaults’This credit card behavior is an under-the-radar riskData center electricity use tripled to 176 Terawatt-hours in the decade through 2023, according to the U.S. Energy Department. Use is projected to double or triple by 2028, the agency said.Data centers are expected to consume up to 12% of total U.S. electricity by 2028, up from 4.4% in 2023, the Energy Department said.They’re “energy hungry,” Curran said. Demand growth has been “unexpected” and largely due to support for artificial intelligence, she said.The U.S. economy is set to consume more electricity in 2030 for processing data than for manufacturing all energy-intensive goods combined, including aluminum, steel, cement and chemicals, according to the International Energy Agency.Continued electrification among businesses and households is expected to raise electricity demand, too, experts said. The U.S. has moved away from fossil fuels like coal, oil and natural gas to reduce planet-warming greenhouse-gas emissions.For example, more households may use electric vehicles rather than gasoline-powered cars or electric heat pumps versus a gas furnace — which are more efficient technologies but raise overall demand on the electric grid, experts said.Population growth and cryptocurrency mining, another power-intensive activity, are also contributors, said BPC’s Hill.‘All about infrastructure’Thianchai Sitthikongsak | Moment | Getty ImagesAs electricity demand is rising, the U.S. is also having problems relative to transmission and distribution of power, said Seydl of J.P. Morgan.Rising electricity prices are “all about infrastructure at this point,” he said. “The grid is aged.”For example, transmission line growth is “stuck in a rut” and “way below” Energy Department targets for 2030 and 2035, Michael Cembalest, chairman of market and investment Strategy for J.P. Morgan Asset & Wealth Management, wrote in a March energy report.Shortages of transformer equipment — which step voltages up and down across the U.S. grid — pose another obstacle, Cembalest wrote. Delivery times are about two to three years, up from about four to six weeks in 2019, he wrote.“Half of all US transformers are near the end of their useful lives and will need replacing, along with replacements in areas affected by hurricanes, floods and wildfires,” Cembalest wrote.Transformers and other transmission equipment have experienced the second highest inflation rate among all wholesale goods in the US since 2018, he wrote.Meanwhile, certain facilities like old fossil-fuel powered plants have been decommissioned and new energy capacity to replace it has been relatively slow to come online, said BPC’s Hill. There has also been inflation in prices for equipment and labor, so it costs more to build facilities, he said.

Extreme heat remains in the forecast and a red flag warning for northern Arizona will be in effect through 8 p.m. June 21.

Lake Mead Is America's Deadliest National Park On April 13, Arizona Hot Springs and Goldstrike Trails in the Lake Mead National Recreation Area announced the closing of several trails after one death and the rescue of several hikers under extremely hot temperatures.The incident showcases the dangers that National Parks and similar wilderness areas pose to visitors, especially those who come underprepared. Unfortunately, as Statista's Katharina Buchholz reports, events like this aren’t uncommon in U.S. National Parks and National Recreation Areas.You will find more infographics at StatistaAbout 19 people die each year at the Lake Mead National Recreation Area, which is popular for boating, tragically leading to drowning deaths also.Deaths in the area over the years have been a mix of drownings, boat and traffic accidents, medical problems, suicides and even homicides. The Grand Canyon National Park is seeing an average of 12 deaths a year, which can occur due to falls, medical problems, heat, traffic accidents and drowning, among others.National Parks data published by Panish Law shows that the two National Park Service locations between 2007 to 2024 received the questionable honor of being the nation's deadliest National Parks, followed by Yosemite National Park in California and Blue Ridge Parkway in Virginia and North Carolina. In the former, climbing and hiking accidents play a bigger role, while in the latter, deaths are mainly chalked up to traffic accidents.At Golden Gate National Recreation Area, a high number of people die due to rip currents while swimming. Deaths involving the Golden Gate Bridge are excluded.The National Park Foundation suggests to do research before heading out to a park and check conditions and alerts. Visitors should also try and assess their physical limits realistically as well as those of their group. It also pays to have an emergency plan, not rely on cell phone reception, check gear thoroughly, stay together as a group, stay on designated trails and keep your distance from wildlife, the organization suggests. Tyler DurdenFri, 06/20/2025 - 22:10

New home demand in Chinese urban cities will remain suppressed at below 5 million units per year. Shrinking population, stagnant incomes and a glut of unsold homes continue to hammer homebuyer and investor sentiment. The demographic shift is also rippling through housing markets adjacent to good schools.China’s real estate sector has grappled with a deepening downturn for years. Now a shrinking population is casting another shadow over the stagnant property market.Goldman Sachs estimates that demand for new homes in Chinese urban cities will remain suppressed at under 5 million units per year in the coming years — one fourth of the peak of 20 million units in 2017.“Falling population and slowing urbanization suggest decreasing demographic demand for housing” in the coming years, Goldman Sachs economists said in a note Monday.The country’s population is estimated to fall to below 1.39 billion by 2035 from 1.41 billion, according to World Bank’s latest data, said Tianchen Xu, senior economist at Economist Intelligence Unit, citing a combination of fewer newborns and more deaths from an ageing population.Shrinking population will cripple home demand by 0.5 million units every year in the 2020s and a lead to a bigger dent of 1.4 million units annually in the 2030s, Goldman Sachs estimates, compared to the positive contribution of 1.5 million units in the 2010s when population was on a steady rise.Fertility rate in the country has continued to fall even after Beijing relaxed its one-child policy in 2016, and despite Beijing’s efforts to incentivize child-bearing via cash incentives. Stagnant incomes, instability over job prospects and a poor social security system have dissuaded Chinese young people from having more babies.Beijing’s pronatalist policies will likely have “limited effect” as they do not address the deep-rooted issues, Xu said, such as high economic costs for child-bearing and people’s tendency to postpone marriage for career progression and “an embrace of individuality.”Underscoring the declining birth rates, nearly 36,000 kindergartens across the country closed down over the past two years, with the number of students in preschools falling by over 10 million. That’s according to CNBC’s calculation of the official data released the Ministry of Education. Similarly, the number of elementary schools dropped by nearly 13,000 between 2022 and 2024.That is rippling through school-adjacent housing markets that once saw inflated prices on the back of strong demand for better public schools.The once-sizable premium was fueled by access to elite schools and expectations of rising property values. But with a shrinking population and local governments scaling back district-based enrollment policies, the added value of these homes has started diminishing, according to William Wu, China property analyst at Daiwa Capital Markets. A mother of a 7-year-old boy in Beijing told CNBC that the price of her apartment had fallen by about 20% from over two years ago when she bought it. It cost her roughly twice the average price for an apartment in the city, so that her son could attend a good elementary school.The number of children entering primary school in 2023 reached the highest level in over two decades, according to Wind Information, before dropping in 2024, the year her son enrolled.Steeper slumpThat demographic shift is an additional overhang to the property market, which has struggled to emerge from a painful downturn since late 2020. Despite a raft of central and local government measures since last September, the real estate slump has shown little sign of abating.New home prices fell at their fastest pace in seven months in May, according to Larry Hu, chief China economist at Macquarie, extending a two-year stagnation, despite the government efforts aimed at arresting the decline.New home sales in 30 major cities fell by 11% year on year in the first half of this month, worsening from the 3% drop in May, Hu said.“Holders of investment properties are likely to be net sellers (to owner-occupiers) for the foreseeable future,” over expectations that home prices will continue to fall, Goldman Sachs estimates.While Goldman expects the rise in China’s urbanization rate to temper in the coming years, hurting urban housing demand, Wu said demographic drag on the property market was not yet “imminent” and may take decades to play out.In the nearer term, “some of this decline will be offset by continued urbanization, and housing upgrade demand,” Wu said, as the latter would account for an increasing share of China’s total housing demand.— CNBC’s Evelyn Cheng contributed to this story.

Telegram founder Pavel Durov says all his 100-plus children will receive share of his estate KSL NewsBillionaire Telegram founder leaves his $14 billion fortune to the 100+ children he’s fathered—which means $132 million for each lucky Gen Alpha kid YahooTelegram founder Pavel Durov says all his 100+ children will receive share of his estate CNNBillionaire Telegram CEO reveals plans to divide wealth among more than 100 children Fox BusinessTelegram boss to leave fortune to over 100 children he has fathered BBC

VICTORIA — Canada's transport minister says she is "dismayed" BC Ferries contracted a Chinese state-owned shipyard to build four new vessels in the current geopolitical context that includes "unjustified" tariffs on Canada.

Canada Transport Minister Freeland 'dismayed' by BC Ferries deal with Chinese company YahooView Full Coverage on Google News