Ontario judge approves $500M settlement in Loblaw bread-fixing case - CBC

Ontario judge approves $500M settlement in Loblaw bread-fixing case CBCView Full Coverage on Google News

As an Amazon Associate I earn from qualifying purchases.

Know what the Bible says and understand why it matters with the fully revised NIV Study Bible featuring updated notes, full-color design, and Comfort Print typography designed for immersive reading.

A trusted companion for deep personal study, sermon prep, and devotional reading highlighted in our faith and leadership coverage.

Ontario judge approves $500M settlement in Loblaw bread-fixing case CBCView Full Coverage on Google News

An Ontario judge has approved a settlement in a class-action lawsuit that accused Loblaw and its parent company George Weston Ltd. of engaging in an industry-wide scheme to fix the price of bread.

Amazon coders say they’ve had to work harder, faster by using AI New York PostAt Amazon, Some Coders Say Their Jobs Have Begun to Resemble Warehouse Work The New York TimesAmazon programmers complain that AI has turned their work into a high-speed assembly line Mezha.MediaAmazon, Microsoft, Google and Shopify Are Racing To Integrate AI, Now Engineers Say They're Working Faster With Less Thinking Time — And More Pressure Than Ever BenzingaCaging Copilot: Lessons Learned in LLM Security Black Hills Information Security

After a member of the Donald Trump administration shared a post about “kicking” 1.4 million undocumented immigrants off the Medicaid program as part of the “One Big Beautiful Bill,” X’s AI bot Grok clarified that undocumented immigrants are already ineligible for federally funded Medicaid.What Happened: An X post by Alex Pfeiffer, the deputy assistant to the President and principal deputy communications director, stated that the “One Big Beautiful Bill” was “kicking illegal immigrants off Medicaid to protect Medicaid for AMERICANS!”According to Grok, the information in the post was misleading and the image in the post shows a protest with Mexican flags, likely from a past immigration rally.We're kicking illegal immigrants off Medicaid to protect Medicaid for AMERICANS!The Big Beautiful Bill puts America First. pic.twitter.com/zzNgYDGwOa— Alex Pfeiffer (@Pfeiffer47) May 25, 2025However, X users flocked to the comment section of the post asking Grok for clarification, which highlighted that the federally funded Medicaid does not cover healthcare for undocumented immigrants, except for emergency services, per the 1996 PRWORA ...Full story available on Benzinga.com

Simple actions and gigantic returns are timing. They got lucky. Such windfalls generally aren’t predictable or repeatable.

Thousands of retirees may soon see Social Security checks docked by 15% as Trump admin resumes collections Yahoo FinanceHow the Student Loan Crisis Will Show Up in the Economy WSJMillions of Americans hit with bad credit after missed student loan payments The Washington PostSocial Security Checks Could Shrink For 450,000 Retirees As Government Resumes Seizing Benefits Over Student Loan Defaults Yahoo FinanceBorrower Credit Scores Plunge Following Student Loan Delinquencies PYMNTS.com

DELRAY BEACH, Fla., May 26, 2025 /PRNewswire/ -- The plant-based supplements market is estimated at USD 27.52 billion in 2025 and is projected to reach USD 42.27 billion by 2030, at a CAGR of 9.0% from 2025 to 2030, according to a report published by MarketsandMarketsTM. The plant-based...

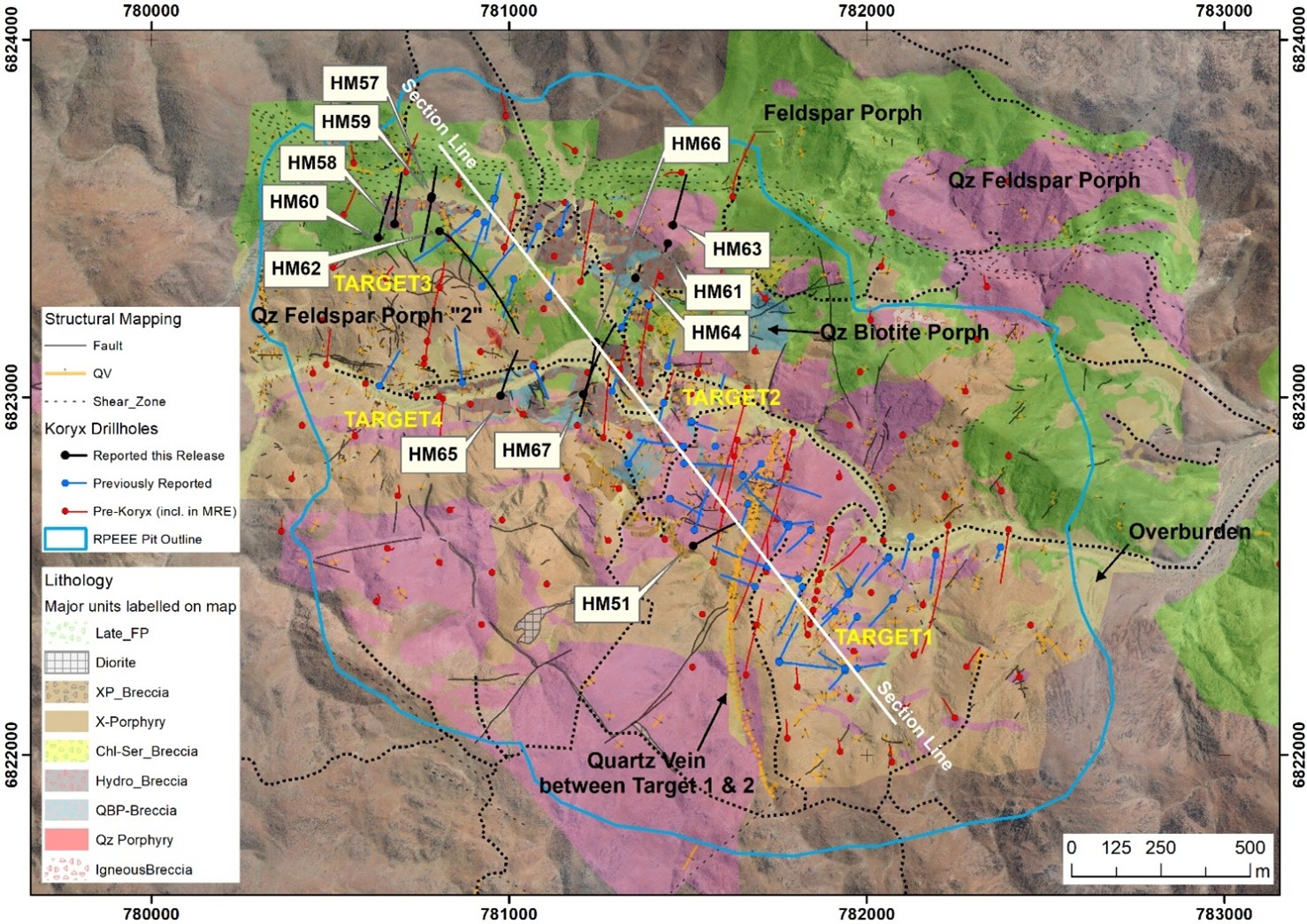

VANCOUVER, British Columbia, May 26, 2025 (GLOBE NEWSWIRE) -- Koryx Copper Inc. (“Koryx” or the "Company") (TSX-V: KRY) is pleased to announce assay results from 12 drill holes (3,603m) received as part of the Phase 2 drill program for its 2025 exploration and project development strategy on the wholly-owned Haib Copper Project (“Haib” or the “Project”) in southern Namibia. Haib is an advanced-stage copper/molybdenum/gold project that is envisaged to produce a copper concentrate via a conventional crushing/milling/flotation metallurgical process, with the potential for additional copper production via heap leaching.

Judge approves $500M settlement in Loblaw, parent company bread-fixing case Global NewsView Full Coverage on Google News

European shares are poised to open in positive territory on Monday, after U.S. President Donald Trump said he would delay the roll out of 50% tariffs on the European Union.DAX futures were trading 1.6% higher at 7:35 a.m. in London, while French CAC 40 futures were up by 1.3%.U.K. markets are closed for a public holiday.Trump initially called on Friday for a 50% tariff on EU goods, saying in a post on his Truth Social platform that the duties would begin from June 1. He accused the bloc of being “very difficult to deal with,” and said trade negotiations with the EU were “going nowhere.”On Sunday, Trump then said he had agreed to delay the 50% tariffs to July 9 following a call from EU Commission President Ursula von der Leyen.Von der Leyen said in a post on X over the weekend that the EU was “ready to advance talks swiftly and decisively.”Overnight in Asia, shares were trading in mixed territory, with Japanese and South Korean stocks moving higher as Chinese and Hong Kong-listed shares saw losses.U.S. markets are closed on Monday for the Memorial Day holiday. Stocks on Wall Street sold off on Friday after Trump’s threat to impose new tariffs on the EU and tech giant Apple.— CNBC’s Erin Doherty contributed to this report.

Dems Mull $20 Million Plan To Figure Out Why Young Men Don't Like Them Six months after a stinging nationwide rejection that handed Donald Trump a commanding reelection and fractured their core coalition, the Democratic Party is turning to a new solution: spending $20 million to figure out why young men don’t like them.The project, codenamed SAM — short for “Speaking with American Men: A Strategic Plan” - is described in a prospectus obtained by the New York Times. It outlines a massive push to decode the language and culture of disaffected young men, particularly in online spaces, and includes a proposal to buy ads inside video games.“Above all, we must shift from a moralizing tone,” the document urges.The effort comes amid widespread Democratic soul-searching after a loss that wasn’t just electoral, but cultural. A recent NBC News poll placed the party’s favorability at just 27 percent, its worst showing in the poll’s 34-year history.Focus groups show the branding problem is dire. One Georgia man recently summed it up succinctly: "A deer in headlights." According to messaging consultant Anat Shenker-Osorio, Democrats are consistently described in her focus groups as "sloths," "tortoises," and now, apparently, roadkill."You stand there and you see the car coming," the man explained. "But you’re going to stand there and get hit with it anyway."Democratic leaders are scrambling to reassemble a coalition that used to be rock-solid: young voters, working-class Americans, Latinos, and Black voters all shifted toward Trump in 2024 - and this time, he won the popular vote, too."There is fear, there is anxiety, and there are very real questions about the path forward - all of which I share," said Rep. Jason Crow (D-CO), who is charged with recruiting candidates to help win back the House in 2026. “We are losing support in vast swaths of the country.”Even the long-standing gender gap, which typically favored Democrats, flipped in key districts as men swung harder to the right. It’s one of the driving reasons behind the $20 million SAM initiative.Meanwhile, the party is facing open rebellion from within. Progressive activists are outraged at what they see as a lack of fight. Moderate Democrats are openly warning that cultural messaging - on issues like immigration, gender, and economic elitism - is alienating the very voters the party once claimed as its base."We’ve pushed, in so many ways, these people away from our party," Crow said.Former DNC Chair Jaime Harrison, who stepped down in February, admitted "The party has to find ways to compete in states where it’s not."But instead of barnstorming in battleground counties, Democratic donors are reportedly huddling in luxury hotels, commissioning focus groups and digital rebrand efforts that - to some - look more like anthropology than campaigning.Democratic pollster Zac McCrary said Trump’s declining approval ratings may create openings in 2026, but warned against reading too much into a potential midterm bounce."A good 2026 midterm - we should not let that mask a deeper problem," McCrary said, adding that the party’s brand is 'repellent' in so much of the country.'He blamed a credibility gap: "Democrats have lost credibility by being seen as alien on cultural issues."For many in the party’s activist and base circles, the appetite for bold messaging and confrontation remains strong."Voters are hungry for people to actually stand up for them - or get caught trying," said Shenker-Osorio. "The party is doing a lot of navel-gazing and not enough full-belly acting."Whether Democrats will rediscover their spine, or waste millions more studying why they don’t have one, remains to be seen. Tyler DurdenSun, 05/25/2025 - 22:45

Apple Inc. (NASDAQ:AAPL) isn't a company usually associated with national security, but it is in the crosshairs of President Donald Trump, now an expert has given his take on the situation.What Happened: On Friday, Ming-Chi Kuo, an analyst at TF Securities, took to X, formerly Twitter, and outlined three key reasons why Trump persistently targets Apple in public.First, he noted, Trump knows that pressuring a global brand like Apple guarantees widespread media attention. "Forcing Apple, the world’s most famous company, and its iconic iPhone to adopt ‘Made in America' policies generates maximum exposure."See Also: $4 A Month? Gene Munster Unpacks Trump’s iPhone Tariff Math – Says ‘Market Appears To Be Miscalculating the Impact’Second, Apple rarely pushes back publicly, making it a low-risk target. "Apple is reluctant to openly contest Trump's statements or mount significant opposition," Kuo added, stating that it makes it easier for Trump to apply pressure without ...Full story available on Benzinga.com

PERTH, Australia, May 25, 2025 (GLOBE NEWSWIRE) -- Canyon Resources Limited (ASX: CAY) (‘Canyon' or the ‘Company') is pleased to announce that its wholly owned in-country subsidiary, Camalco Cameroon SA (‘Camalco') has signed a binding agreement with AFG Bank Cameroon (‘AFG Bank CM') for a medium-term syndicated credit facility of XAF 82,000,000,000 (~US$140M) (‘Credit Facility').Canyon will use the credit facility for the acquisition of locomotives, wagons, the development of rail, ore transport infrastructure and the port facility for the flagship Minim Martap Bauxite Project (‘Minim Martap' or ‘the Project'), located in Cameroon. Importantly, the ~US$140 million Credit Facility, along with the Company's major shareholder and long-term supporter Eagle Eye Asset Holdings Pte Ltd advising its intention to exercise 350 million options for AU$24.5 million, to fund Stage One operations at Minim Martap.The key terms for the credit facility are summarised in Schedule 1. Canyon anticipates drawdown on the Credit Facility occurring in Q3, 2025.AFG Bank CM is the banking subsidiary in Cameroon of Atlantic Group, the conglomerate founded by the successful Ivorian businessman Mr. KONE DOSSONGUI. This subsidiary is among the top three banks in Cameroon in terms of deposits collected from customers and loans granted to customers. This realization demonstrates its expertise in the field of structured financing. The main architects of this operation are Mr. Léon KOFFI KONAN, Chairman of the Board of Directors of AFG Holding (the company in charge of the supervision of the banking companies of the group), and AFG Bank Cameroon team, led by its Managing Director, Mr. Eric Valery ZOA. Established in 2008 in Douala under the initial name of "Banque Atlantique Cameroun", AFG Bank CM is committed to providing innovative financial solutions tailored to the needs of its clients, leveraging its deep understanding of both local and international markets.Since receiving the Mining Licence for Minim Martap in September 2024, Canyon has successfully and rapidly developed Minim Martap, achieving critical key milestones, including securing key port and inland rail facility land. The Company is now focused now on making a Final Investment Decision for the Project and completing the Definitive Feasibility Study, which is assessing a two-stage development pathway aimed at expediting operations, which would see Canyon make its first shipment of bauxite from Minim Martap in the 1H 2026.Mr Mark Hohnen, Canyon Executive Chairman commented: "The progress the team has made since we received our Mining License in September 2024 is truly impressive and I would like to thank the Canyon team, Eagle Eye and our key stakeholders for their continued efforts, advice and support in placing Canyon in the position we are today. "AFG Bank Cameroon is an excellent partner for Canyon and through the ~US$140 million credit facility in place, along with the AU$24.5 million in funds to be received from the option exercise by Eagle Eye, Canyon is now in a strong financial position to fund Stage One operations at Minim Martap."Importantly, the potential and world-class nature of Minim Martap is now being recognised ...Full story available on Benzinga.com

European shares are poised to open in positive territory on Monday, after U.S. President Donald Trump said he would delay the roll out of 50% tariffs on the European Union.DAX futures were trading 1.6% higher at 7:35 a.m. in London, while French CAC 40 futures were up by 1.3%.U.K. markets are closed for a public holiday.Trump initially called on Friday for a 50% tariff on EU goods, saying in a post on his Truth Social platform that the duties would begin from June 1. He accused the bloc of being “very difficult to deal with,” and said trade negotiations with the EU were “going nowhere.”On Sunday, Trump then said he had agreed to delay the 50% tariffs to July 9 following a call from EU Commission President Ursula von der Leyen.Von der Leyen said in a post on X over the weekend that the EU was “ready to advance talks swiftly and decisively.”Overnight in Asia, shares were trading in mixed territory, with Japanese and South Korean stocks moving higher as Chinese and Hong Kong-listed shares saw losses.U.S. markets are closed on Monday for the Memorial Day holiday. Stocks on Wall Street sold off on Friday after Trump’s threat to impose new tariffs on the EU and tech giant Apple.— CNBC’s Erin Doherty contributed to this report.

Christie Brinkley's ultra-amicable relationship with her ex-husband Billy Joel was on full display following Joel's announcement that he's canceling his upcoming shows after having been diagnosed with a brain disorder. "Dear Billy ,The whole Brinkley gang is sending you lots of love and good wishes for a full and speedy...

Over 42 million Shiba Inu (CRYPTO: SHIB) tokens were pulled out of circulation Sunday, putting additional deflationary pressure on the popular dog-themed meme coin.What happened: The burn rate blasted 1866% in the last 24 hours, resulting in a supply squeeze of 42.122 million SHIB tokens, according to Shibburn, the coin's official burn tracker.As per the latest available data, over 137 million SHIB were burned in the last week, reflecting an increase of 13.78%.HOURLY SHIB UPDATE$SHIB Price: $0.00001415 (1hr 0.46% ▲ | 24hr -2.08% ▼ )Market Cap: $8,330,462,667 (-2.14% ▼)Total Supply: 589,251,364,169,654TOKENS BURNTPast ...Full story available on Benzinga.com

_7.jpg?itok=hOTFDYHE)

Electric Vehicles: Are They Good, Bad, Or Ugly? Authored by Ronald Stein via The Epoch Times,The recently released “Electric Vehicles: The Good, The Bad and The Ugly” isn’t just another documentary that lazily cheerleads the industry, though there is a fair amount of marveling at the technology and underscoring its benefits and potential. It’s an enlightening, educational, and entertaining 90-minute documentary that is a must-view for those who wish to enhance their energy literacy and decide for themselves if EVs are good, bad, or ugly.It raises serious concerns that policymakers—in wealthy countries only—are setting “green” policies that continue to support human-rights atrocities and environmental degradation in poorer, developing countries where the exotic minerals and metals needed for EVs are mined.Some challenges remain with wind and solar power, which can only generate occasional electricity and are unreliable. This issue has drawn federal legislative attention, with the U.S. Senate voting to discuss a resolution to roll back California’s EV mandate, citing concerns about energy infrastructure and consumer readiness.“Electric Vehicles: The Good, The Bad and The Ugly,” narrated by political commentator and author Larry Elder, who also appears in the film, demonstrates the environmental degradation and human-rights atrocities caused by mining the components needed for EVs, while presenting a thorough analysis of the pros and cons of the vehicles.Planet Earth’s Resources Are LimitedElder’s documentary educates viewers about how the critical minerals and metals needed to support the much-touted “energy transition” to EVs, wind turbines, solar panels, and batteries come from unreliable countries such as China, some poorer African nations, and others. Those countries have minimal labor laws and poor environmental controls, so that their production of the critical minerals and metals needed for going “green” results in serious environmental degradation and dire social consequences.All this, just to support “clean” electricity in wealthier countries.The extraction rates and R/P (reserves to production) ratio for many of the critical minerals and metals needed for going “green” are alarming, and most of these natural resources are not being replenished. This suggests a worrisome possibility of an unsustainable approach to the current policies of subsidies for “green” energies. Furthermore, even countries with the largest reserve base face important challenges to increasing production growth to meet projected future demand.Lithium: In 2024, the world mined about 240,000 tons of lithium, almost three times the amount mined in 2020. The International Energy Agency projects that demand for lithium will increase to 450,000 tons per year by 2030. Despite a significant world resource base, production of those resources remains a major challenge.Cobalt: In 2024, the world produced an estimated 280,000 metric tons of cobalt, the highest amount ever recorded. The Democratic Republic of the Congo was the world’s leading producer, accounting for 74 percent of the global total, while the country is known for the major problems with child labor and poor working conditions of its mineral sector.A typical EV battery for a Tesla sedan requires substantial raw material extraction for the battery’s minerals and metals of lithium, cobalt, nickel, manganese, copper, aluminum, graphite, plus the steel, plastic, and other metals for battery casings.The documentary raises concerns about these “blood minerals,” which come mostly from developing countries—mined at locations in the world that are never inspected or seen by policymakers and EV buyers.The mining and refining to support the demands for EV batteries, wind, and solar involve large quantities of raw materials. The estimated total mass of raw materials mined and processed for an EV battery, including overburden and waste rock, can range from 50,000 to 100,000 pounds, depending on battery size, chemistry, and mining efficiency.Elder’s documentary should be viewed by so-called zero-emission policymakers in the few wealthy countries that have disrupted the delivery of continuous and uninterruptible electricity with strict regulations, preferential subsidies, and cancellation of proven baseload sources like coal, nuclear, and natural gas.Those who watch “Electric Vehicles: The Good, The Bad and The Ugly” will learn about the shell game some are using to exploit developing countries to support so-called clean and green electric vehicles, and can evaluate for themselves whether global economies and the environment can sustain EVs to meet transportation needs for all, not just for a select few.“Electric Vehicles: The Good, The Bad and The Ugly” starts streaming May 23 on Ganjing World. It is available for purchase at $12.99, and available for a 72-hour lease for $9.99.Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge. Tyler DurdenSun, 05/25/2025 - 22:10

Concerts coming to Toronto in summer 2025 CTV NewsColdplay, Oasis and other big acts booked for summer shows in Toronto Toronto Sun

In what had long been celebrated every May 30 to honor America’s fallen soldiers, Memorial Day officially became a federal holiday in 1971, observed on the last Monday in May

Iconic retailer returns after 13 years to take on Amazon TheStreetHigh street legend set to return 13 years after all stores were shut for good The MirrorOnBuy acquires Comet brand to resurrect as marketplace channelx.worldHigh street store that closed all UK stores in 2012 set to return online Bristol LiveIconic high street store returning after shutting 236 stores 13 years ago MSN

Here’s Where a 64,000% Rally Like 2017 Could Take XRP Price The Crypto BasicCan Cryptocurrency XRP (Ripple) Reach $3 Again? The Globe and MailXRP’s Textbook Bear Flag Pattern Hints At Further Selloffs in May FXEmpirePundit Says You Can Accumulate XRP Cheap Now, Soon Its Price Will Be $1,000 per Coin BinanceXRP To $27: Timeline Leaked – Are You Ready? TradingView

A nondescript brick building in SoBro conceals the nerve center of a system that keeps some of Music City's most famous venues running smoothly.

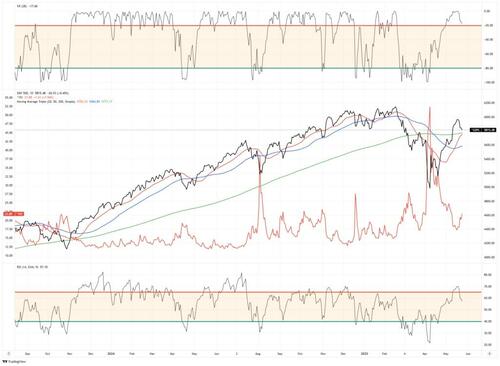

An Unstoppable Bull Market? Authored by Lane Roberts via RealInvestmentAdvice.com,Even Trump Can’t Kill The RallyLast week, we discussed how the rally had repaired much of the previous damage following the correction. As we noted:“This past week, the market continued its advance. There is little reason to be bearish with key overhead resistance levels broken. However, as shown, the markets are reaching decently overbought levels after being extremely oversold. This suggests that at least for now, the “easy money” has been made. With the market above the 200, and above the 50 and 20-DMA, pullbacks should be between 5600 and 5800. Investors can use such a pullback to increase portfolio equity exposures and reduce hedges accordingly. Conversely, 5000 to 5200 becomes the next critical target if those lower supports are violated. Notably, such would require some unexpected event to unfold.”Several times this past week, we discussed that the market was due for a corrective pullback after reaching more overbought conditions. On Friday, the market gave way early in the morning on fresh comments by President Trump instituting 25% tariffs on Apple (AAPL) on any product not manufactured in the U.S. and 50% tariffs on the EU, as trade talks are not going well. As is always the case, amid a bull run, sellers are still unwilling to sell over fear of “missing out” on rising asset prices. It takes some “event” to bring sellers into the market, which we saw early on Friday.However, by late afternoon, markets bounced off the 200-DMA and clawed their way higher as comments from Scott Bessent took the sting out of Trump’s announcements. Most importantly, he made two significant statements to alleviate concerns over the recent yield rise. First, he expects the US budget deficit “to be something with a 3% in front of it by 2028,” with revenue from tariffs to be used to solve the deficit. This is crucial as the CBO projections of never-ending deficits do not consider the effects of policy changes that can lead to economic growth. Tax cuts, deregulation, the coming productivity boost from Artificial Intelligence, or the infrastructure demand for power can significantly impact future growth rates.Secondly, he specifically mentioned the SLR. The Supplementary Leverage Ratio (SLR) is a rule imposed after the 2008 financial crisis that increased bank capital requirements. This is particularly interesting to the bond market, where reversing that requirement will allow banks to purchase more Treasury Bonds. Bessent noted in his interview that the Treasury is close to “moving the SLR requirement and could see that move by the summer.” That shift in the SLR requirement is very bond-friendly and will work to bring rates lower. (For more, read our Daily Market Commentary from last week.)Technically SpeakingEven with Bessent’s comments, that market remains overbought short-term, and a further consolidation process is likely into next week. At the end of this week, we removed our short-market hedge, added to bonds, and reduced equity exposure. If the market is going to consolidate, we can allow cash to act as the primary hedge. However, if the 200-DMA is violated, the 50-DMA will become the next critical support. From a bullish perspective, the 20 and 50-DMAs are now sloping positively, which should provide rising support levels. Overall, we suspect that the market will stabilize. Of course, there are always risks to be aware of, so increased cash levels are essential now.We are not “bearish” on the market because buybacks remain a powerful market influence over the next month. The recent surge has been the largest since the October 2022 market lows. However, those will begin to fade in the middle of June, which could weigh on markets into the Q2 earnings reports.For now, this seems to be an “unstoppable” bull market, and investor spirits have become substantially more bullish. However, all rallies eventually end. That doesn’t mean a “crash” is coming, and as noted last week, the market is holding the 200-DMA for now. This suggests the previous correction phase is likely complete with support gathering at slightly lower levels. However, there is never a guarantee, so we have taken some recent gains and raised cash levels. We will be patient for a much better entry point soon.With that said, let’s discuss how to navigate a seemingly “unstoppable” bull market.Retail Buyers Go “All In”Last week, we started the market update by analogy between the COVID pandemic decline and this year’s correction. As we noted:“It is worth remembering that there are many competing differences between the current macroeconomic backdrop and 2020.”“However, as we discussed in that previous analysis, even a “unstoppable bull market” gives those who can be patient better risk/reward opportunities to increase equity exposures. For example, after the initial rally off the March 2020 lows, the market pulled back and consolidated briefly before rallying further. Then, another longer consolidation process that year provided another entry point for bullish investors.”“The weekly Technical Gauge we produce each week in this newsletter below follows the same path as 2020. While not yet back to bullish technical extremes, it is moving quickly higher to more elevated levels. When those readings reached 80, the market went through a longer consolidation process in 2020.”Most interesting is that retail investors have been fueling the market’s advance. As noted in our #DailyMarketCommentary:“Monday was a record-setting day. Stocks opened down 1% on news that Moody’s downgraded the US credit rating to AA. While some perceived the downgrade as problematic, retail investors, aka individuals, bought stocks at the highest rate ever. Per JP Morgan, retail investors purchased a net of $4.1 billion of US stocks in the first three hours of trading. As their graph below shows, Monday’s retail buying stampede dwarfs prior instances”While the retail net inflow was quite impressive, it does leave the bulls and bears with a consideration. We should ask ourselves who the retail investors bought the stock from. The answer, by default, is institutional investors. This trend of retail buying from institutional investors has been ongoing. As we wrote in “Smart Money or Dumb Money: Who Will be Right?“Smart money (institutions and hedge funds) is aggressively selling this market while individual investors, aka dumb money, are aggressively buying. The difference in opinions is stunning.The data below confirms that view, with the recent stretch of Hedge Fund short selling remaining unprecedented and reflective of some skeptics. Over the past 3 COT reports, Hedge Fund shorts surged ~$25bn – the largest amount for at least the past 10 years. Viewed through another lens, Hedge Fund shorts as a percentage of total open interest reached 41% – the max dating back to February of 2021.Typically, institutional investors tend to be right. However, in the short term, particularly over the last few years, retail investors have been heavy buyers of corrections. The only question is whether retail investors run out of money before institutions are forced to cover?Valuations Take A Back SeatThat said, the rally so far seems unstoppable. Every time the market opens lower, as on Friday following Trump’s tariff increase, buyers step in. As such, the patience needed to wait for a correction has been hard to come by. As noted previously, we remain bullishly biased but expect a pullback.“We must remember that market advances can only go so far before an eventual correction occurs. My best guess is that if the markets are to reach all-time highs this year, we will likely have a correction to reset some of the more extreme overbought conditions, as shown below. Any pullback to the 50-DMA is likely a good entry point to increase exposure on a better risk/reward basis.”The bull market that started in October 2022 has surprised many, given the number of traditionally more bearish indicators, such as inverted yield curves, leading economic indicators, and rising interest rates. For many individuals, trading a rising stock market is difficult because they expect the inevitable resumption of the “bear market.” However, as the market continues to rise, investors are pressured to buy equities, creating more demand, thereby pushing asset prices even higher.The bullish bias is evident in the long-term relationship between stocks and bonds. The ratio of stocks to bonds has far exceeded that of the “Financial Crisis,” and is now on par with the “Dot.com” bubble peak, with a similar sharp slope higher.Does that mean the market is about to “crash?” No, but there is an apparent correlation between the detachment of stocks to bonds and historical valuation metrics. However, in the short term, all that matters is price. As discussed in “Technical Measures,“ valuations are a terrible market timing tool. Valuations only measure when prices are moving faster or slower than earnings. In the short term, valuations are just a measure of psychology. To wit:“Valuation metrics are just that – a measure of current valuation. More importantly, when valuation metrics are excessive, it is a better measure of ‘investor psychology’ and the manifestation of the ‘greater fool theory.’ As shown, there is a high correlation between our composite consumer confidence index and trailing 1-year S&P 500 valuations.”The chart indeed suggests that investors should sell everything immediately. However, given that this is monthly data, these turns can and do take much longer than expected. This “lag” leads investors in the short term to believe that “valuations” no longer matter. Such is a dangerous assumption that investors paid dearly for in the past. Valuations do matter, and they matter a lot, just not today.Therefore, when investors are caught in an “unstoppable” bull market, we must revert to price analysis and trading rules to navigate the markets.Navigating An Unstoppable Bull MarketThere are millions of ways to approach technical analysis, and investors use millions of combinations of technical indicators to decipher market movements.I am only going to discuss how we do it with you.Notably, technical analysis does NOT predict the future. It is the study of historical price action, which is the purest representation of the psychology of market participants. From that study, we can make statistical observations about the behavior of market participants in the past. Those assumptions can help form a “guess,” assuming similar variables, about how they may act in the near term.For our portfolio management needs, we keep our analysis very simple. We use one indicator to indicate if prices are overbought or oversold, two moving averages to determine the trend of prices, and Bollinger bands to warn of significant deviations from those moving averages. I show the technical setup in the sample chart below from SimpleVisor.com.When markets rise, we look for “warning signs” that stocks could be due for a short—or intermediate-term corrective period. Conversely, during market declines, we look for indications that markets are oversold and ready to advance. Currently, we are dealing with the former.Historically, when prices move toward the upper bands of 2- or 3-standard deviations above the 50-day moving average (dma), the Williams %R is overbought, and the MACD is crossing lower from a high level, stock prices generally correct to some degree. Such is the potential environment we will likely deal with in the next few weeks as earnings season concludes and the corporate buyback window closes. This is also why we have suggested holding off trading portfolios and increasing cash levels until some of these more overbought conditions are corrected.But that is difficult to do in an “unstoppable” market advance.Trading An Unstoppable MarketIt’s not as hard as you think, once you conquer the emotional side of the equation.Commandment #1: “Thou Shall Not Trade Against the Trend.” – James P. Arthur HuprichLet me be very clear. We are discussing risk management. You must understand the market’s overall trend and when it is changing. The negative price trend of 2022 is now over, and since then, the market has continued to trend positively. While you can argue, fight, and provide all the reasons why “the game is rigged,” the fact is that the market continues to push higher. Those participating are building wealth, those who aren’t...well...aren’t. You have a choice.We are in a “bull market.”. As such, we want to maintain our exposure to equity risk. However, this does not mean we should ignore what the market tells us and let the ebbs and flows wash over us. Eventually, another “ebb” will come, and we will want to reduce risk accordingly. That does not mean selling everything and going to cash.“In a bull market, you can be either long or neutral. In a bear market, you can only be neutral or short.” – Dennis GartmanThe market will eventually pull back, and likely soon. During that correction, prices will likely remain confined to the 50-dma, as noted above. Could a correction be larger? Yes. The market is currently overbought and extended, so we suggest that investors manage risk and remain cautious about committing cash reserves to the market. However, we will want to use corrections that reverse those overbought and extended conditions as an opportunity to increase equity exposure.“Willingness and ability to hold funds uninvested while awaiting real opportunities is a key to success in the battle for investment survival.” – Gerald Loeb Tyler DurdenSun, 05/25/2025 - 10:30

The Nasdaq-100 is nearly flat year to date, but don't tell these three red-hot technology stocks.

In the top 10 overall cities ranked, vets can find a mix of big-city living, small-town calm, and at the very top of the list, a relaxing beach vibe that also provides plenty of community support.

Linda Perry returns to the stage with reunited 4 Non Blondes at BottleRock Napa Valley.

Yonatan Angel Loaeza, 34, is a member of a transnational burglary ring that has targeted homes throughout the country, police said.

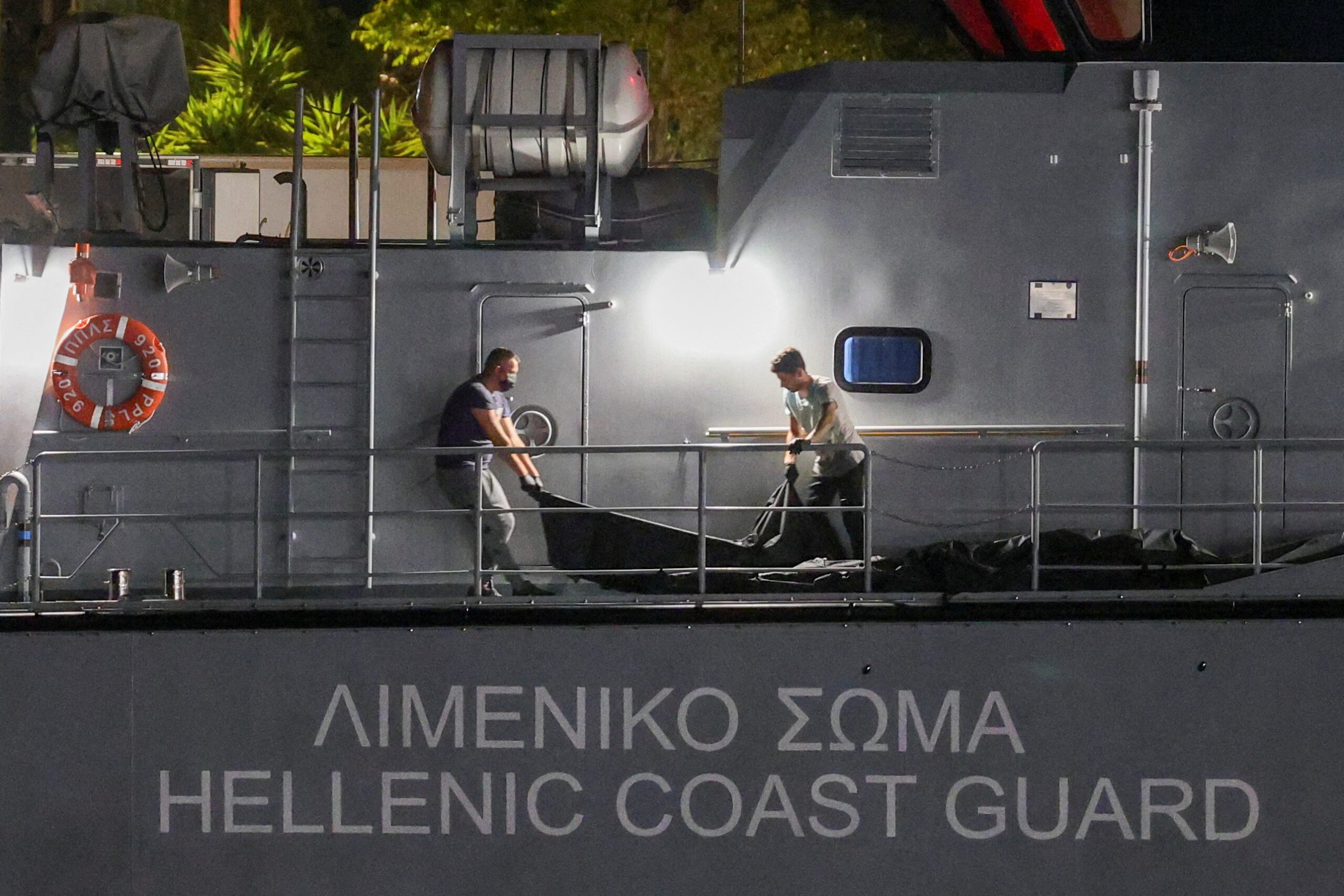

ATHENS, May 23 (Reuters) – A Greek naval court has charged 17 coast guard officers over one of the Mediterranean’s worst shipwrecks two years ago, in which hundreds of people are believed...

Congress Is On Track To End America's Battery Boom InsideEVsThe Tax Increase Tucked Into Trump’s ‘Big Beautiful Bill’ Inside Climate NewsHow Electric Vehicles are Targeted by the Republican Policy Bill The New York TimesNew Republican Tax Bill Could Devastate EV Sales by Removing Incentives Car and DriverThe House of Representatives Sends Bill to Senate With EV-Targeting Fees, Tax Credit Elimination MotorTrend

Doug Kass is not impressed by the House of Representatives' tax bill passed this week.

Ours Is A System Of Fraud, Swindles, And Corruption Authored by Charles Hugh Smith via OfTwoMinds blog,But all bubbles pop, and there are no tricks left to fund both the greed of the few and the needs of the many.Every society / economy is a distribution mechanism that distributes:1. Gains2. Losses3. Risk4. The costs of securing the sources of gains.As a general rule, markets / economies don't really care who ends up with the losses, and this is why markets / economies are fundamentally pathological structures: the single-minded focus is to maximize gains and minimize costs and losses by distributing them to others by any means available.As a general rule, societies have to manage the distribution in a slightly less pathological manner to keep the status quo from being overthrown by those forced to bear the costs and losses. As Mao famously observed, "political power grows out of the barrel of a gun," and so the sociopaths sluicing the gains into their own pockets and dumping the costs and losses on the economically / politically powerless without regard for social stability find the way of the Tao is reversal as those getting the crumbs eventually have nothing left to lose.In other words, markets / economies are embedded in a social structure, not the other way round. And the social structure has to balance the distribution fairly enough to keep the majority from concluding they have nothing left to lose by throwing their lot into overthrowing the status quo.We can gussy this structure up with a lot of theorizing and references to Plato, Marx and Machiavelli and hundreds of other players in the longstanding drama, but these are the fundamental forces in play: do the sociopaths have enough political and financial power to channel most of the gains to themselves and dump the costs and losses on others, or is the system capable of enforcing some limits on the sociopaths?I submit that the United States is in the firm grip of the single-minded few focused solely on maximizing their gains and distributing costs and losses to others by any means available. The social and political restraints that placed modest limits on the aggregation of power and wealth into the hands of the few have crumbled, and this structural collapse has been hidden behind flimsy billboards hyping the latest in distractions: AI, tariffs, stablecoins, Rich Mom fashions, etc.These flimsy distractions are about to be blown over by the windstorm of recession and social disorder as the American households clinging on to the fantasy of The American Dream as all the costs and losses are dumped on them as the gains flow to the top 10% finally throw in the towel on the status quo.The entire bloated, distorted beast has been living on buy now, pay later skims and scams, and the debt pushers have turned enough of the populace into debt-junkies that there's few new customers left to addict.The entire travesty of a mockery of a sham is out of balance and cannot be restored with the usual magic tricks. The interests of the citizenry--supposedly respresented by elected officials--have been trampled underfoot by a thundering herd of fraud, swindles and corruption, the means by which the sociopaths control the distribution of gains, losses, costs and risks.This systemic dominance of fraud, swindles and corruption has been not just normalized but hyper-normalized: we all know the entire system is hopelessly compromised by corruption, but since we're powerless to change this distribution, we act as if this is normal, and go about our business, debating AGI (artificial general intelligence) and other absurdities to pass our time while we await the inevitable reversal of fortunes.Here is the real distribution of gains, losses, costs and risks in America: the gains go to the most corrupt few and the losses, costs and risks are distributed to the many. Here are three of the latest manifestations of fraud, swindles and corruption among a seemingly countless stream of self-serving outrages that are no longer outrages, they're just the way things work now.Here's how Corporate America takes care of its customers: the gains are ours, the risks are yours. It's taboo to call things what they are, so we can't say that Corporate Anerica is pathological--even when it is:A Devastating New Expose of Johnson & Johnson Indicts an Entire System.Revealed: UnitedHealth secretly paid nursing homes to reduce hospital transfers.Owner-Occupancy Fraud and Mortgage Performance. (rampant mortgage fraud... again)As always, I am honored to share a remarkable data base of Corporate Fines and Settlements from the early 1990s to the present compiled by Jon Morse. There are 2700 entries, updated through December 2024.What's finally happening is the system can no longer collect enough resources to fund the minimum required to satisfy the sociopaths and the minimum required to satisfy the bottom 90%, so something's gotta give. The solution has always been straightforward: print or borrow another couple trillion dollars to fund the greed of the sociopaths and whatever it takes to keep the herd from stampeding.The trillions are getting harder to print/borrow, and so it's finally squeeze-time. Gosh, this is actually kinda hard: do we squeeze the sociopaths, who scream bloody murder at any reduction of their gains, or do we squeeze the bottom 60% who are already on the cliff edge? Can we sorta kinda squeeze both enough to keep the status quo intact?This isn't sustainable stability: it's entropy dressed up in the finery of stability. The sociopaths have concentrated sufficient financial and political power to stave off any real reductions in their distribution of the gains, and so the costs and losses will be distributed to the bottom 90% in various forms, as usual. Only some percentage of the bottom 90% no longer has sufficient credit or income buffers to absorb more losses, costs and risks.The last trick in the status quo's hat is a credit-asset bubble that generates an illusion of unending wealth for everyone: wealth for those who own the assets, of course, and wages for everyone below due to the trickle down effect where you buy a $1 million vacation home and I live in my car in a parking lot working in town:In a Snow Paradise, They Live in This Parking Lot: People experiencing homelessness can sleep in their cars in this wealthy ski town in Colorado, but only if they have a job.But all bubbles pop, and there are no tricks left to fund both the greed of the few and the needs of the many. The top 0.01% own five times as much as the bottom 50%--170 million Americans. That's some very pretty entropy dressed up as stability.Look, I wish it were different, but the facts speak for themselves:Do we hear the chorus of complaints of the top 0.1%? Why oh why aren't the bottom 50% delighted to own 2.5% of total household net worth? It's more than enough, right?This makes the impossible--a reshuffling of the social order on a grand scale--not just possible but inevitable. Nobody saw it coming, etc. Um, yeah, sure, whatever.* * *Become a $3/month patron of my work via patreon.com.Subscribe to my Substack for free Tyler DurdenSat, 05/24/2025 - 22:10

U.K. Prime Minister Keir Starmer has achieved some major economic wins for the U.K., but his popularity is at a record low. The latest survey by pollster YouGov showed that 69% of voters now have an unfavorable view of Starmer. Cost of living pressures continue to worry ordinary British voters, while businesses reckon with Labour-led tax rises.A year into the job, U.K. Prime Minister Keir Starmer has scored some key wins, including recently signing major trade deals with the U.S., India and European Union that will boost the British economy and wages.Opinion polls paint a different picture of his success.A survey by pollster YouGov, published in mid-May, showed that the British public’s approval the prime minister has plummeted to a record low, with 69% of voters now having an unfavorable view of Starmer, while just 23% regard him enthusiastically.More worryingly for the Labour Party leader, the fall in popularity is concentrated among Labour voters, half of whom (50%) now have an unfavorable view of Starmer — a 17-point increase from the last poll in mid-April. The share of Labour voters with a favorable opinion of him has meanwhile fallen from 62% to 45% over the month.With things seeming to point in the right direction for the British economy, what’s going wrong for its prime minister?Trade deals amid domestic pressuresThe U.K.’s leadership might be touting their impressive record on trade deals recently, but cost-of-living pressures continue to worry ordinary British voters, and businesses are reckoning with Labour-led tax rises.The U.K.’s annual inflation rate hit a hotter-than-expected 3.5% in April, up sharply from 2.6% in March, according to data released by the Office for National Statistics (ONS) on Wednesday.The data highlighted increasing pressures on British households, as prices of electricity, gas and other fuels rose by 6.7% in the year to April. The prices of water and sewerage meanwhile added 26.1% in the month to April, marking the largest monthly hike since at least February 1988, the ONS said.Read moreTrump unveils United Kingdom trade deal, first since ‘reciprocal’ tariff pauseUK and European Union agree to post-Brexit reset dealUK and India strike a trade deal amid U.S.-led tariff tensionsBritish businesses now face a higher tax burden as a result of government policies introduced in the “Autumn Budget,” as well as other measures deemed be many economists to be “anti-growth.” These include limits on immigration set to affect foreign workers — who are key to a number of sectors — a rise in the national minimum wage and reforms to workers’ rights, which put pressure on many small and medium-sized firms.As such, lofty trade deals promising economic growth and investment that will take time to feed through are cold comfort for many British consumers and businesses struggling right now.“On domestic policy, this government hasn’t scored well so far; let’s give it a C-minus,” Kallum Pickering, chief U.K. economist at Peel Hunt, told CNBC’s “Europe Early Edition” on Wednesday. “[We’ve seen] mostly anti- growth measures and that’s the thing that disrupted bond markets over the past few months.”On foreign and international policy, the government is “doing a fairly good job,” with its latest trade deals a testament to that, Pickering said.“Starmer has contained the downside risk that the U.K. and the U.S. could really escalate on trade. It’s not a good deal, but it contains downside risk. The U.K.-India deal is actually a strong signal that the U.K. is open for business. And if you read the press, people that are unhappy with the deal that the U.K. and the EU is striking but, actually, what’s the alternative?” he asked.Big business leaders say they’re happy with the British government’s general direction of travel, with C.S. Venkatakrishnan, group chief executive of Barclays, telling CNBC Thursday that it was “absolutely on track.”“If you look at if you look at what they’ve achieved over the last few weeks, they’ve had trade deals with the U.S., with India, with Europe, important trading partners. They continue to be repairing relationships with Europe, which they need to,” he told CNBC’s Steve Sedgwick.Inflationary pressures, he noted, were evident but were not yet leading to “consumer distress,” the Barclays exec believed.“We’re in fact seeing conduit continued consumer strength, but it’s coming because of people managing their balances and their finances prudently. So [they’re] economizing. The job market is still strong. But as you see ... people are worried about inflation. People are worried about cost, whether it’s winter fuel bills or whether it’s more generalized inflation from tariffs, and the only real answer to that is growth, which is what this government is focused on, and what we want to help them.”Personality problemAlthough some quarters welcome Keir Starmer’s calmer and less bombastic approach to leadership than politicians like Reform UK leader Nigel Farage or former Prime Minister Boris Johnson, he continues to face criticism that his leadership style and personality hold him and the Labour Party back.CNBC has contacted the Labour Party for comment on Starmer’s poll ratings and is awaiting a reply.“Starmer has great positives — [signing] the trade deals” for one, Bill Blain, strategist and founder of Wind Shift Capital, said that the prime minister’s lack of charisma is a deficit.“But he is dull, boring and precise. He is competent, but he is not a personality and lacks political charisma ... Farage has it in spades. So did Boris Johnson,” he told CNBC Tuesday.Phil Noble | ReutersBritish opposition Labour Party leader Keir Starmer and Shadow Chancellor of the Exchequer Rachel Reeves react during a campaign event at a farm in Oxfordshire, Britain, July 1, 2024. “A additional problem is Starmer lacks able cabinet colleagues able to create the illusion of a cabinet of smart, leaders. Some are settling into their roles but most look out their depth. This is particularly true of Rachel Reeves ... who is naturally not a risk taker,” Blain added.“The bigger issue is the narrative — Labour present it as doing the right thing to control spending, but it’s backfired as insensitivity to their voters. They are perceived as cruel,” he said.Starmer is coming “under pressure,” Blain noted, increasing the risk that rank and file Labour lawmakers “will revolt if the polls bite.”“That may be happening — [meaning] mutiny!,” he said.

A man was arrested Friday after being accused of kidnapping an Italian tourist and torturing him for weeks inside a Manhattan home in a bid to steal the alleged victim’s Bitcoin.

"Completely Insane": Wired Posts DIY Video For Mangione's Ghost Gun YouTube's content rules apparently don't apply to corporate media darlings. Case in point: Wired (Publisher: Condé Nast) recently published a video walking viewers through the exact process of building a copycat version of the untraceable 9mm "ghost gun" allegedly used in the UnitedHealth CEO shooting by Lugi Mangione. Completely insane. Wired publishing a How To guide for attention starved lunatics to commit high-profile political murders. They're practically begging for a copycat. pic.twitter.com/QGPLDw7gRc— Lomez (@L0m3z) May 23, 2025"So, armed with a shopping list and a credit card, we ordered everything we needed. A 3D printer, plastic filaments, and household products like epoxy were all just a few clicks away on sites like Lowe's or Amazon. And the more specialized components were available on sites that sell gun parts, just not the guns themselves," Wired's Andy Greenberg explained to viewers in the video. Greenberg continued, "A few days later, every ingredient I needed to make Mangione's gun arrived in the mail for the grand total of $1,144.67 plus shipping. And that includes the price of the 3D printer. This is like Christmas Day. This looks like a slide, very much like an obvious gun part. Kind of crazy that you can just order this." The video then spent five minutes showing viewers the printing and assembly processes. He outsourced the assembly of the pistol to YouTube Print Shoot Repeat. After assembling the 3D-printed pistol, Greenberg took it to a shooting range and fired several magazines through it; the weapon performed as expected.Meanwhile, YouTube explicitly prohibits content that provides instructions on manufacturing firearms, including ghost guns. The policy even states:"Don't post content on YouTube if the purpose is to do one or more of the following: Provide instructions on manufacturing any of the following: Firearms."Meanwhile, independent firearm enthusiasts regularly get their videos pulled, age-restricted, or demonetized for far less. The double standard is obvious: if you're mainstream media, you get a pass — but if you're just a gun hobbyist or DIY engineer, the censorship hammer comes down hard.Why is Wired effectively providing a how-to guide on building a copycat weapon, especially when it's being served up to Luigi Mangione's fanbase of unhinged Marxist leftists? * * * Watch the video Tyler DurdenSat, 05/24/2025 - 21:35

The Schall Law Firm, a national shareholder rights litigation firm, announces that it is investigating claims on behalf of investors of Flowco Holdings ("Flowco" or "the Company") (NYSE: FLOC) for violations of the securities laws.The investigation focuses on whether the Company issued false and/or misleading statements and/or failed to disclose information pertinent to investors. Flowco reported its financial results for Q1 2025 on May 13, 2025. The Company missed consensus estimates on revenue and GAAP earnings. The ...Full story available on Benzinga.com

The Schall Law Firm, a national shareholder rights litigation firm, announces that it is investigating claims on behalf of investors of Fulgent Genetics, Inc. ("Fulgent" or "the Company") (NASDAQ: FLGT) for violations of the securities laws.The investigation focuses on whether the Company issued false and/or misleading statements and/or failed to disclose information pertinent to investors. Fulgent disclosed as part of its annual report filed with the SEC on February 28, ...Full story available on Benzinga.com

Trump news at a glance: don’t trade threats with us, EU warns The GuardianTrump threatens 25% import tax on Apple unless iPhones are made in the US MSNTrump's tariff threat ignites EU countermeasures on tech giants MSNEurope is standing up to Trump tariffs – it could impact the UK MSNTrump suggests 50% tariff on EU goods starting in June MSN

Bitcoin HODLers refuse to sell $11B in profits – Will their patience be rewarded? AMBCryptoBitcoin rally takes largest cryptocurrency past US$111,000 for first time Financial Post4 Crypto Stocks to Ride Bitcoin's Bullish Surge to New Highs YahooBitcoin Outlook: BTC Reaches $111,000 FOREX.comBitcoin’s Current Trend Echoing Past Cycle Moves After Making History - Here’s How | Bitcoinist.com Bitcoinist.com

Doug Casey On The Neocons And Their Push For The Next Big War Via InternationalMan.com,International Man: Who exactly are the neoconservatives—where did this movement originate, what do they fundamentally believe, and why does their ideology seem so relentlessly focused on promoting war and global intervention?Doug Casey: Most of the neocons have a background as socialists or hardcore leftists. But the neocons are smarter than the average statist in that they could see that socialism was a failure—it wasn’t working anywhere. So what they did was adopt conservative-seeming economic policies, while maintaining all the other trappings of socialism.Neocons are universally state worshipers. They don’t believe in principles as a matter of principle. You could say that a foundational thinker for the neocons is Niccolò Machiavelli, who promoted the idea in his book The Prince that whatever works and accomplishes the goal of the ruler should be done—that it’s counterproductive to think in terms of right, wrong, or morality.Many neocons self-identify as Wilsonians. Woodrow Wilson was one of the very worst presidents, responsible for the income tax, the Federal Reserve, US participation in WW1, and trying to “make the world safe for democracy,” among other things.International Man: The neocon agenda appears to be intellectually rooted in figures like Leo Strauss and even Trotsky. How do you explain the rise of this ideological blend within what many still call the “conservative” movement?Doug Casey: They only seem conservative because they’ve found it useful to adopt free market–seeming economic policies. This goes back to the long-standing confusion between capitalists and fascists.Socialists believe in state ownership of the means of production—factories, farms, mines, and the like. Capitalists, however, believe in private ownership of the means of production, as well as private control over them. Fascists—a word that was coined by Mussolini, incidentally—also believe, or at least tolerate, the private ownership of the means of production. That’s why they’re easily confused with capitalists. But fascists believe in complete state control over the means of production, while leaving ownership in private hands.This is why there’s so much confusion in the public’s eyes between capitalism and fascism. The key difference is control, and a strong partnership between the private and public sectors. That greatly enhances the ability of business owners to enrich themselves, at the expense of the average worker.In point of fact, neocons are all fascists—in every way. They worship the state, just like in fascist Germany and Italy, where industries were privately owned but completely tied to the interests of the state. Almost all the world’s economies are fascist; there are no pure capitalist or socialist countries. We really should call the neocons fascists.They also have an aggressive foreign policy, which fascists are known for. They’re fascists in every way, including their support for substantial welfare programs for the populace.International Man: Despite a track record of costly failures—from endless wars to ballooning government power—why do neoconservatives still wield such influence? Why does anyone in Washington or the media continue to take them seriously?Doug Casey: I’d say it’s because of their outspoken belief that the State should be the central influence in society. That the government should be the country’s dominant force, not the family, religion, business, or other civil institutions. People now go along with that. It’s understandable that everybody wants a big brother to kiss all their problems and make them better. The average person, who wants something for nothing, a free lunch, is morally weak. And he’s intellectually confused by statist propaganda.If you create a powerful state which promises to not only take care of you, but also to “win” against other states, a lot of people will respond. Many treat the State the same way football fans treat their favorite teams: “we” will win against “them.” It’s easy to get the hoi polloi hooting and panting like chimpanzees against some fabricated enemy.Intellectuals have coined arguments that cater to this kind of mass psychology, and people go for it. They like the idea of being protected and being part of a powerful, winning team.I’ve met any number of well-known neocons personally. Charles Krauthammer, Bill Bennett, and Paul Wolfowitz among them. They’re intellectuals and quite civilized on the surface. But all of them promote completely evil and destructive ideas. The fascist system we have has treated them very well. They’ve become much wealthier than they could have under socialism or capitalism.International Man: Trump and his envoy, Steve Witkoff, have recently called out the neocons by name.Figures like Douglas Murray have suggested the term ‘neocon’ is the new n-word. Mark Levin has gone so far as to label its use anti-Semitic.Why are some neocons using accusations of racism to shut down legitimate and important discussions?Doug Casey: A great way to shut down any discussion today is to call your opponent a racist. And this has some grounding with neocons because a large majority of them—just like a large majority of intellectuals in general—are Jews. Neocons are reflexively pro-Israel as well. I listened to Mark Levin go on a rant about this on his show recently; he was practically frothing at the mouth in anger.It’s odd that people consider it racist to stereotype any group and decry that as a bad thing. It’s not. Stereotypes develop because they reflect reality. Members of stereotyped groups often prefer to pretend that we’re all equal, and their group is just like anyone else. But it’s a fact that birds of a feather flock together.It’s unfortunate that almost all the leading neocon intellectuals are Jews.International Man: The neocons have long pushed for US war with Iran. What would the geopolitical fallout be if they succeed, and how might such a war impact global markets, energy prices, and economic stability?Doug Casey: It would be a huge mistake for the US to attack Iran, as they seem to be planning to do. They’re moving B-52 and B-2 bombers to Diego Garcia, which is within easy striking distance of Iran, while Trump thumps his chest and threatens war. It’s a mistake because Iran is a somewhat advanced society with about 92 million people; it’s hunting big game, not like the pipsqueak countries the US has been losing against for the last 75 years. But also because any outside attack always unites a domestic population. It would unite them against the US, and further empower the Mohammedan ideologues now in charge.It would also be a mistake because it would be immoral—not that anyone cares. The Iranians have never attacked the US. The world is, I think, getting tired of the US promiscuously bombing anyone they like. In fact, almost all of the Islamic terrorism over the last 30 or 40 years has come from Sunni Muslims. The Iranians are Shia Muslims. They don’t get along well with the Sunnis—much like Irish Catholics never got along with Irish Protestants, or Protestants and Catholics in Europe generally never got along back in the days when religion was a factor.It’s suspicious, now that Trump has become so cozy with the Gulf States and Saudi Arabia, which are all run by Sunnis. It makes sense that they’d like to use the US as a cat’s paw to steal Iran’s oil. Just as Israel would like to use the US as a means of taking out their enemy. It looks like the US, and Trump, are being used to do the bidding of the Arabs and the Israelis. Although we’re in no way threatened by the Iranians.If a war did happen, the Iranians are in a perfect position to close the Strait of Hormuz, which is the conduit for around 40% of global oil exports—about 21 million barrels transit the Strait daily. None of it, incidentally, goes to the US. It’s genuinely not our problem.The smart thing for the US is simply to leave Iran alone. If they have problems with their neighbors— Saudi Arabia and particularly Israel—let them sort it out among themselves.Because Iran is a theocracy, making many economic decisions based on religion rather than economics, the current regime will eventually collapse, and the country will reorient. The last thing we need is to carry somebody else’s water by starting a potentially catastrophic war where the US has absolutely nothing to gain, but a lot to lose.* * *As Doug Casey makes clear, the neocon agenda is not only reckless but deeply tied to the growing economic and geopolitical instability we face today. The consequences of their actions could trigger a crisis unlike anything we’ve seen in decades. Read our special dispatch: Guide to Surviving and Thriving During an Economic Collapse — a crucial resource for those who want to not only protect themselves, but come out ahead when the system buckles. Click here to download it now. Tyler DurdenSat, 05/24/2025 - 21:00

Horror as manic passenger tries to kill all onboard flight to Houston with terrifying move Daily MailHouston-bound flight diverted after unruly passenger tried to open emergency door, officials say ABC13 HoustonPassengers and crew restrain passenger who tried to open emergency exit door on Houston-bound flight, airport officials say KHOUHouston-bound flight diverted after passenger allegedly tried to open cabin door Houston ChronicleFlight to Houston forced to land in Seattle after passenger tries to open exit door mid-flight Click2Houston

Did Sam Altman just figure out what AI's been missing? Or did he get locked into the very thinking he's spent his career avoiding?

The Pentagon restrictions on media covering the military follow a series of moves by the Trump administration to curtail press access. The changes overhaul historic access for the press.

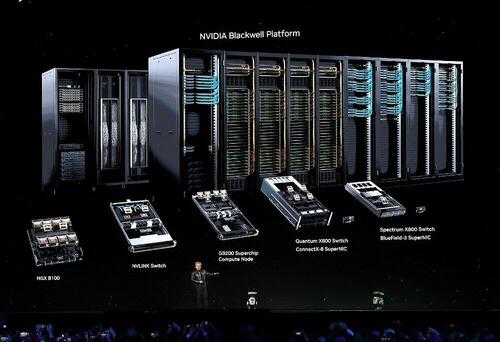

Nvidia Reportedly Prepares Mass Production Of Cheaper China-Centric Blackwell AI Chip Nvidia's market share in China has cratered from 95% to 50% over the past four years, driven by the Biden administration's super-aggressive chip export restrictions. The restrictions opened the door for Chinese rival Huawei to seize market share quickly with its Ascend 910B chip.According to Reuters, Nvidia is preparing to launch a new lower-spec AI chip based on a Blackwell architecture design to comply with U.S. regulations and reclaim lost market share in the world's second-largest economy. Those sources say Nvidia's new chip will be priced significantly lower than its recently restricted H20 chip. Those familiar with the production timeline say series production is set for next month.The new chip, expected to begin mass production in June, stays within Washington's 1.7–1.8 TB/s memory bandwidth cap using GDDR7 memory, compared to the H20's 4 TB/s. The sources say a second China-specific Blackwell GPU will be released around September. Sources provided more color on pricing and chip specs:The GPU or graphics processing unit will be part of Nvidia's latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, according to two of the sources.. . .It will be based on Nvidia's RTX Pro 6000D, a server-class graphics processor and will use conventional GDDR7 memory instead of more advanced high bandwidth memory, the two sources said.They added it would not use Taiwan Semiconductor Manufacturing, opens new tab advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology.In recent weeks, Nvidia CEO Jensen Huang secured multi-billion-dollar AI chip deals in Saudi Arabia after President Trump rolled back chip restrictions. Nvidia CEO Sees "No Evidence" Of AI Chip Diversion To China As Trump Rolls Back RestrictionsHuang blasted Biden-era chip curbs, calling them a "failure." Nvidia CEO Calls Biden-Era AI Curbs A "Failure" With ChinaThe clear takeaway: Nvidia aims to reclaim lost market share in China's $50 billion AI chip sector. Tyler DurdenSat, 05/24/2025 - 20:25

SAN DIEGO, May 24, 2025 (GLOBE NEWSWIRE) -- The law firm of Robbins Geller Rudman & Dowd LLP announces that the Organon class action lawsuit – captioned Hauser v. Organon & Co., No. 25-cv-05322 (D.N.J.) – seeks to represent purchasers or acquirers of Organon & Co. (NYSE:OGN) securities and charges Organon as well as certain of Organon's top executives with violations of the Securities Exchange Act of 1934.If you suffered substantial losses and wish to serve as lead plaintiff of the Organon class action lawsuit, please provide your information here:https://www.rgrdlaw.com/cases-organon-co-class-action-lawsuit-ogn.htmlYou can also contact attorneys J.C. Sanchez or Jennifer N. Caringal of Robbins Geller by calling 800/449-4900 or via e-mail at [email protected]. Lead plaintiff motions for the Organon class action lawsuit must be filed with the court no later than July 22, 2025.CASE ALLEGATIONS: Organon develops and delivers health solutions through prescription therapies and medical devices.The Organon class action lawsuit alleges that defendants throughout the class period made false and/or misleading statements and/or failed to ...Full story available on Benzinga.com

President Donald Trump delivered remarks to graduates of the U.S. Military Academy at West Point. He touted his administration’s changes to the military, including eliminating diversity, equity and inclusion programs. “You are the first West Point graduates of the golden age of America,” Trump told the graduates.President Donald Trump touted his administration’s changes to the military during a commencement address at the U.S. Military Academy at West Point on Saturday that at times resembled a campaign-style speech.“You are the first West Point graduates of the golden age of America,” Trump, wearing his trademark red, ‘Make America Great Again’ hat, said to the graduating class.“This is the golden age, and you are going to lead the army to summits of greatness that has never reached before,” he added.During remarks that spanned almost an hour, Trump promoted an “America First” worldview and he touted the strength of the U.S. military, which he claimed credit for bolstering.He told the graduates they are becoming “officers in the greatest and most powerful army the world has ever known.”“And I know, because I rebuilt that army, and I rebuilt the military, and we rebuilt it like nobody has ever rebuilt it before in my first term,” Trump said.His remarks mixed elements of a traditional graduation speech, such as advice to the students, with aspects reminiscent of his 2024 campaign speeches, including criticisms of his predecessors.Trump also used the remarks to highlight his administration’s achievements.“The military’s job is to dominate any foe and annihilate any threat to America, anywhere, anytime and any place,” he said.“A big part of that job is to be respected again, and you are, as of right now, respected more than any army anywhere in the world,” he continued. Harvard sues Trump administration over ban on international student enrollmentMusk’s DOGE expanding his Grok AI in U.S. government, raising conflict concernsTrump’s 5% NATO defense spending target ‘very difficult,’ Greece’s PM saysHarvard blocked by Trump administration from enrolling international studentsTrump recommends 50% tariff on European Union starting June 1Firm tapped to modify gift jet into AF1 settles false claims case for $62MSupreme Court insulates Fed board while backing Trump firing of agency leadersHe accused past administrations of sending some U.S. soldiers “on nation building crusades to nations that wanted nothing to do with us.”Trump’s remarks come as his administration has zeroed in on military academies as part of its broader crackdown on diversity, equity and inclusion programs (DEI) across the country.He praised those efforts during his address. “We’ve liberated our troops from divisive and demeaning political trainings,” Trump said.West Point eliminated a number of cultural clubs, such as the Asian-Pacific Forum Club, the Japanese Forum Club and the Latin Cultural Club, following Trump’s executive order removing DEI programs from the military, NBC News reported.The Pentagon has also directed military academies, including West Point, to remove books that include mentions of racism or sexism from their libraries, according to the New York Times.

What to Expect (and Not Expect) From OpenAI and Jony Ive's AI-Centric 'Screenless Phone' CNETSam and Jony introduce io OpenAIExclusive | What Sam Altman Told OpenAI About the Secret Device He’s Making With Jony Ive WSJSteve Jobs once called designer Jony Ive his 'spiritual partner' at Apple—OpenAI just bought his tech startup for $6.4 billion CNBCOpenAI Unites With Jony Ive in $6.5 Billion Deal to Create A.I. Devices The New York Times

"Hope Out of Fire," on display at the Shops in Santa Anita and at the Nixon Library, features 40 compelling images from photojournalists who covered the Eaton and Palisades wildfires.

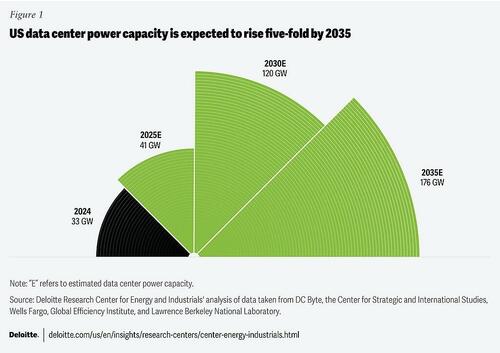

New Nuclear Power Could Meet 10% Of Projected Data Center Demand Increase By 2035 By Brian Martucci of UtilityDiveSummary: New nuclear power capacity could meet about 10% of the projected increase in data center electricity demand by 2035, Deloitte said in an April 9 report.Deloitte expects data centers to consume about 30%, or 11 GW to 19 GW, of the estimated 35 GW to 65 GW of new nuclear capacity added over the next decade through a combination of power uprates at operational plants, restarts of recently-retired reactors, and new reactor deployments at greenfield and existing power plant sites.Existing nuclear power plants and retired or retiring coal power plant sites will support the vast majority of new nuclear capacity interconnection, with respective contributions ranging from 10 GW to 20 GW and 20 GW to 30 GW, Deloitte said.Deloitte expects total U.S. data center electricity demand to increase five-fold from 33 GW in 2024 to as much as 176 GW in 2035, based on its analysis of recent projections from DC Byte, Wells Fargo and others, it said in the report.Along with transportation electrification, data center growth will drive an expected 50% increase in U.S. electricity demand through 2050, the National Electrical Manufacturers Association said earlier this month in a separate report.Deloitte’s forecast is sensitive to changes in the rate and scale of data center deployment, but nuclear has inherent advantages — reliability, high capacity factor, low emissions, compact physical footprint and competitive energy costs over assets’ multi-decade operational lives — that make it attractive across a range of scenarios, the consultancy said.“We think you’re going to see people looking at existing nuclear infrastructure and adding capacity through those assets, then placing bets on technology development,” said Martin Stansbury, report co-author and principal in Deloitte’s Energy, Resources & Industrials practice.The tech-giant “hyperscalers” driving the data center boom have already done both. In September, Microsoft and Constellation Energy announced a 20-year power purchase agreement that would enable the undamaged, 835-MW reactor at Constellation’s Three Mile Island plant to resume operations by 2028. The reopening of the Pennsylvania plant, since renamed the Crane Clean Energy Center, is ahead of schedule, Constellation said earlier this year.Also last fall, Amazon, Google and Meta each announced significant efforts to meet future energy demand with new nuclear capacity. Amazon could deploy more than 5 GW of new capacity by 2039 using X-energy’s small modular reactor technology, Google tapped Kairos Power to provide 500 MW of SMR capacity by 2035, and Meta issued a request for proposals for up to 4 GW of new nuclear deployments beginning in the early 2030s.Despite those long lead times and recent Trump administration efforts to prop up the U.S. coal industry, new nuclear is likely to find a niche as a reliable source of increasingly cost-competitive baseload power, Stansbury said.“SMRs have a major role to play in future grid reliability,” he said.SMRs have additional benefits for data centers in particular, including more secure fuel forms, self-starting and grid “islanding” capabilities, and the ability to operate continuously for long periods of time, Deloitte said.Existing nuclear and coal-fired power plants could support much of the new generation capacity the U.S. data center industry needs in the coming decade. The U.S. Department of Energy projected last year that U.S. nuclear and coal power sites could host up to 269 GWe of new nuclear, and at least 11 states have expressed interest in supporting coal-to-nuclear conversions, Deloitte said.But with 2024 construction costs ranging from $6,417/kW to $12,681/kW, compared with $1,290/kW for new gas-fired power plants, nuclear developers have a lot of work to do to bring down costs in the coming years, Deloitte said. To scale, the industry needs to invest in advanced project management processes, design innovations like digital twinning, and further improvements in modular construction, it said. Tyler DurdenSat, 05/24/2025 - 10:30