What is 'frost crack' and how does it affects trees?

Sudden or severe cold temperature can cause trees to experience "frost crack." NPR's Scott Simon talks with Bill McNee of the Wisconsin Department of Natural Resources about what happens and why.

As an Amazon Associate I earn from qualifying purchases.

Know what the Bible says and understand why it matters with the fully revised NIV Study Bible featuring updated notes, full-color design, and Comfort Print typography designed for immersive reading.

A trusted companion for deep personal study, sermon prep, and devotional reading highlighted in our faith and leadership coverage.

Sudden or severe cold temperature can cause trees to experience "frost crack." NPR's Scott Simon talks with Bill McNee of the Wisconsin Department of Natural Resources about what happens and why.

Smartphone weather apps that summarize their forecasts with eye-popping numbers and bright icons may be handy during mild weather, but meteorologists say it's better to listen to human expertise during multi-faceted, dangerous winter storms like the one blowing through the U.S.

Another person was shot to death Saturday by federal immigration officers in Minneapolis. A Department of Homeland Security spokesperson told the AP that the person killed, who was identified by the police chief as a 37-year-old man, had a firearm with two magazines and distributed a photo of a handgun...

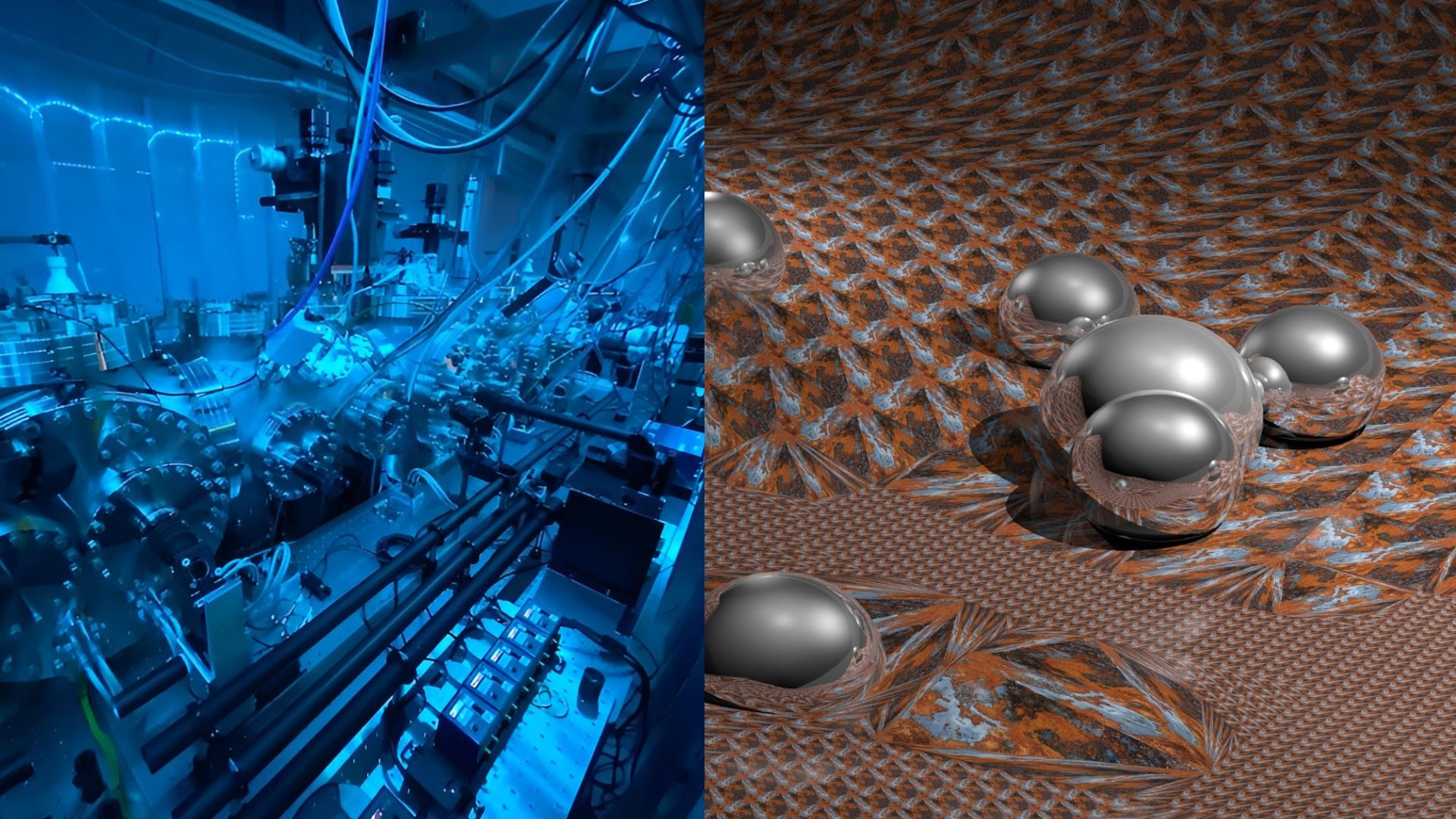

Using powerful X-rays, researchers at SLAC are trying to recover erased traces of a 2,000-year-old star catalog that could rewrite the early history of astronomy.

NASA’s Artemis 2 mission is no mere test flight. The crew will partake in some seriously mind-blowing science during their 10-day trip around the Moon.

In one day, 433 people won the Philippine lottery jackpot. What were the chances?

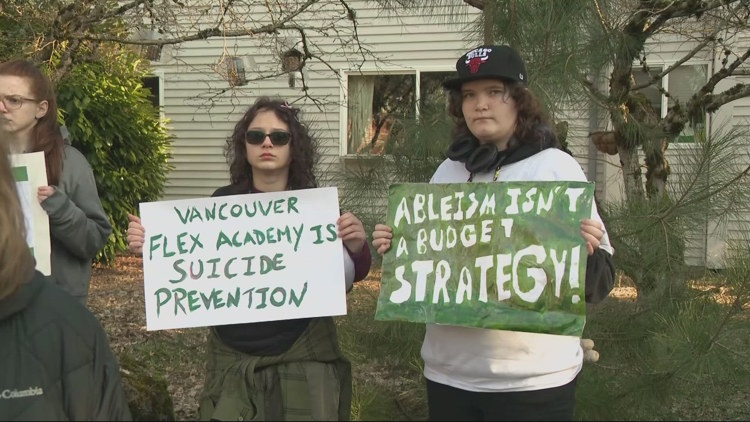

Flex Academy parents received notice via email in December that Flex Academy was going to be closing, worrying about the disruption it causes for their kids.

Hubble peers through thick dust to capture hidden young stars NotebookcheckHubble sees baby stars in Large Magellanic Cloud photo of the day for Jan. 21, 2026 SpaceHubble Captures Images of Huge Stars Still Forming NewserHubble Nets Menagerie of Young Stellar Objects NASA (.gov)

Recently released images from NASA’s Hubble showed baby stars and their properties. By studying the properties of the stars, astronomers can try to determine the evolutionary stage of the star. All of these are important in understanding how these massive stars form.

An animal ecologist researching large marine animals such as whales and dolphins, Assistant Professor Iwata Takashi of the Graduate School of Maritime Sciences has performed surveys in oceans across the world. By using a method known as "biologging," which involves attaching various recording instruments to animals in order to collect data, Iwata is working to elucidate the activity and surrounding environment of mysterious marine life.

Highlights from NBC News, Agence France-Presse, NPR’s “Science Friday” and others.

The phase 2 study is testing a novel, off-the-shelf chimeric antigen receptor (CAR) T-cell therapy called WU-CART-007. Developed by Wugen Inc., the investigational therapy uses CRISPR-Cas9 gene editing and is specifically designed for children and adults with T-cell leukemia and lymphoma.

We live near a fusion reactor in space that provides all our heat and light. That reactor is also responsible for the creation of various elements heavier than hydrogen, and that's true of all stars. So, how do we know that stars are element generators?

With western states deadlocked in negotiations over how to cut water use along the Colorado River, the Trump administration has called in the governors of seven states to Washington to try to hash out a consensus.

In a new study Indiana University researchers observed episodic memory in rats to a degree never documented before, suggesting that rats can serve as a model for complex cognitive processes often considered exclusively human.

Sarah Elliott, Argonne assistant scientist and 2025 Physical Sciences and Engineering Early Investigator Named Award recipient, seeks new approaches to accurately model dynamic chemical reactions, particularly in gas phases.

The University of Manitoba is taking a major step to help boost vaccine development and the study of viruses.

Researchers in the Okanagan have developed a device promising to dramatically reduce the uncontrollable movements associated with hand tremors.

Georgia Tech Names Mike Gazarik Director of Georgia Tech Research Institute

Dear Colleagues: The National Institutes of Health (NIH) issued the following policy notices this week. If you have any questions, please contact your Federal Contracts and Grants Officer (https://research.uci.edu/about-or/contact/staff-by-dept-assign...

While human missions to the moon will be facing Earth, on the other side of the moon, completely hidden from view, there will be a plethora of robots silently peering out to the edge of the universe and back to find out how it all began.

The Best in Science News and Amazing Breakthroughs

There's growing concern about the rise of harmful and aggressive forms of masculinity, whether at home, in schools or in public spaces.

Jan 24: 'Gifted' dogs learn from eavesdropping, and more... CBC

How do cutting-edge science and technology respond to ethical and legal issues when incorporated into society? These issues are known as ethical, legal and social issues, or "ELSI" for short, and research on these issues is being carried out both within Japan and around the world.

It's no secret that Florida's iconic coral reefs are in trouble. Repeated body blows from hurricanes, pollution, disease, climate change—and a near-knockout punch from a 2023 marine heat wave—has effectively wiped several species off the map and shrunk the reefs that stretch from the Keys throughout South Florida.

Another partially reusable Chinese rocket, the Long March 12B, is nearing its first test flight.

When NASA’s Dragonfly begins full rotorcraft integration and testing in early 2026, the mission team will tap into a trove of data gathered through critical technical trials conducted over the past three years.

A "gene silencer" (technically known as small interfering RNA, or siRNA), locally delivered by nanoparticles embedded in an injectable gel produced through 3D printing, can switch off the defective gene responsible for serious rare diseases known as craniosynostoses.

A team of Carolina researchers received $400,000 to make detection and treatment affordable and accessible.

Their presence appears to lower the risk of food-borne illnesses from pathogens.

HAMILTON, BERMUDA / ACCESS Newswire / January 23, 2026 / Altamira Therapeutics Ltd. ("Altamira" or the "Company") (OTCID:CYTOF), a company dedicated to developing and commercializing nucleic acid delivery technology for targets beyond the liver, announced today that it will be...

On January 21, two news releases by the Federal Minister of Agriculture and Agri-Food, Heath MacDonald, and Saskatchewan Minister of Agriculture David Marit drew the attention of agriculture’s livestock and forage producers.

Scientists Discovered That Two Genetic ‘Wrongs’ Could Make a Genetic ‘Right’ Yahoo News Canada

A study of dolphins’ epigenetic ages found that animals with more high-quality friendships were biologically younger than their lonely peers

Tough one to swallow.The post X’s Head of Product One Shotted by Errant Piece of Fried Chicken appeared first on Futurism.

Cosmology and quantum physics both offer tantalizing possibilities that we inhabit just one reality among many. But testing that idea is challenging.

Captain Dylan Hubbard has your Good Catch Fishing Report.

Claire chatted to Razanne Abu-Aisheh from the University of Bristol about how people feel about interacting with robot swarms. Razanne Abu-Aisheh is a Senior Research Associate in the Centre for Sociodigital Futures at the University of Bristol. Her work explores how people interact with robot swarms, with a focus on how collective robot behaviours influence [...]

As the four-person crew of Artemis II prepares to launch on a historic mission around the moon as soon as February, some experts are worried about the spacecraft’s heat shield.

A new comprehensive review from researchers at the Icahn School of Medicine at Mount Sinai details how decades of cancer vaccine research are converging into a new era of more precise, personalized, and effective immunotherapies, particularly when combined with other cancer treatments.

A new study combines drone data, satellite observations, and ground-based flux measurements to examine methane emissions from ruminants in Kenya. The research represents a pioneering effort to quantify methane (CH4) emissions from livestock using drones in sub-Saharan Africa. It is also among the first field studies to measure methane emissions from camels, a largely understudied source.

Argonne researchers have developed a method for combining diamond with a thin layer of molybdenum disulfide, enabling electronic devices to operate at room temperature and potentially improving performance in challenging environments.

Florida State University researchers have discovered a pathway within a certain type of molecule that limits chemical reactions by redirecting light energy. The study could help develop more efficient reactions for pharmaceuticals and other products. The researchers examined ligand-to-metal photocatalysts.

Despite lots of hype, "voice AI" largely been a euphemism for a request-response loop. You speak, a cloud server transcribes your words, a language model thinks, and a robotic voice reads the text back. Functional, but not really conversational. That all changed in the past week with a rapid succession of powerful, fast, and more capable voice AI model releases from Nvidia, Inworld, FlashLabs, and Alibaba's Qwen team, combined with a massive talent acquisition and IP licensing deal by Google DeepMind and Hume AI.Now, the industry has effectively solved the four "impossible" problems of voice computing: latency, fluidity, efficiency, and emotion.For enterprise builders, the implications are immediate. We have moved from the era of "chatbots that speak" to the era of "empathetic interfaces." Here is how the landscape has shifted, the specific licensing models for each new tool, and what it means for the next generation of applications.1. The death of latency – no more awkward pausesThe "magic number" in human conversation is roughly 200 milliseconds. That is the typical gap between one person finishing a sentence and another beginning theirs. Anything longer than 500ms feels like a satellite delay; anything over a second breaks the illusion of intelligence entirely.Until now, chaining together ASR (speech recognition), LLMs (intelligence), and TTS (text-to-speech) resulted in latencies of 2–5 seconds.Inworld AI’s release of TTS 1.5 directly attacks this bottleneck. By achieving a P90 latency of under 120ms, Inworld has effectively pushed the technology faster than human perception. For developers building customer service agents or interactive training avatars, this means the "thinking pause" is dead. Crucially, Inworld claims this model achieves "viseme-level synchronization," meaning the lip movements of a digital avatar will match the audio frame-by-frame—a requirement for high-fidelity gaming and VR training.It's vailable via commercial API (pricing tiers based on usage) with a free tier for testing.Simultaneously, FlashLabs released Chroma 1.0, an end-to-end model that integrates the listening and speaking phases. By processing audio tokens directly via an interleaved text-audio token schedule (1:2 ratio), the model bypasses the need to convert speech to text and back again. This "streaming architecture" allows the model to generate acoustic codes while it is still generating text, effectively "thinking out loud" in data form before the audio is even synthesized. This one is open source on Hugging Face under the enterprise-friendly, commercially viable Apache 2.0 license. Together, they signal that speed is no longer a differentiator; it is a commodity. If your voice application has a 3-second delay, it is now obsolete. The standard for 2026 is immediate, interruptible response.2. Solving "the robot problem" via full duplexSpeed is useless if the AI is rude. Traditional voice bots are "half-duplex"—like a walkie-talkie, they cannot listen while they are speaking. If you try to interrupt a banking bot to correct a mistake, it keeps talking over you.Nvidia's PersonaPlex, released last week, introduces a 7-billion parameter "full-duplex" model. Built on the Moshi architecture (originally from Kyutai), it uses a dual-stream design: one stream for listening (via the Mimi neural audio codec) and one for speaking (via the Helium language model). This allows the model to update its internal state while the user is speaking, enabling it to handle interruptions gracefully.Crucially, it understands "backchanneling"—the non-verbal "uh-huhs," "rights," and "okays" that humans use to signal active listening without taking the floor. This is a subtle but profound shift for UI design. An AI that can be interrupted allows for efficiency. A customer can cut off a long legal disclaimer by saying, "I got it, move on," and the AI will instantly pivot. This mimics the dynamics of a high-competence human operator.The model weights are released under the Nvidia Open Model License (permissive for commercial use but with attribution/distribution terms), while the code is MIT Licensed.3. High-fidelity compression leads to smaller data footprintsWhile Inworld and Nvidia focused on speed and behavior, open source AI powerhouse Qwen (parent company Alibaba Cloud) quietly solved the bandwidth problem.Earlier today, the team released Qwen3-TTS, featuring a breakthrough 12Hz tokenizer. In plain English, this means the model can represent high-fidelity speech using an incredibly small amount of data—just 12 tokens per second.For comparison, previous state-of-the-art models required significantly higher token rates to maintain audio quality. Qwen’s benchmarks show it outperforming competitors like FireredTTS 2 on key reconstruction metrics (MCD, CER, WER) while using fewer tokens.Why does this matter for the enterprise? Cost and scale. A model that requires less data to generate speech is cheaper to run and faster to stream, especially on edge devices or in low-bandwidth environments (like a field technician using a voice assistant on a 4G connection). It turns high-quality voice AI from a server-hogging luxury into a lightweight utility.It's available on Hugging Face now under a permissive Apache 2.0 license, perfect for research and commercial application.4. The missing 'it' factor: emotional intelligencePerhaps the most significant news of the week—and the most complex—is Google DeepMind’s move to license Hume AI’s intellectual property and hire its CEO, Alan Cowen, along with key research staff.While Google integrates this tech into Gemini to power the next generation of consumer assistants, Hume AI itself is pivoting to become the infrastructure backbone for the enterprise. Under new CEO Andrew Ettinger, Hume is doubling down on the thesis that "emotion" is not a UI feature, but a data problem.In an exclusive interview with VentureBeat regarding the transition, Ettinger explained that as voice becomes the primary interface, the current stack is insufficient because it treats all inputs as flat text."I saw firsthand how the frontier labs are using data to drive model accuracy," Ettinger says. "Voice is very clearly emerging as the de facto interface for AI. If you see that happening, you would also conclude that emotional intelligence around that voice is going to be critical—dialects, understanding, reasoning, modulation."The challenge for enterprise builders has been that LLMs are sociopaths by design—they predict the next word, not the emotional state of the user. A healthcare bot that sounds cheerful when a patient reports chronic pain is a liability. A financial bot that sounds bored when a client reports fraud is a churn risk.Ettinger emphasizes that this isn't just about making bots sound nice; it's about competitive advantage. When asked about the increasingly competitive landscape and the role of open source versus proprietary models, Ettinger remained pragmatic. He noted that while open-source models like PersonaPlex are raising the baseline for interaction, the proprietary advantage lies in the data—specifically, the high-quality, emotionally annotated speech data that Hume has spent years collecting."The team at Hume ran headfirst into a problem shared by nearly every team building voice models today: the lack of high-quality, emotionally annotated speech data for post-training," he wrote on LinkedIn. "Solving this required rethinking how audio data is sourced, labeled, and evaluated... This is our advantage. Emotion isn't a feature; it's a foundation."Hume’s models and data infrastructure are available via proprietary enterprise licensing.5. The new enterprise voice AI playbookWith these pieces in place, the "Voice Stack" for 2026 looks radically different.The Brain: An LLM (like Gemini or GPT-4o) provides the reasoning.The Body: Efficient, open-weight models like PersonaPlex (Nvidia), Chroma (FlashLabs), or Qwen3-TTS handle the turn-taking, synthesis, and compression, allowing developers to host their own highly responsive agents.The Soul: Platforms like Hume provide the annotated data and emotional weighting to ensure the AI "reads the room," preventing the reputational damage of a tone-deaf bot.Ettinger claims the market demand for this specific "emotional layer" is exploding beyond just tech assistants."We are seeing that very deeply with the frontier labs, but also in healthcare, education, finance, and manufacturing," Ettinger told me. "As people try to get applications into the hands of thousands of workers across the globe who have complex SKUs... we’re seeing dozens and dozens of use cases by the day."This aligns with his comments on LinkedIn, where he revealed that Hume signed "multiple 8-figure contracts in January alone," validating the thesis that enterprises are willing to pay a premium for AI that doesn't just understand what a customer said, but how they felt.From good enough to actually goodFor years, enterprise voice AI was graded on a curve. If it understood the user’s intent 80% of the time, it was a success.The technologies released this week have removed the technical excuses for bad experiences. Latency is solved. Interruption is solved. Bandwidth is solved. Emotional nuance is solvable."Just like GPUs became foundational for training models," Ettinger wrote on his LinkedIn, "emotional intelligence will be the foundational layer for AI systems that actually serve human well-being."For the CIO or CTO, the message is clear: The friction has been removed from the interface. The only remaining friction is in how quickly organizations can adopt the new stack.

Scientists Solve Earth’s Oldest Greenhouse Mystery GreekReporter.com

The first highly radioactive capsules of cesium stored underwater in an aging pool at the Hanford nuclear site in Eastern Washington were transferred this week to safer dry storage.

Spinal Resources Inc. received a Notice of Allowability from the United States Patent and Trademark Office Inc. expanding the usage of its Bezier Parametric Curve Spinal Rod System. The patented system, US Patent No. 12,251,133, comprises a spinal rod system with different regions separated by a gradual transition region wherein the curve and a length of the first and second segments and the transition region are customizable to a specific patient anatomy.

Colorado will not release more wolves this winter to supplement its reintroduction program after federal officials stopped the planned relocation of wolves from Canada.

Worldwide, it ranks among the cities with the highest levels of air pollution—and it's located in the heart of Europe: Sarajevo, the capital of Bosnia and Herzegovina. Previously, the spatial distribution of air pollutants here was largely unknown, as were their sources. Now the Paul Scherrer Institute PSI, using its mobile laboratory, has provided the first reliable data—and found the causes of the high level of pollution.

Scientists mapped 775 plant nutrients and discovered that the gut bacteria's ability to convert them varies dramatically from person to person.

Pre-operative perfusion MRI can help predict how microbubbles will distribute in the human brain. These findings pave the way for more personalized, image-guided planning of focused ultrasound during blood-brain barrier opening procedures.

By shifting into an RNA‐binding phase, MYC‐driven tumors eliminate R‐loop–derived alarm signals and stay hidden from immune attack, exposing a selective vulnerability that may help make MYC‐high cancers detectable again.The post High‐MYC Tumors Evade the Immune System by Clearing R‐Loop Alarm Signals appeared first on GEN - Genetic Engineering and Biotechnology News.

"Synthetic Genomes and Genetic Codes for Virus Resistance, Biocontainment, and Therapy"Akos Nyerges, PhDResearch Associate, Department of GeneticsHarvard Medical School, Boston, MAHost: Dr. Omar Abdel-WahabTea at 10:45 AM Category: Events & Seminars Date and Time: Wednesday, February 4, 2026 - 11:00am to 12:00pm Event Location: ZRC 105 Source link: https://events.weill.cornell.edu/event/special-seminar

Texas A&M AgriLife Research scientists have developed a patented breakthrough system that marks a major step forward in insect biomanufacturing, waste reduction and sustainable protein production.

(MENAFN - GlobeNewsWire - Nasdaq) As highlighted by Towards Packaging research, the global pouch materials for pharmaceutical market, valued at USD 10.59 billion in 2025, is expected to reach USD ...

(MENAFN - GlobeNewsWire - Nasdaq) The heat stabilizers market is growing steadily as PVC usage expands across construction and automotive sectors, supported by safer stabilizer alternatives and ...

Researchers used the South Pole Telescope to uncover powerful, short-lived bursts of millimeter-wavelength light from two known accreting white dwarf systems in the inner Milky Way.

(MENAFN - FinanceWire) Palo Alto, United States, January 23rd, 2026, FinanceWireBlissBot, a leader in AI-driven neurodevelopmental technology, today announced the official release of StarHealing, ...

Scientists may have discovered a new extinct form of life Phys.orgMystery Prototaxites tower fossils may represent a newly discovered kind of life Scientific AmericanMysterious Giants Could Be a Whole New Kind of Life That No Longer Exists ScienceAlert‘New form of life’ discovered ... and it’s 26ft tall The TelegraphThe First Great Forests Were Neither Fungus Nor Plant, But Lifeforms Without Living Descendants IFLScience

Executed in accordance with FDA human factors and usability engineering guidance, the study is intended to de-risk downstream regulatory review and support a streamlined path toward clinical development

The series, now in its 19th year, will take place at Sage Chapel every other Thursday through March 26, starting at noon.

The abstract in PubMed or at the publisher’s site is linked when available and will open in a new window. Papers deriving from NASA support: Other papers of interest: Astrobiology, space biology, space medicine, microgravity, NASA,The post NASA Spaceline Current Awareness List #1,183 16 January 2026 (Space Life Science Research Results) appeared first on Astrobiology.

For 450 million years, plants and soil fungi have been trading partners. The fungi weave through plant roots, delivering phosphorus and other soil minerals in exchange for sugars and fats produced by the plant through photosynthesis. This ancient collaboration supports roughly 80% of Earth's plant species—including corn, wheat, and other crops that feed billions of people.

More than $520 million in contributions from David A. Duffield ’62, MBA ’64 – including a new pledge of $371.5 million and a 2025 commitment of $100 million, combined with previous gifts – will establish the Cornell David A. Duffield College of Engineering.

Chile is reeling from one of its most serious wildfire emergencies in years. Deadly flames sweeping across central and southern parts of the South American ...

(MENAFN - Investor Brand Network)Researchers at the University of Michigan (U-M) have developed a system that leverages both AI and machine learning to create a digital twin of a patient's brain ...

Independent research identifies few learning gains

(MENAFN - 3BL)Originally published on BMSPRINCETON, N.J., January 22, 2026 /3BL/-- Bristol Myers Squibb (NYSE: BMY,–BMS–), a global leader in oncology, announced an agreement with Microsoft, a ...

As consumer awareness and nutrition science continue to focus on the negative impact of ultraprocessed foods, Spindrift sets the standard for how beverages should be made NEWTON, Mass., Jan. 22, 2026 /PRNewswire/ -- Spindrift Beverage Co., Inc., the only sparkling water made with real...

Modern cells are complex chemical entities with cytoskeletons, finely regulated internal and external molecules, and genetic material that determines nearly every aspect of their functioning. This complexity allows cells to survive in a wide variety of environments and compete based on their fitness. However, the earliest primordial cells were little more than small compartments where [...]The post How Early Cell Membranes May Have Shaped The Origins Of Life appeared first on Astrobiology.

CLEVELAND, Jan. 22, 2026 (GLOBE NEWSWIRE) -- SPR will feature eight abstracts on 60-day peripheral nerve stimulation (PNS) with SPRINT® PNS that will be presented at the North American Neuromodulation Society (NANS) Annual Meeting in Las Vegas, January 22-25. Various...

AI-mediated culture is already being filtered in ways that favor the familiar, the describable and the conventional.

Expertise comes with training, experience and accreditation. And expert consensus is the best guide modern democracies have for making decisions about...

He Jiankui, the Chinese biophysicist who was jailed for creating the world's first gene-edited babies

(The Conversation is an independent and nonprofit source of news, analysis and commentary from academic experts.)

The tropical oceans that once served as oxygen-rich havens for Earth’s earliest complex life have become the planet’s largest marine dead zones. The dramatic reversal occurred hundreds of millions of years ago and researchers are now beginning to better understand its timing. A new study led by former Syracuse University doctoral student Ruliang He and [...]The post When Tropical Oceans On Earth Were Oxygen Oases appeared first on Astrobiology.

Nine months ago, President Donald Trump signed a presidential memorandum instructing his administration to "achieve maximum speed and efficiency" in moving to block invasive Asian carp from reaching the Great Lakes.

Hi Keith, The past couple of days brought low clouds, some drifting snow, and steady winds that peaked around 30 m/s (~67 mph). Today, the sun made a welcome return and although the wind stayed brisk through much of the day, conditions were stable enough for us to get some solid work done. We collected glacial ice, [...]The post Dale Andersen’s Astrobiology Antarctic Status Report: 21 January 2026: Lake Untersee Base Camp Weather appeared first on Astrobiology.

On the first day of fall break, I flew from Baltimore to Toronto to visit my best friend, who is studying engineering at the University of Toronto (popularly abbreviated as U of T). The last time we saw each other was in July, during the final leg of our grad trip in Seoul. It had been about two months since then, which I realized was the longest we've been apart - that's the thing about high school, you're never really separated from your best friends for more than the two months of summer break - so, after many tearful phone calls, she finally convinced me to visit her.I would consider this my first real visit to Toronto. (According to my parents, we came once when I was one year old while they were scouting for a city to settle in after immigrating from China to Canada, but, because it was the dead of winter, they chose Vancouver instead.) The flight from BWI to Pearson was supposed to take two hours, but only took one. After I breezed through the Canadian Citizens line, the customs officer glanced at my passport before saying, "Welcome home." It was strangely comforting, even though Toronto wasn't really home.My friend lives in Chestnut Residence, home to most of U of T's first-year engineering students. A fifteen-minute walk from campus, it's a renovated three-star hotel that directly faces a much fancier DoubleTree by Hilton. The security guards are strict there. You have to wave your daily colored guest pass or room key every time you line up for the elevator, or they will call you out with an irritated "hey" or "excuse me." My yellow guest pass somehow worked for three days straight without being checked, which made the whole routine feel somewhat pointless.My friend carved out time from her hectic nine-to-five class schedule to give me a tour of downtown Toronto. On the first night, I helped myself to three orders of heart-shaped mango pudding soaked in mango sauce and condensed milk. For the first time in months, I had congee, which I had yet to find in any Chinese restaurant in Baltimore. I saw the right type of custard buns (the runny kind) on the menu and was given chopsticks instead of forks with my takeout. I walked under office buildings, past yoga and Lagree and pilates studios and botox clinics, by chain hotels and through Eaton Centre while sipping Molly Tea.On campus, I waited at food trucks with lines around the block and snuck into a chemistry lecture with 300 other students. Between classes, I sat in libraries with crammed tables and eavesdropped on arguments during group project meetings. Everything seemed a lot bigger and livelier there. Even the drama was interesting. One night in the common room, my friend pointed out all of the "opps" she had already made in the first two months of school.I suppose my other reason for visiting my friend was because I subconsciously wanted to escape. I was halfway through my first semester at Hopkins and felt stuck in the eat-study-sleep schedule I had fallen into. The closest thing I had to comfort me was Instagram reels with comments from lonely classmates who felt the same thing and promises from alumni that it would all get better by graduation. Still, I couldn't see myself here for four years.I thought it would all be better in Toronto, and in a sense it was. But this alternate life that I lived for four days didn't feel the way I thought it would. Even though my best friend was by my side, I couldn't help but feel like a trespasser in every space we visited.At U of T, I really didn't belong. I didn't instinctively know where the card readers were on the wall or how many seconds you needed on the microwave. I didn't know their café's equivalent of Kitschenette's "Breakfast at Tiffany's" or which soups were the least salty in the dining hall. I didn't recognize anyone we walked past in the dorms. All of these things I know at Hopkins, and maybe I don't need to wait until graduation before I feel like I belong.Angel Wang is a freshman from Vancouver, Canada studying Writing Seminars. In her column, she writes about the people, places and passages that help make sense of what's in her mind.

What feels like just a few days ago, my biggest frustration was Grey's Anatomy characters ragebaiting me: it was the COVID-19 lockdown; my last year of middle school had come to an abrupt halt. Another day later, I was speed-walking from debate practice and frantically trying to grasp basic thermodynamics concepts in AP Chemistry, which seems so trivial today. Yesterday, I was frantically journaling every minuscule event in hopes of a killer Common App essay topic, binge-reading college application guides at 2 a.m., convinced that one obscure extracurricular would determine the course of my life. Today, I am 20 years old. Blink, and somehow those "days" stack into an entire span of five years. Just like that, being a teenager - and more importantly, the vast majority of my youth - is already behind me.Milestones like these are, understandably, exciting for everyone. At 13 years old, you're a teenager and can have your own cell phone (but I didn't have mine until high school) and even create your social media persona (which I secretly already had since 5th grade). At 16 years old, you can get a driver's license and finally drive yourself (I still don't have a driver's license nor can I even drive). At 18 years old, you unlock many "adult" privileges such as legally entering into contracts (I have no idea what I am even signing) and scheduling your own doctor appointments (my mom still does that for me). Soon enough, I'll be a middle-aged woman and then a senior citizen who won't know how to operate whatever technology will exist.I can no longer say that I am "barely legal." Although if I were to ask for the kid's menu right now, they wouldn't question it. Despite my looks fitting in with teenagers - and, mostly, my feeling like one - the responsibilities and looming "adult decisions" are slowly making it clear: childhood is over and adulthood isn't optional. As an adult, I am supposed to handle my own finances and my own living conditions. However, being confined to a college campus where every necessity is just a short walk or meal swipe away, everything is already handed to me. Still being a student, my only responsibility is to study for exams, partake in my extracurriculars and sprinkle in some self-care.Absolutely nothing about my daily life screams "adult." My dining dollars disappear faster than my motivation to study for midterms as I live off overpriced café food with my only cooking expertise being a meager avocado toast. My nervous system can't tell the difference between being attacked by a bear and having to make a single call to deal with any kind of "real-life" adult task.Every little decision feels monumental: figuring out what classes to prioritize, calculating a way to distribute my dining dollars and days to order UberEats or remembering to do simple errands such as picking up a package that's already been left in the mailroom for a few days. I can't shake the idea that entering the real world where I am employed (hopefully), where I am actually an adult, will be exponentially worse.I can't help but wonder if I have even spent my youth well. Did I have the teenage experience? Now that sophomore year is almost halfway done, have I even had a college experience yet? Am I meeting every single expectation and achievement I have set myself as a highly ambitious person or am I just treading water while time slips fast? I never snuck into places I shouldn't have, never had late-night food runs or gossip sessions with a friend, never even attended homecoming or prom.Feeling like a chaotic person myself, I can't help but feel like I was supposed to have a messy, unpredictable and unforgettable reckless phase of youth, filled with moments that just feel so cinematic in hindsight. Instead, I lived a structured routine - each day planned down to the hour, chasing productivity over spontaneity. My nights were filled with bedrotting and doomscrolling while panicking over upcoming midterms instead of making questionable memories. Every moment felt like preparation for the next, leaving little room to actually live in the one I was in.Sometimes I go through this strange spiritual awakening, staying up until 5 a.m., where I give myself an entire ultimate guide on getting my life together. I'm convinced that I unlock a beast mode version of myself where I will be locked in 24/7, finally cut down on spending by actually prepping my own meals and pile my schedule with activities to craft the perfect CV, all in hopes of becoming a distinguished accomplished adult.By noon the next day, my peak productivity fantasy quickly collapses, replaced by a strong urge to nap, a craving for a single Fruity Pebble waffle that costs $10 at the Student Center and a truckload of deadlines that seem to multiply (hence, me submitting this article a couple days after the deadline) met with the overwhelming realization that adulting and ultimately becoming a wiser version of myself is much messier than a single past midnight epiphany can prepare me for. However, small victories sneak in despite the chaos even if that's using my coffee machine instead of going to Brody's to spend $5 or attending every single lecture, including my 9 a.m.Yet, maybe that's part of it: the growing pains of figuring life out without a script. Maybe the beauty of it all isn't in the chaos I should be experiencing or in a thought that I'm missing, but in the quiet moments of learning to exist: finding comfort in the uncertainty, laughing through the stress and realizing that not every memory has to be cinematic to matter. Maybe navigating these awkward, unglamorous parts of becoming an adult is the real coming-of-age story after all.Grace Wang is a sophomore from Tuscaloosa, Ala. majoring in Neuroscience. Her column chronicles life's unpredictable, beautiful mess - never neat, always honest and willing to show the chaos, contradictions and awkward truths we usually try to hide.

With advanced computing, semiconductors and AI hardware essential to national competitiveness, a transformative investment positions Duke to lead in computer engineering.The post Duke University Announces Landmark Gift Naming the Pierre R. Lamond Department of Electrical and Computer Engineering appeared first on Duke Pratt School of Engineering.

A new list of threatened mammals in South Africa, Lesotho and Eswatini shows that 11 more species have edged closer to extinction since 2016. Those that have joined the International Union for the Conservation of Nature's regional Red List for mammals at risk are: Lesueur's hairy bat, the laminate vlei rat, the thick-tailed bushbaby, the aardvark and the African straw-colored fruit bat. The Namaqua dune mole-rat showed one of the sharpest declines, jumping from Least Concern to Endangered. Joseph Ogutu is a statistician who researches collapsing wildlife populations in Africa. He explains that of the 336 mammals assessed, 70 are now threatened and 42% of the mammals only found in South Africa are at risk of extinction.

Mason Diaz, a sophomore attending the School of Engineering at Rutgers University-New Brunswick, will spend part of his spring and summer interning for a company that makes autonomous underwater robots known as gliders.It is the latest opportunity for Diaz that merges his major - mechanical engineering - with marine science.

Sweeping winds of vaporized metals have been found in a massive cloud that dimmed the light of a star for nearly nine months.

Researchers from the Department of Energy's Oak Ridge National Laboratory have unveiled a new additive manufacturing technology that uses an innovative nozzle to multiplex, or combine, multiple smaller extruders into one stream to achieve the same high output of a single large extruder.

Argonne's summer educational programs -- which include workshops, camps, research partnerships and more -- help cultivate the nation's future STEM workforce and equip the next generation in areas vital to national security and competitiveness.

Gain access authorization to these balloon men so you can research new tech.

Researchers at Columbia Engineering have developed a faster, cheaper, and more environmentally friendly way to extract this critical mineral.

Rose Tan, MD, MSc, PhD, has been named the 2026 recipient of the ARVO Foundation Research Catalyst Award. The $70,000 award supports an initial project for a superb research idea by an investigator beginning their career or returning to the workforce after an extended leave.

NASA announced Tuesday the selection of three new science investigations that will strengthen humanity's understanding and exploration of the moon. As part of the agency's CLPS (Commercial Lunar Payload Services) initiative and Artemis campaign, American companies will deliver these research payloads to the lunar surface no earlier than 2028.

Next-generation technology requires next-generation materials that can be tailored to exact mission requirements. Additive manufacturing, or 3D printing, has already revolutionized industries like aerospace engineering by enabling previously unthinkable component designs.

Lawrence Livermore National Laboratory (LLNL) computer scientist Peter Lindstrom recently received a 2025 IEEE VIS Test of Time Award for...

Astronomers just found a ‘mystery object’ surrounded by a metallic wind cloud Yahoo News CanadaView Full Coverage on Google News

<img src="https://www.newswise.com/legacy/image.php?image=https://now.tufts.edu/sites/default/files/styles/large_1366w_912h/public/uploaded-assets/images/2026-01/veterinary_opthalmology.jpg?h=e4f440a4=kzncK-0ewidth=100height=150" alt="Newswise image" /A look inside the world of veterinary ophthalmology

Scientists show metal nanoparticles can exist in quantum superposition, pushing quantum mechanics into macroscopic scales.

High-precision oxygen isotopes in Apollo lunar soils reveal a persistent impactor fingerprint, showing that impacts contributed only a tiny fraction of Earth’s water.

Fast-fashion companies churn out affordable, trendy tops and trousers to meet the tastes of the day, targeting fashion-savvy Gen Zers and young adults on a budget. For years, the Spanish fast-fashion retailer Zara has stood out for delivering wardrobe staples and bold new styles to its stores with remarkable speed.

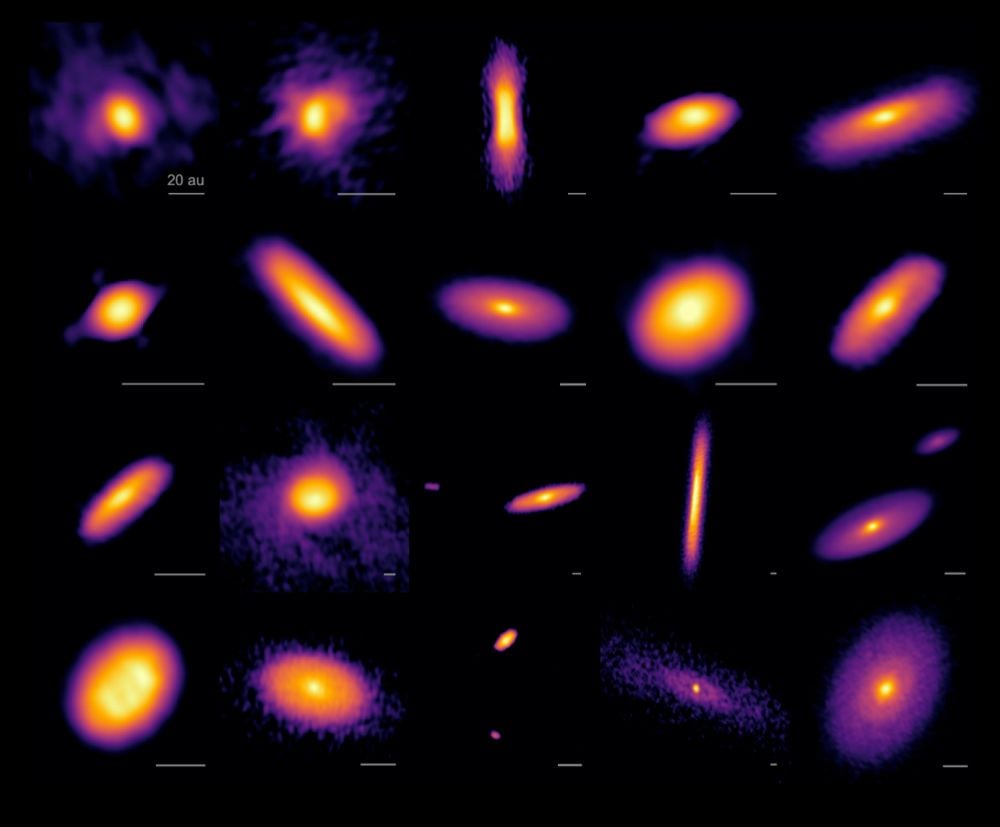

Back in 2014, the Atacama Large Millimeter/submillimeter Array (ALMA) captured an image of a young protoplanetary disk around a young star named HL Tauri. The image showed gaps and rings in the disk, substructures indicating that young planets forming there. This meant that planet formation began around young stars a lot sooner than thought. ALMA is continuing its investigation of protoplanetary disks in its ARKS survey (ALMA survey to Resolve exoKuiper belt Substructures).

Real estate website scrubbed data under pressure from California real estate brokers.